S&P 500

The S&P 500 had a quiet session on Friday as one would expect, as traders will have been thinking more about Christmas than putting money in a risky position. However, as we go through the holidays it appears to me that we may have short-term buying opportunities from time to time. I recognize that with the banks being on holiday today, it can be difficult to find any type of liquidity in this market. However, this is not change the analysis as I believe the 2250 level underneath offers quite a bit of support that the market will continue to respect. CFD markets could find the buyers at lower levels, awaiting the trading of the underlying S&P 500 once the market opens back up. This being the case, I think we’re going to bounce around with a slightly upward bias and then eventually break out after the holidays to the upside.

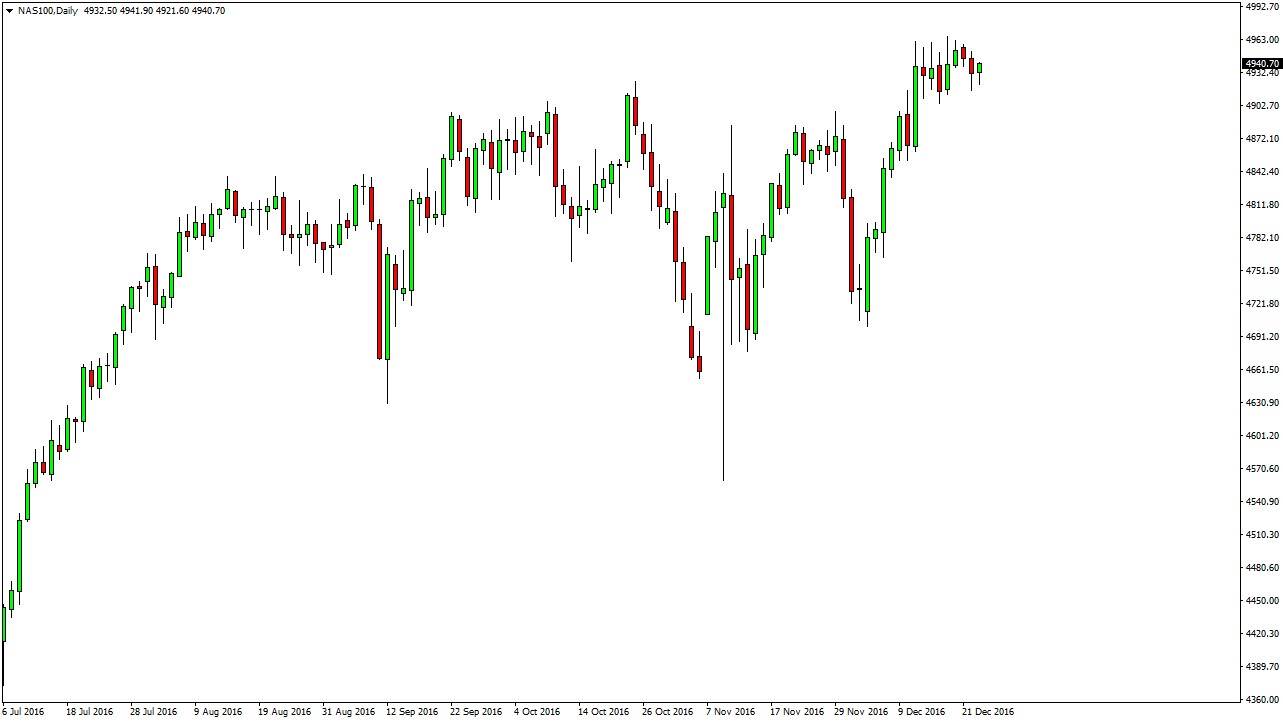

NASDAQ 100

The NASDAQ 100 dipped on Friday, but did find enough buying pressure underneath to turn around and form a slightly positive candle. The resulting hammer suggests that we still have plenty of support underneath, and as a result I believe that the CFD markets will find buyers every time we start reaching towards the 4900 level. It’s going to be choppy, and quite frankly the move to take a while to happen. However, I believe ultimately we reach towards 5000 and that has been my target for quite some time. I believe that every time this market pulls back, you must start thinking about buying as there has been so much bullish pressure over the longer-term.

I think the 4900 level will offer a bit of the floor in this market, and once we break above the 5000 handle, things will change as it will bring more of a “buy-and-hold” type of scenario to this CFD.