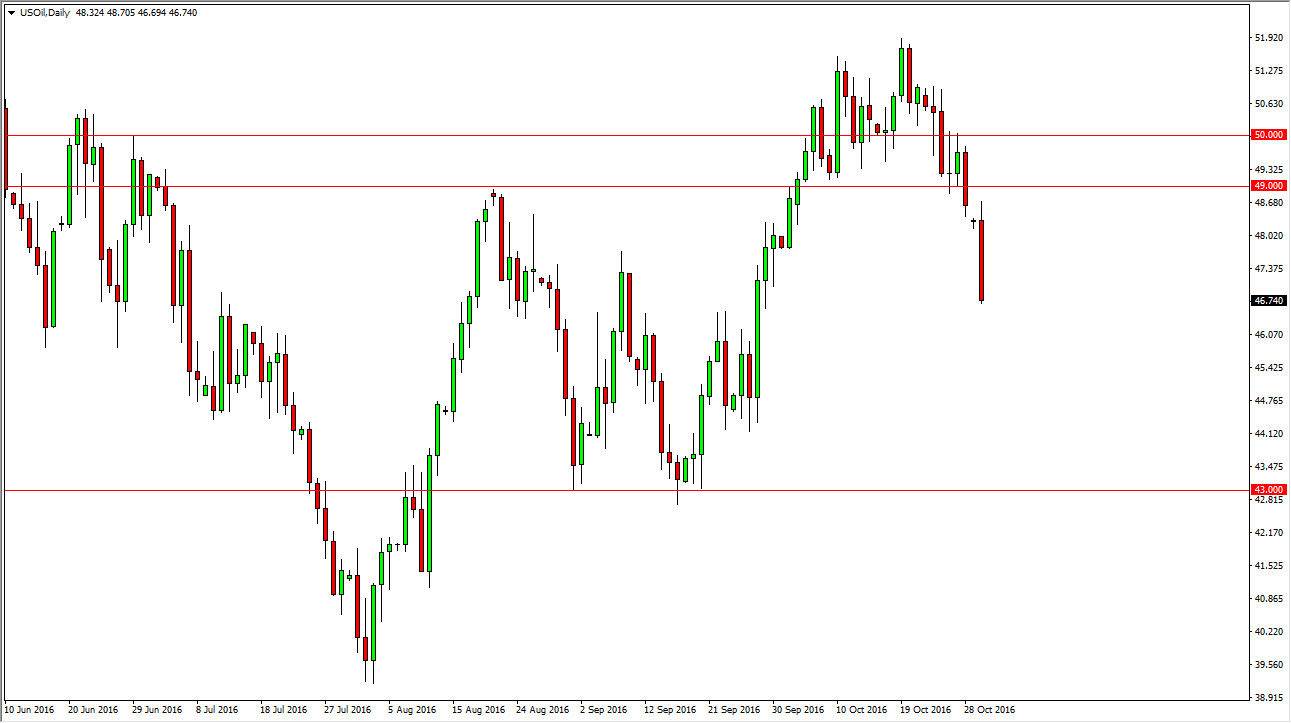

WTI Crude Oil

The WTI Crude Oil market gapped lower at the open on Monday, but then turned around to fill that gap and then fall significantly as we broke down below the $47 level. It looks as if the market is ready to continue going lower, and short-term rallies at this point in time should offer plenty of selling opportunities. Part of the negativity that has reentered the market is that the non-OPEC countries are looking very unlikely to follow along with the kind in oil production that the OPEC companies wanted. With this, oversupply should continue to be a problem, and of course we have to worry about demand as well, as it simply won’t be as strong as the web thought. At this point, it’s very likely that short-term rallies will offer selling opportunities.

Natural Gas

The natural gas markets fell rather significantly during the course of the day on Monday as well, crashing into the $3 handle. This is an area that I think we will see quite a bit of support act, not only because of the large, round, psychologically significant number, but the uptrend line, and then of course the 50-day exponential moving average. Any type of supportive candle in this area could be a nice buying opportunity, just as a bouncing would as well. If that is the case, the market could very well reach towards the $3.20 level again, and then eventually the $3.30 level. If we can break down below the uptrend line, and on a daily close, at that point I feel that the market would start to fall apart and then go much lower as it would be a significant breakdown in general. With this market looking so volatile, you’re probably better off waiting until the end of the day in order to make decisions.