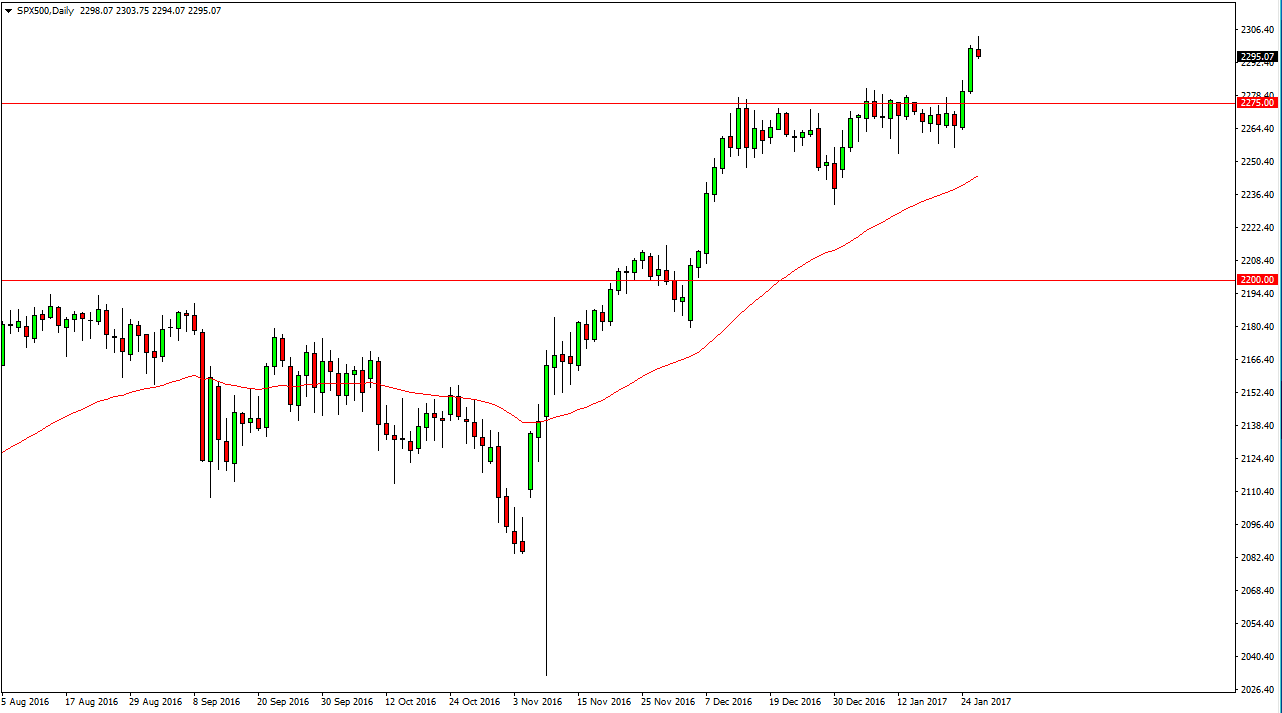

S&P 500

The S&P 500 rallied initially during the session on Thursday, but turned around to form a shooting star. This of course is a negative sign but we have just broken above a massive resistance barrier. Because of this, the market looks as if it is going to drop down to the 2275 level, which would be a nice buying opportunity. That is an area that should offer quite a bit of a nice “floor” in the market, and with that being the case we will continue to go higher. On the other hand, if we can break above the top of a shooting star, the market should continue to go even higher, as we continue the longer-term uptrend. I have no interest in selling this market, US indices look very strong now.

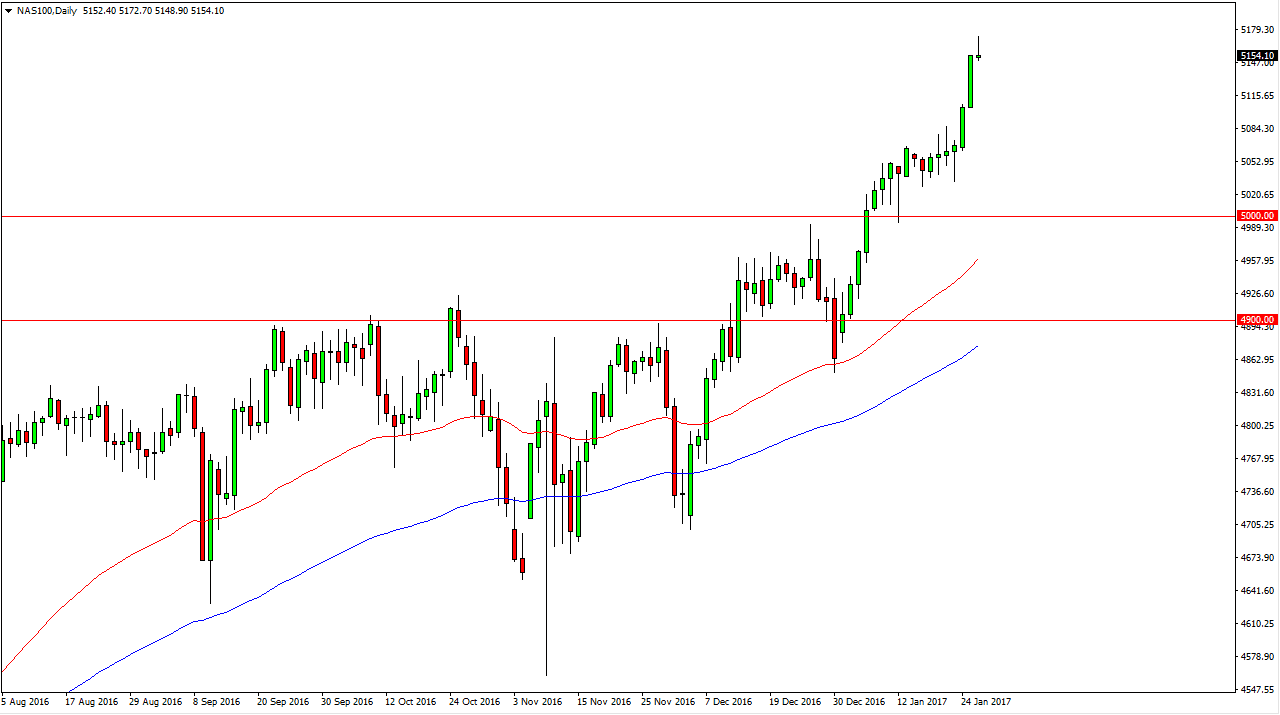

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day on Thursday as well, but just as we saw in the S&P 500, the market struggled and ended up forming a shooting star. A pull back below the bottom of the shooting star signals that we may need to come back to lower levels to find enough support underneath to continue the longer-term uptrend. I believe that the 5000-level underneath continues offer a “floor” in this market, and given enough time the market will continue to go much higher. The NASDAQ 100 has been one of the strongest indices that I follow, and I think it will continue to shoot higher and push the US stock markets higher. If we broke above the top of the shooting star, I feel that the market could continue to go higher but then you must worry about being overextended.

There is no selling opportunity in this market as far as I can see, and only the foolish fight this type of move. Yes, I recognize we will more than likely fall from here, but it will be short-lived at best, as the real money will be made holding on to the long positions.