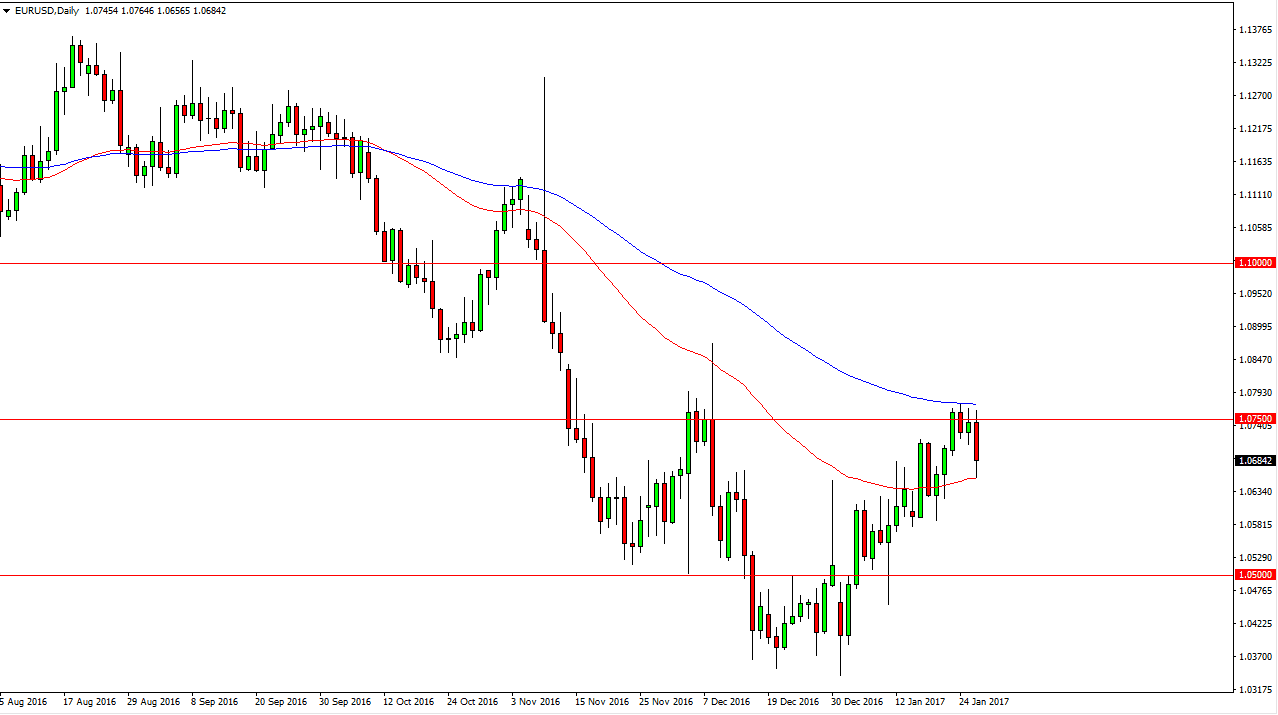

EUR/USD

The EUR/USD pair broke down during the day on Thursday, touching the 50-day exponential moving average. We did find a bit of buying in that area though, so it looks as if we are going to continue to consolidate although I now believe that the sellers are starting to step up their pressure. Currently, I believe that a break above the blue exponential moving average on the chart, which is the 100-day exponential moving average, is a buying opportunity. Alternately, a breakdown below the red 50-day exponential moving average on the chart is a selling opportunity. It will be choppy regardless a we do, but quite frankly that will be the nature of Forex markets over the next several weeks anyway.

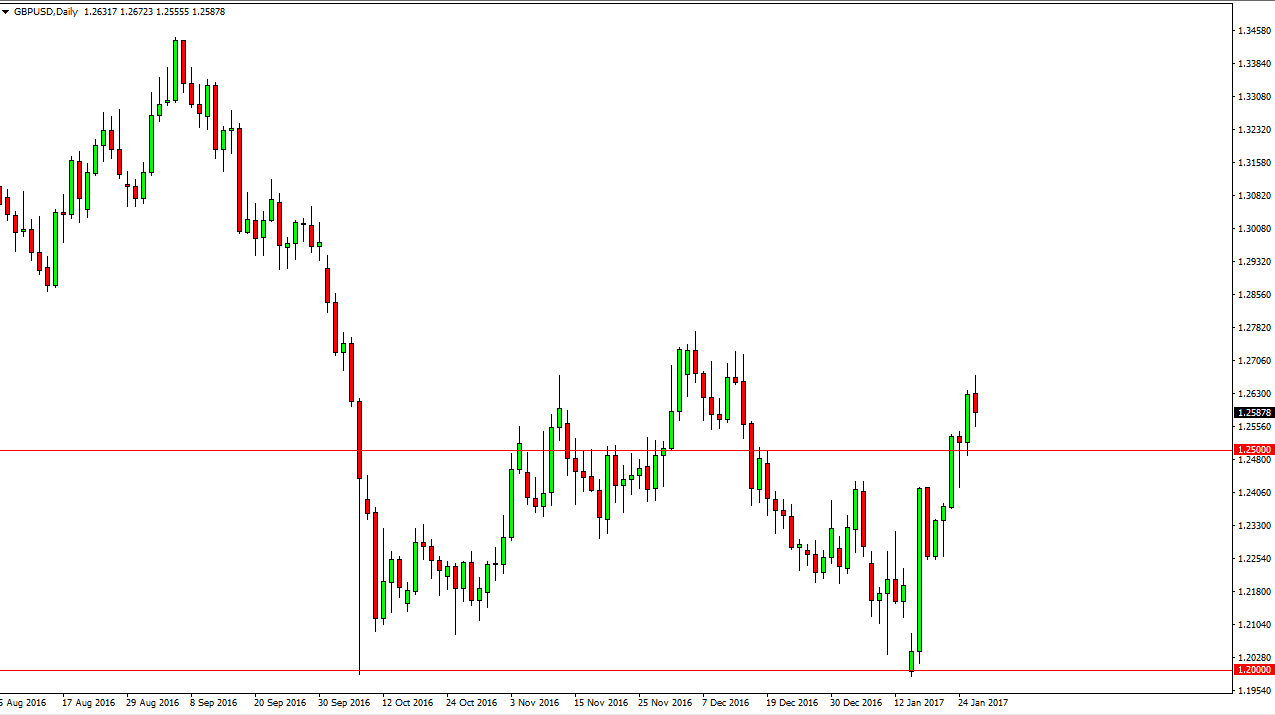

GBP/USD

The British pound had a calm session on Thursday, considering that we had broken out so strongly during the Wednesday session. At this moment, I believe that the 1.25 level offer support, and is essentially the “floor” in the market, and extends all the way down to the 1.24 level. It is because of this that I’m looking for opportunities to buy supportive candle. I would either buy the pullback or a break above the highs to go long. I think that the 1.2750 level will offer a bit of resistance, but it’s only a matter of time before we breakout above there. If we did breakdown, the 1.24 level being broken would be a very negative sign, and a 1.2250 break would be horrible for the British pound. I believe that we are trying to form a bit of a floor in the longer-term trend as well, and that’s always a messy affair. Given enough time, we should continue to go much higher but I think volatility is going to be a mainstay of this currency pair as we try to figure things out.