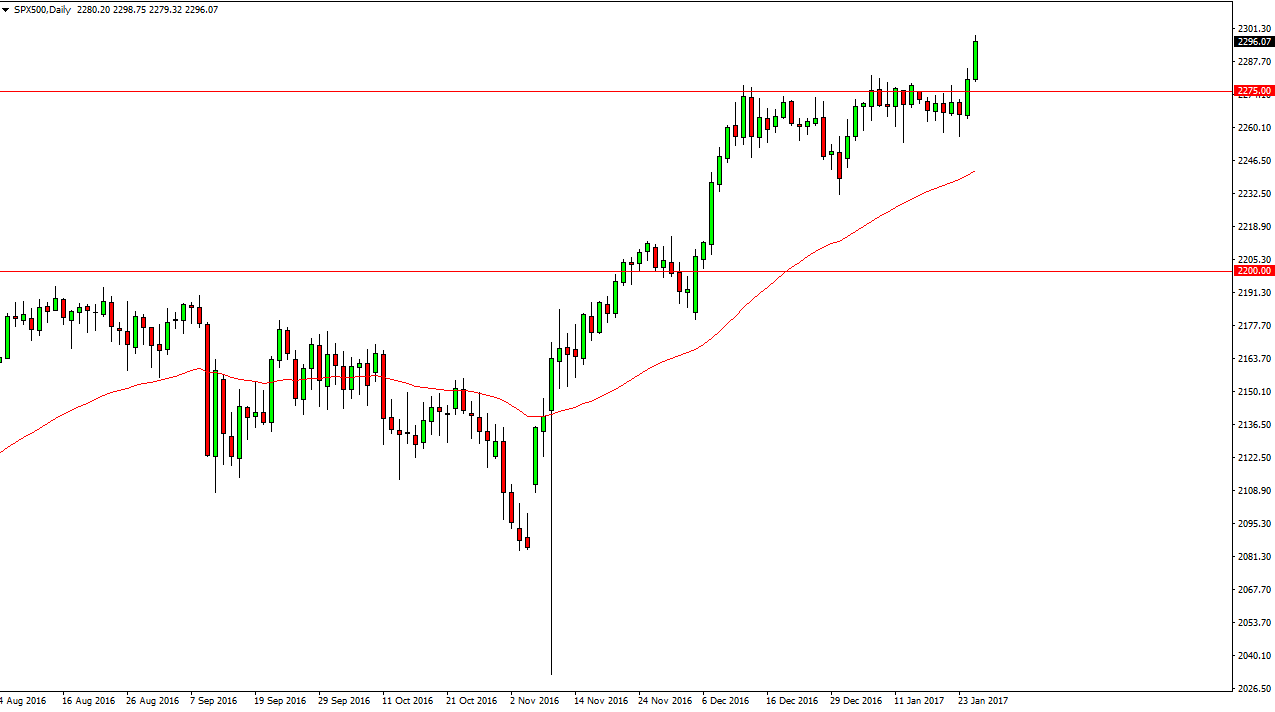

S&P 500

The S&P 500 had an explosive moved to the upside during the session on Wednesday as US stock markets took off. This was partially in response to President Trump’s signing of several business friendly executive orders. It looks as if the new administration is going to be very business friendly, and Wednesday only reaffirmed this. Because of this, stock markets continue to be very bullish, and of course optimistic. I believe that the S&P 500 has a bit of a floor now at the 2275 handle, and short-term pullbacks should be buying opportunities. The 2300 level did offer a little bit of resistance during the day, but I think at best that’s probably psychological resistance.

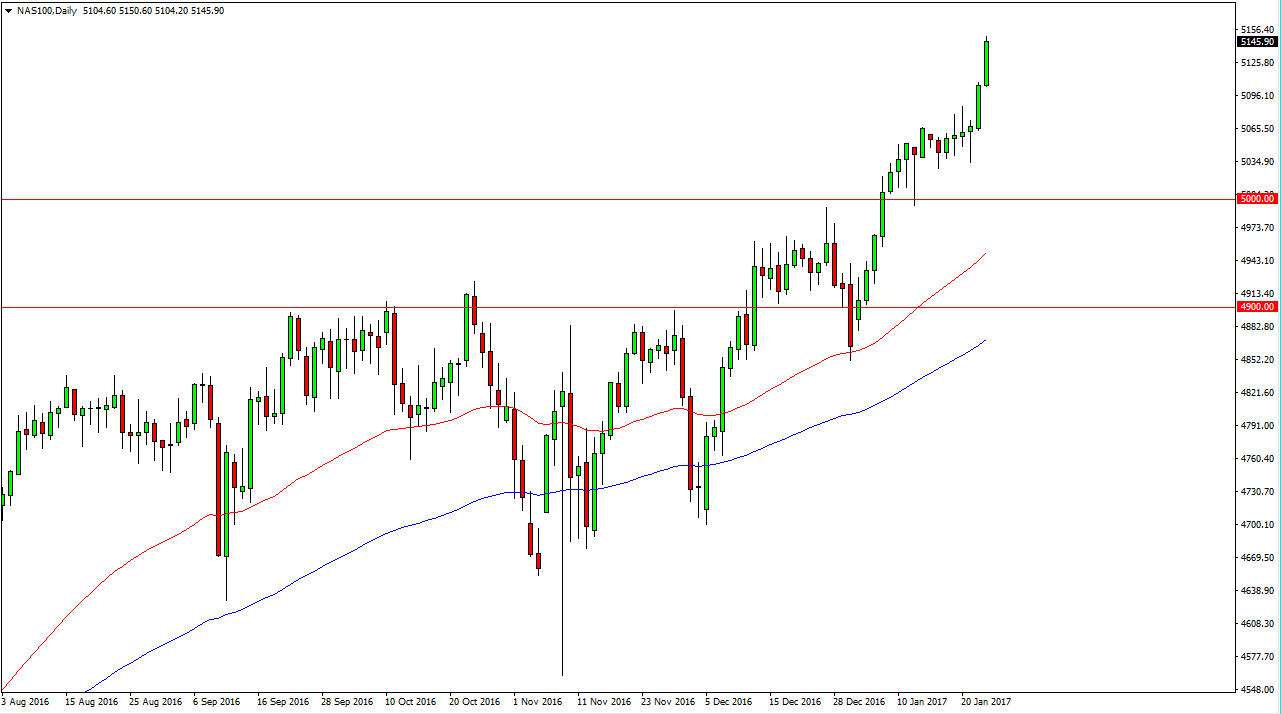

NASDAQ 100

The NASDAQ 100 took off to the upside as well, as a continues to lead all the other indices in the United States to the upside. I believe the pullbacks are value that you need to take advantage of, because quite frankly these are the types of moves that don’t happen very often. I think that the 5000 level will now continue to be the floor, but I think we could even see quite a bit of support at the 5050 handle as well. In other words, this is a “buy only” type of market, making this one of the easiest buys that we can find.

I don’t typically use the phrase “one-way trade”, but this is certainly an example of one. We are bit overextended so I would expect a short-term pullback soon. However, that is a buying opportunity based upon value as far as I can see. I currently don’t have a hard target, but I would suspect that the markets probably going to aim for at least 5250 to the upside.

I don’t have a scenario in which a willing sell right now, and I believe that it would have to be something appearing on longer-term charts such as the weekly period to consider it.