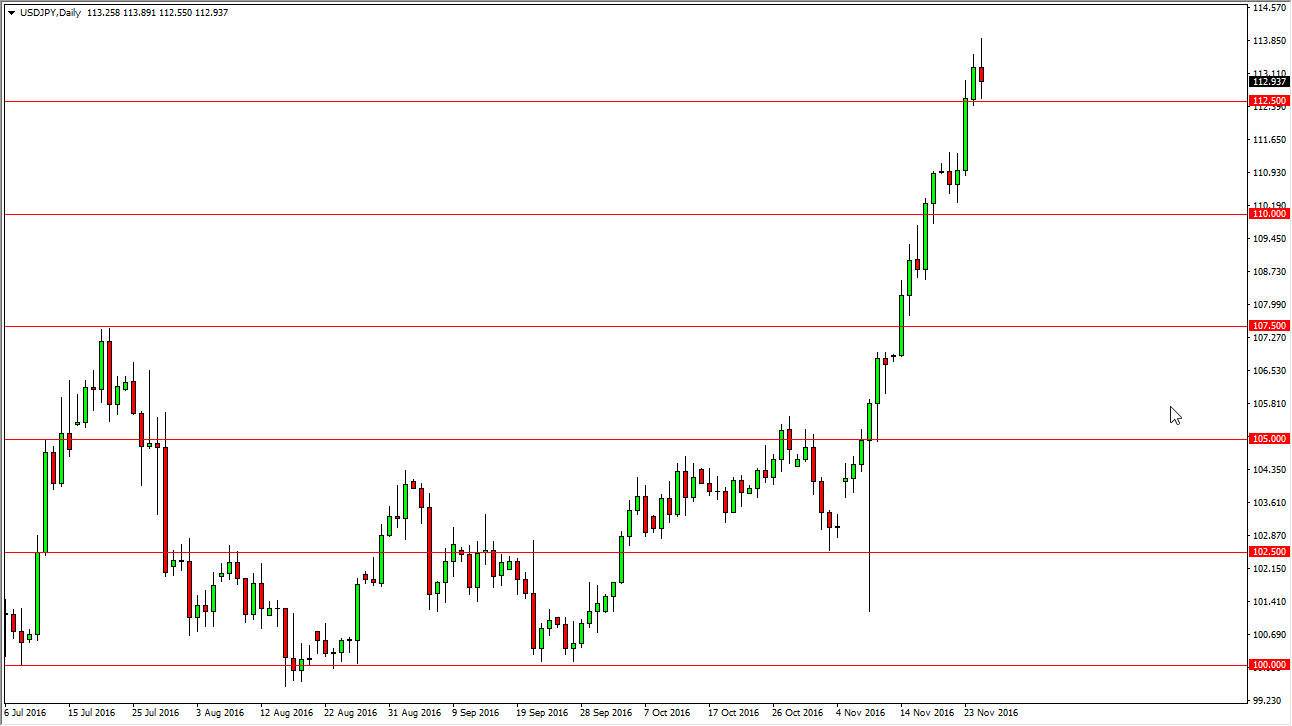

USD/JPY

The USD/JPY pair went back and forth during the session on Friday, as the 112.50 level offers significant support. At this point, I believe that it’s only a matter of time before we see some type of pullback, perhaps reaching down to the 110 level. This is a market that is clearly broken out and changed the overall trend, but at this point we need to pullback in order to build up enough momentum to finally go even higher. I think the pullback could be rather significant, and I would prefer to see several days’ worth of negativity first. I would not sell this pair though, I would simply wait for a supportive candle in order to turn things back around and start going long yet again. I have no interest in selling this market at all.

AUD/USD

The Australian dollar initially rose during the session on Friday, but found enough resistance above the 0.7450 level to turn things around and form an exhaustive candle. The exhaustive candle of course suggests that perhaps the downward pressure should continue in this market. It also makes quite a bit of sense considering that gold has broken down through a significant support level. Because of this, I’m willing to sell the Aussie as long as we can stay below the 0.75 handle, and believe that we will reach towards the 0.73 level underneath.

A break above the 0.75 level would of course be very bullish, and could send the market back into the previous consolidation area. I believe that’s very unlikely at this point though, and I believe that we will probably eventually break down to a fresh, new low, perhaps reaching towards the 0.70 level under there. I don’t know if we can go below that level, but I would expect due to the fact that it is such a large number, that we would have a significant fight on our hands.