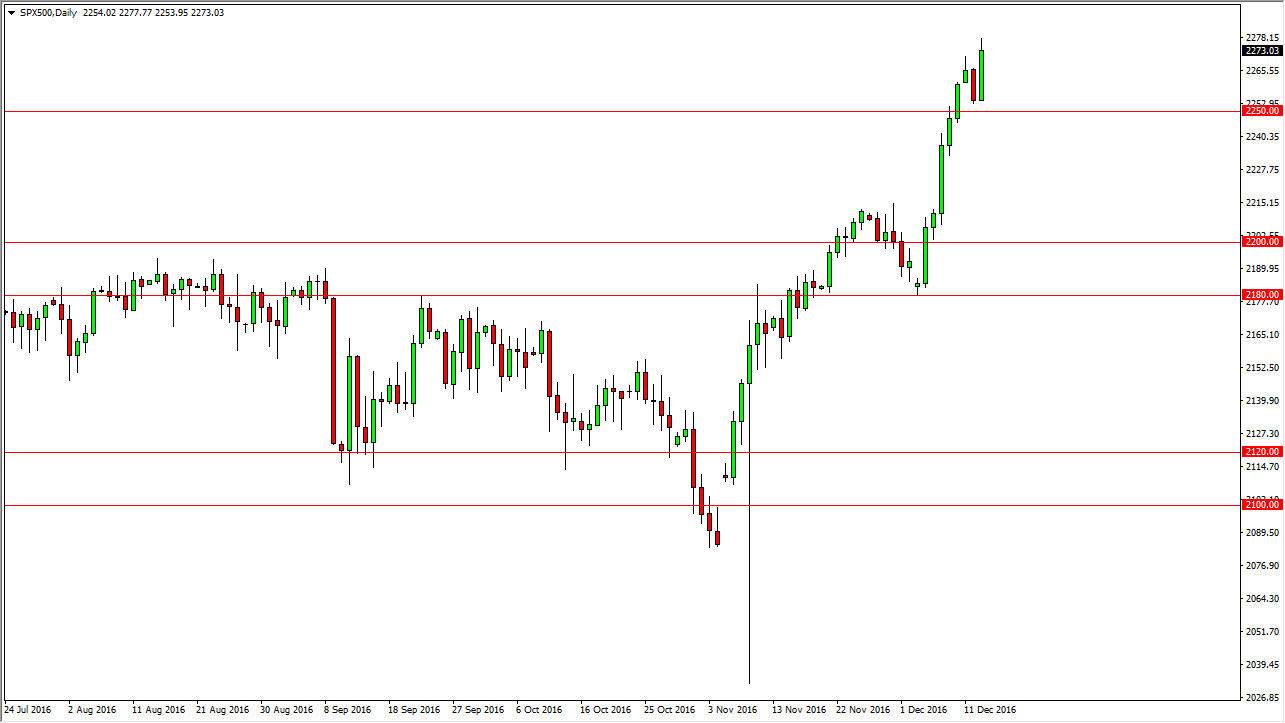

S&P 500

The S&P 500 broke higher during the Tuesday session as we continue to see quite a bit of buying pressure. It looks as if the 2250 level is now acting as a bit of a “floor” in this market, and we should continue to go much higher. I think pullbacks continue to offer value that we can take advantage of, as of course the US indices all look very bullish. I think that we will continue to reach towards the 2300 level, perhaps even higher than that. Even if we did break down below the 2250 level, I think that the market has a “floor” at the 2200 level that is the absolute bottom of this market. I have a hard time believing that the market won’t view some type of pullback as value.

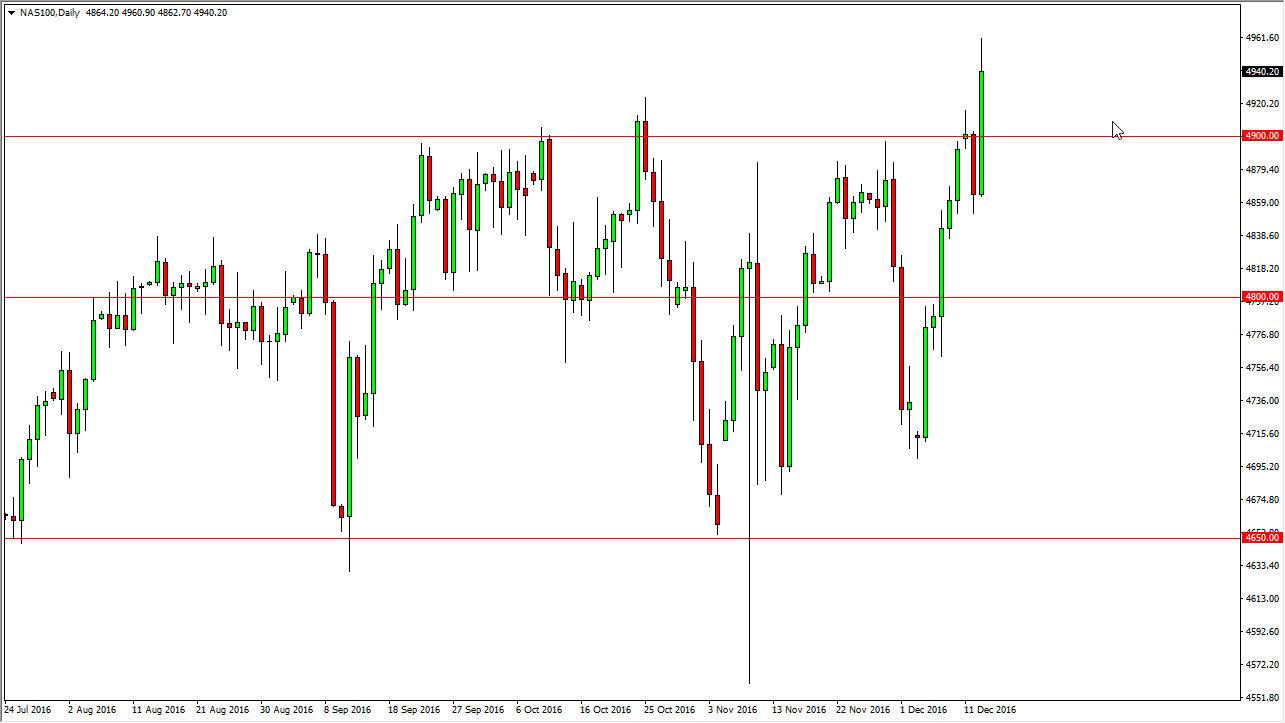

NASDAQ 100

The NASDAQ 100 finally broke out on Tuesday, as the 4900 level gave way. It now looks as if we are going to continue to go to the 5000 handle above. The 5000 level above is a large, round, psychologically significant number, and as a result it’s likely that the pullbacks from time to time will be nice buying opportunities. The 4900 level below is essentially the “floor” in this market, and because of this I feel that the market will not break down below there again. Anytime we reset area, I also have to believe that there are people out there that have missed the rally looking to get involved.

This candle is very strong looking, so at this point I feel that the buyers have certainly taken control, just as I had anticipated that they would. At this point, there’s no way to sell this market and I believe that US indices in general should continue to go much higher over the longer term. The US economy is stronger than most of the other major ones out there, so this move makes a lot of sense.