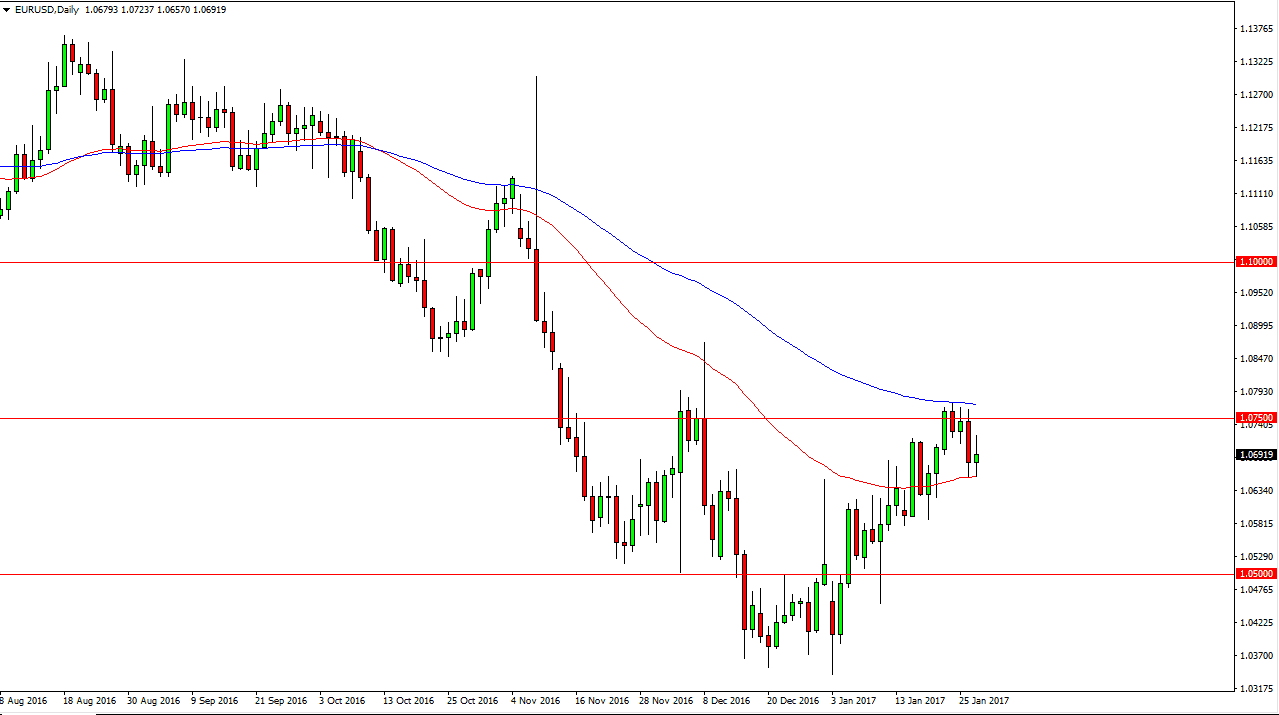

EUR/USD

The EUR/USD pair rallied on Friday, but as you can see struggle to hang on to those gains. Because of this, we ended up forming a less than stellar looking candle, and I could even make an argument for the market forming a shooting star. The red moving average just below the candle is the 50-day exponential moving average, and if we can break down below there I would be more than willing to start selling. The market should then reach the 1.05 level underneath, which has been massively supportive but I see a lot of noise between here and there. Alternately, the 100 exponential moving averages just above the 1.0750 level, and if we can clear that I think we will go higher. One thing that I would point out, the weekly candle is a shooting star which of course is bearish.

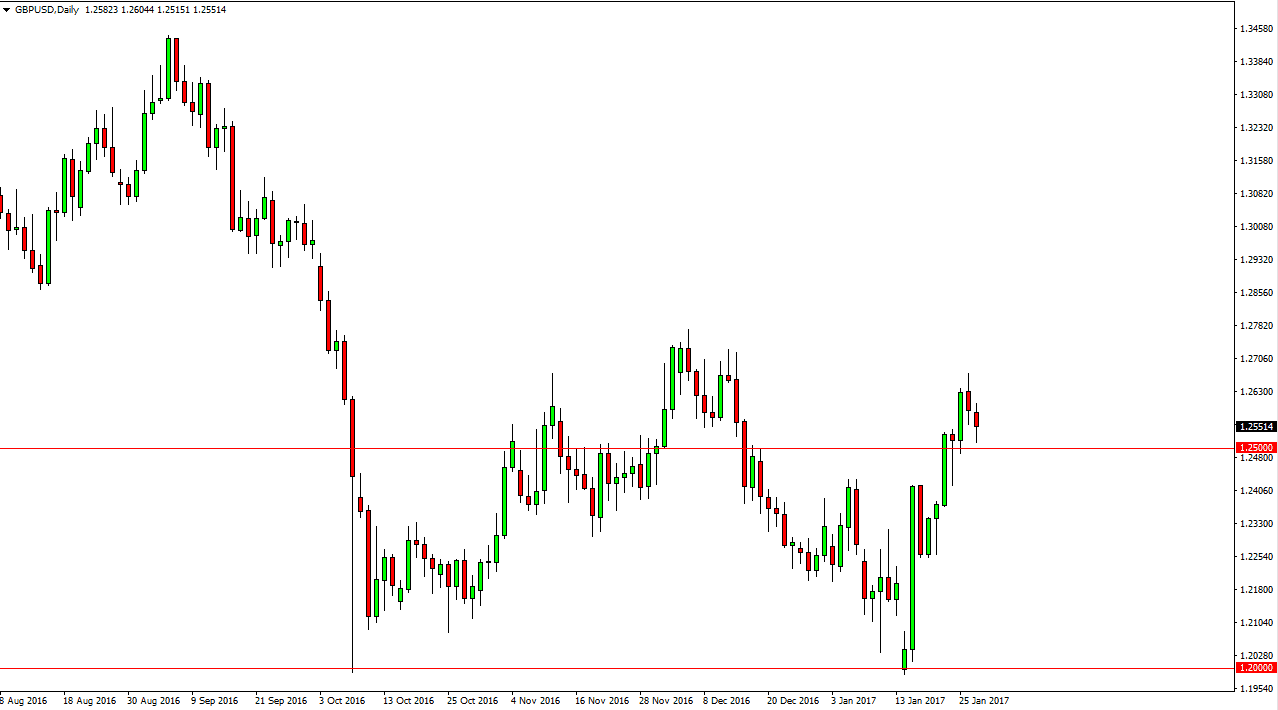

GBP/USD

The British pound fell significantly during the session on Friday but found enough support at the 1.25 level to turn things around and form a hammer. A hammer of course is a bullish sign, and it in turn sits on top of another hammer. Because of this, I believe that the British pound is going to try to continue going higher, as I suspect that the trend is changing. Because of this, I much prefer going long over short, but I recognize that a breakdown below the 1.24 level should be a selling opportunity. Either way, I think it is going to be choppy because most trend changes are, and of course we have a lot of focus on the fact that the United Kingdom is leaving the European Union. However, I’m starting to believe that perhaps the market overreacted, as it tends to do from time to time.

Either way, you’re going to have to be able to go back and forth in this market over the next several weeks as we try to figure out where were going next.