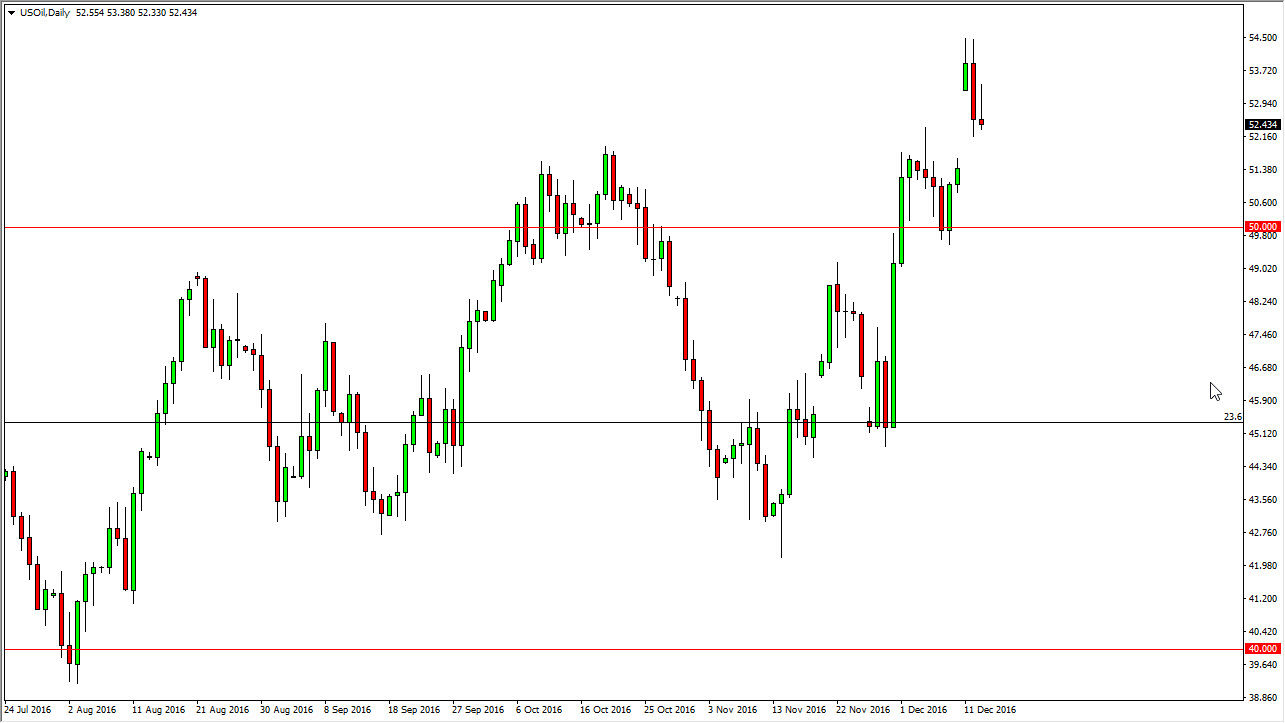

WTI Crude Oil

The WTI Crude Oil market initially shot higher at the open on Tuesday but turned around to form a shooting star. The shooting star is sitting on top of the gap still, so I think that we will probably drift lower. However, there should be quite a bit of support below, especially near the $50 level. I wonder whether or not we can continue to go higher, based upon the OPEC and the non-OPEC countries coming to an oil production cut agreement. Any type of supportive candle in this region, and extending all the way down to the $50 level could be a nice buying opportunity. A break down below the $50 level should send this market much lower, so this point in time I would have to be fairly cautious about trading.

Natural Gas

Natural gas markets broke down below the $3.50 level, and broke below the bottom of the hammer from the Tuesday session. Because of this, looks as if we are going to continue to drop from here, but it will be more or less a grind than some type of massive breakdown. After all, the market has a ton of support underneath it, and we are quite a bit overextended at this point. The $3.25 level below should be supportive, so having said that I don’t think we go much lower than that. I think that a supportive candle in that area would represent quite a bit of value.

Given enough time, I feel that the market will rally again, mainly due to cold temperatures in the northeastern part of the United States. However, sooner or later the longer-term structural issues when it comes to natural gas will jump to the forefront again as higher prices will bring more drills into the fields of North America and increase supply.