S&P 500

The S&P 500 sold off on Wednesday in reaction to the Federal Reserve raising rates, but quite frankly I think that’s a short-term move at best, as the market had already anticipated that it would happen. Because of this, I think the short-term buyers will step into this market place and look to get long again. We are obviously in a bullish trend, and I think that’s going to continue to be the case. Because of this, I’m going to look at the short-term pullbacks as buying opportunities and look for hammers and other candles like that on shorter time frames. I believe that the 2250 level should be supportive, and most certainly the 2200 level below there will be as well.

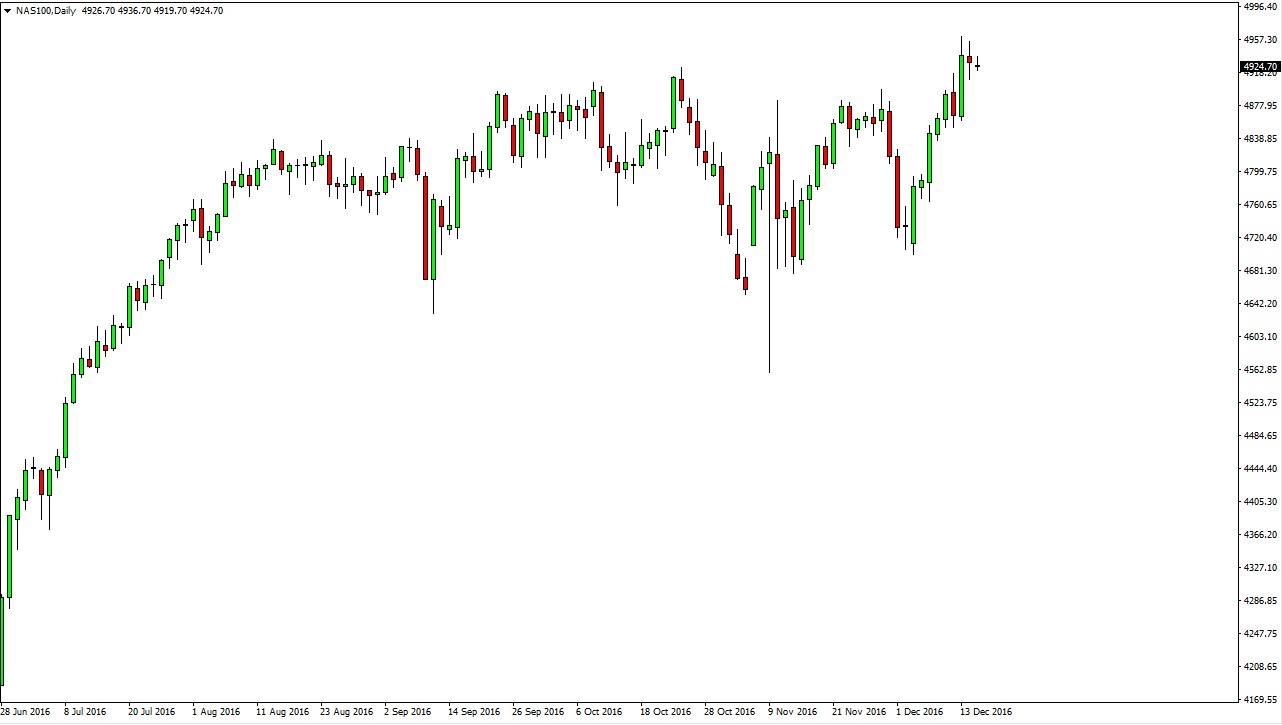

NASDAQ 100

The NASDAQ 100 had a fairly quiet session, as we have just recently broken out. The NASDAQ 100 has some catching up to do when it comes to the S&P 500 and the Dow Jones 30, so I think in a sense this might be the best market to play on the bounce. Ultimately, this market should reach towards the 5000 level which is been my longer-term target for quite some time now, and of course has a certain amount of psychological significance to it. If we reach that area, expect quite a bit of resistance, at least in the short term. I believe the pullbacks offer value the people will look to take advantage of, and that the 4900 level now should be rather supportive.

Nonetheless, I have no interest in shorting US indices as they seem to be some of the strongest in the world, if not the most reliable. I believe that the US economy will continue to strengthen and the Federal Reserve said as much during the Wednesday session, so I don’t see any reason why the stock markets would suddenly start to sell off.