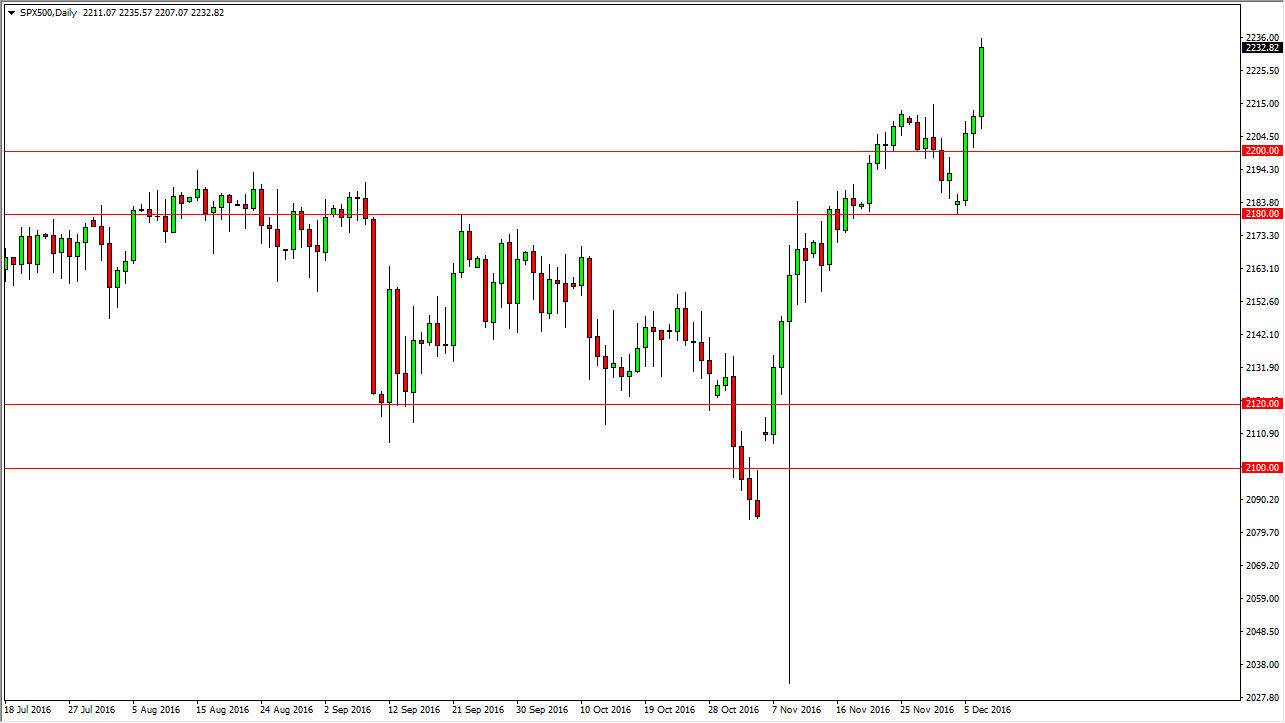

S&P 500

The S&P 500 broke out to the upside on Wednesday, as we continue to see buyers enter this market. We will more than likely see a continuation of this move, but I also recognize that pullbacks could be thought of as buying opportunities. The 2200 level below should be the “floor” in this market, as it was previously so resistive. I recognize that the US economy is doing better than most other larger economies, so having said that it’s probably only a matter of time before the buyers continue to flood into this market. I have no interest in selling at this point, as the market has seen so much in the way of bullish pressure over the last several weeks.

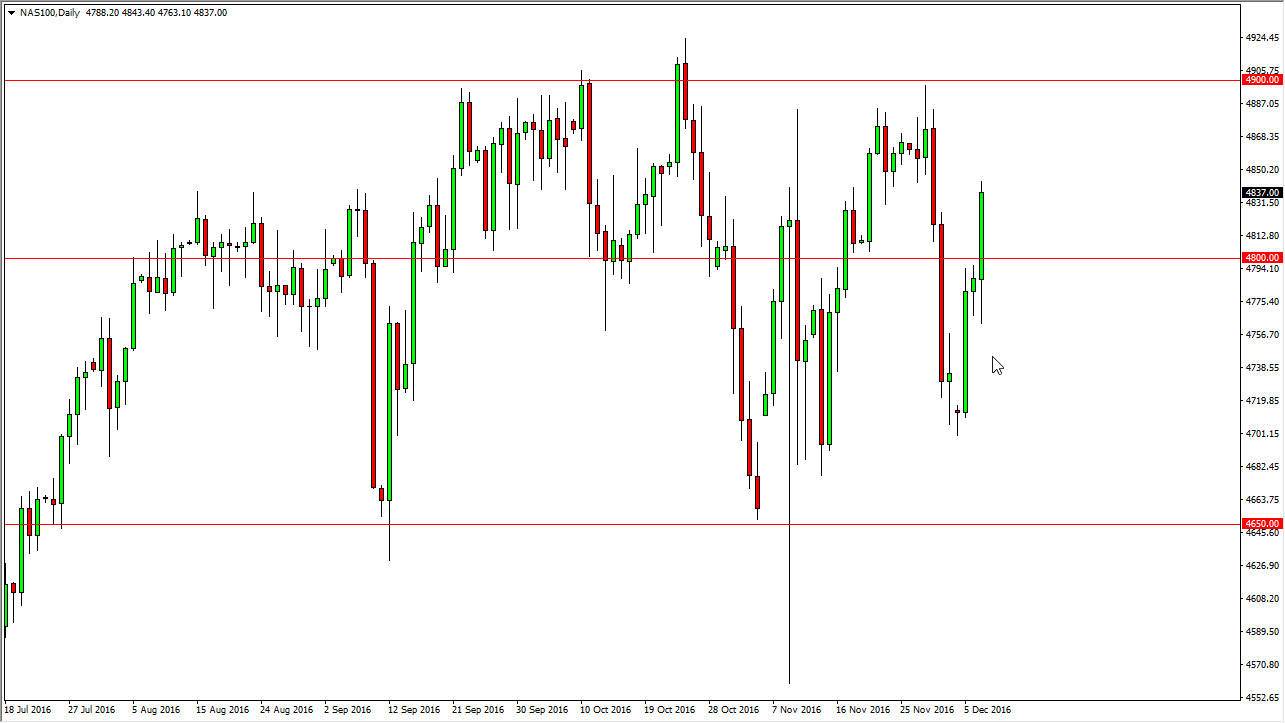

NASDAQ 100

The NASDAQ 100 initially fell on Wednesday, but turned around to find quite a bit of bullish pressure as we smashed through the 4800 level. A break above the 4800 level since this market towards the 4900 level above which was the top of the previous consolidation area. The market pulling back should be a buying opportunity, and I believe that we are more than likely going to try to break out above the 4900 handle, and then reach towards the 5000 level after that. I have no interest in selling, US indices look very healthy, and quite frankly the NASDAQ 100 is a bit of a laggard. This is a market that should continue to follow the S&P 500 and the Dow Jones 30, both of which have exploded to the upside in have broken out completely. The NASDAQ 100 could offer a bit of a cheap way to play those markets, as we should continue to see money flowing the US indices overall.

Even if we pullback from here, I think that the 4800 level below should be supportive. I believe that there are supportive levels under there as well, and given enough time the buyers do get an opportunity to step in and take advantage.