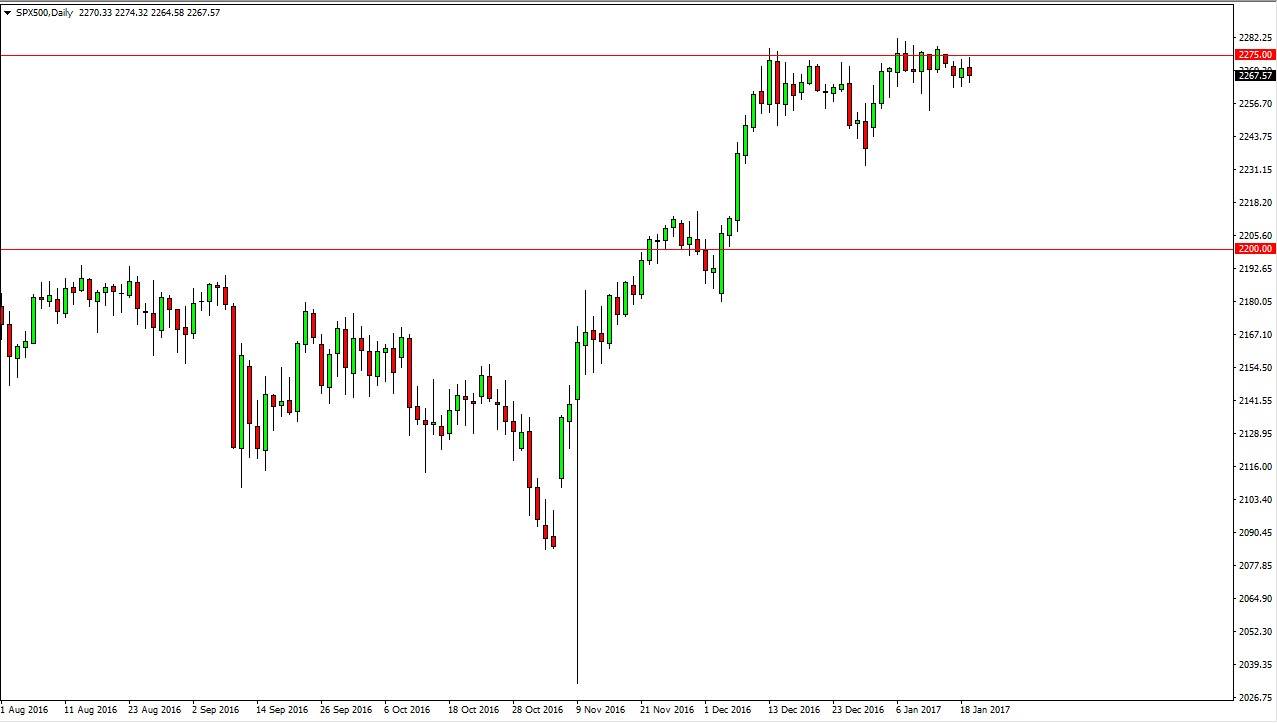

S&P 500

The S&P 500 fell slightly during the course of the session on Thursday, as the 2275 level continues to be resistive. Pullbacks of this point should be a buying opportunity, so having said that I looking for a supportive short-term candle in order to start going long. If we can break to a fresh, new high, the market should continue to reach towards the 2300 level, and perhaps even higher than that. I think that there is a massive amount of support down at the 2250 handle, and with that being the case it looks as if the market will continue to find buyers based upon value. The US economy and of course the US dollar both have seen quite a bit of strength, and I think that is going to continue going forward.

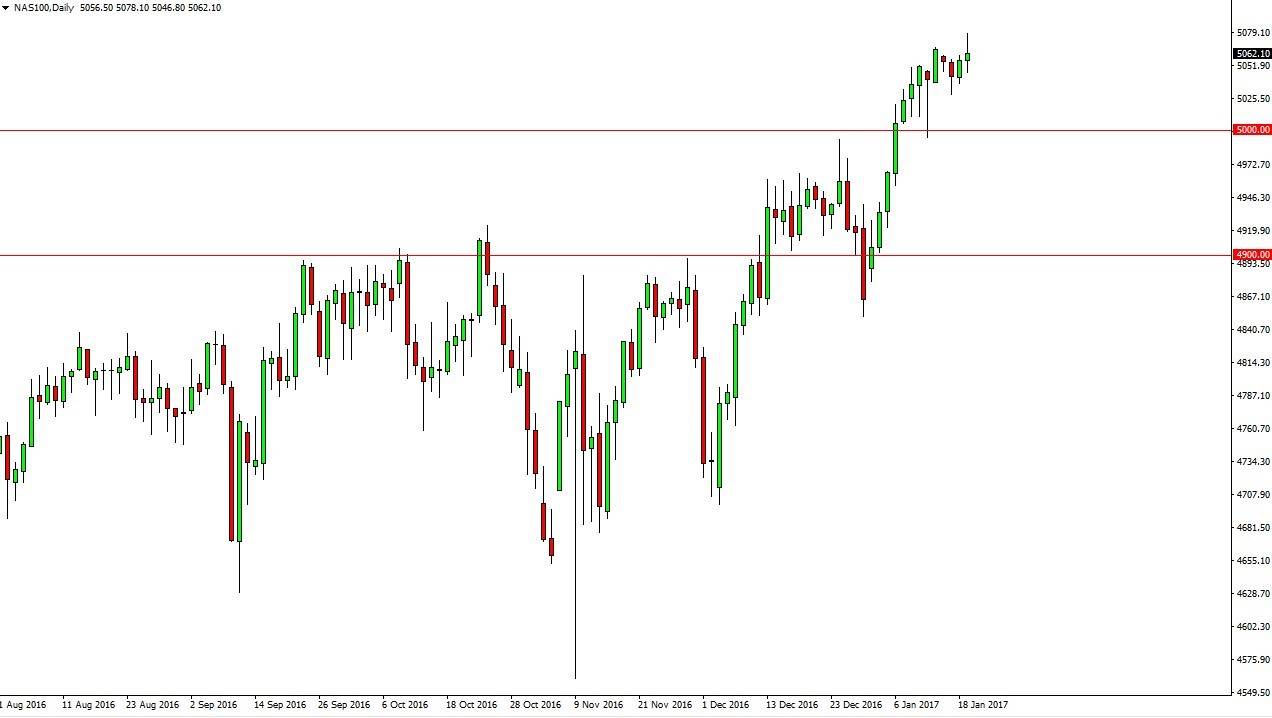

NASDAQ 100

The NASDAQ 100 initially rallied during the day on Thursday, but gave back quite a bit of the gains. I believe that when we pull back, there will be plenty buyers underneath and that the 5000 level should be massively supportive. Also, keep in mind that Donald Trump gets inaugurated today, so there will be a speech. That of course could move the US dollar in general and of course have a knock-on effect in the stock markets. Nonetheless, we are in a massive uptrend and I think that the 5000 level offer support all the way down to at least the 4950 level.

Currently, I believe that we’re going to reach towards the 5100 level over the next several sessions, but it could be choppy before we finally build up enough momentum to go higher. In the meantime, buying on the dips is about all you can do as we are waiting to see the momentum come back to a market that has recently exploded to the upside.