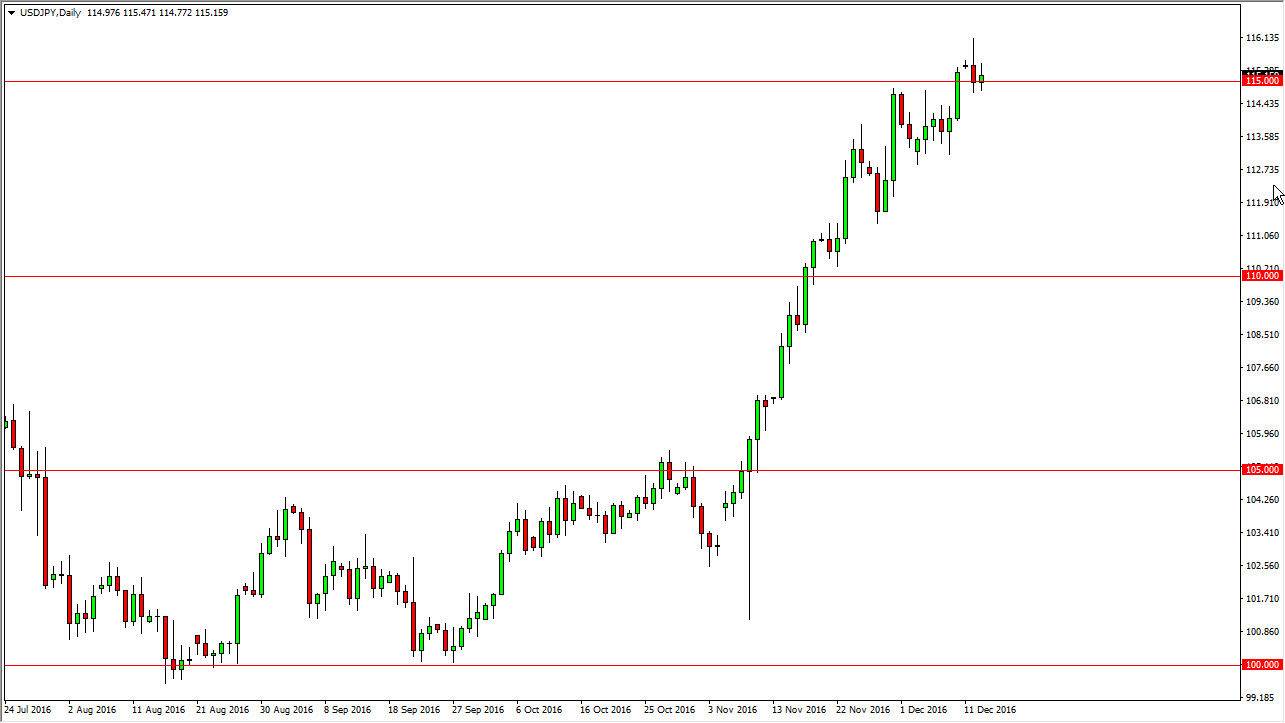

USD/JPY

This has been a very quiet session on Tuesday in the USD/JPY pair, one that looks a bit over extended at the moment, and at this point I feel that the market needs to pull back. I also believe that the market will probably find quite a few buyers below, and on short-term bounces could offer buying opportunities going forward. I believe that the absolute “floor” in this market is the 110 level, and quite frankly the time we pullback I feel that you have to take a shot at the “value” in the US dollar. I have absolutely no interest in shorting this market, and believe that longer-term we are going to go much higher, perhaps reaching towards the 120 handle. The only way I see this changing as if the Federal Reserve decides not to raise interest rates, something that I really doubt going to happen.

AUD/USD

The Australian dollar had a choppy day during the session on Tuesday, as the 0.75 level continues offer quite a bit of resistance. By forming a fairly neutral candle, I think it essentially functions as a shooting star, meaning that if we can break down below the bottom of it, we will drop to the 0.73 level. Alternately, if we break above the top of the range for the session on Tuesday, we will then reach towards the uptrend line that had previously been so supportive. A rally from here will more than likely find exhaustion above, and quite frankly I think that’s just a better opportunity to start shorting this market higher levels so that we can take advantage of value in the US dollar.

If we can get to higher levels, which is simply makes the US dollar cheap. Just as in the USD/JPY pair, I believe that the only way that this market turns around races to the upside for any real length of time is if the Federal Reserve decides not to raise interest rates.