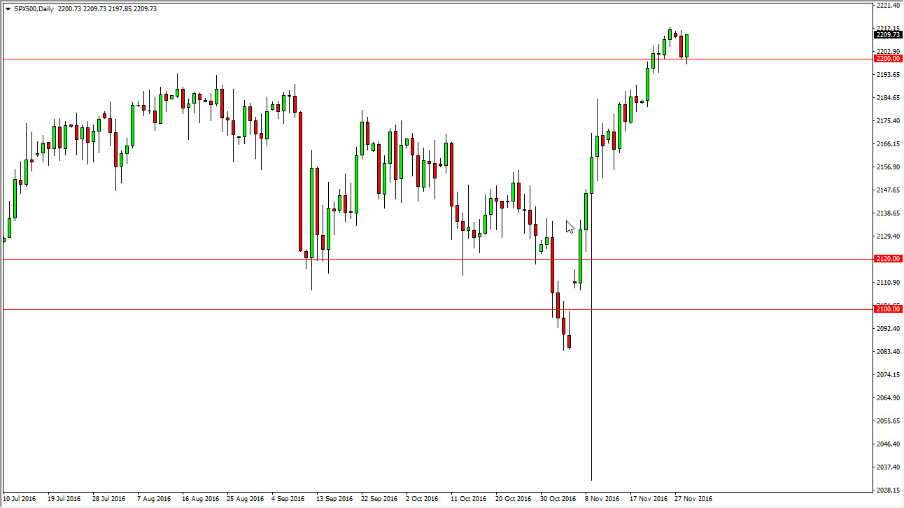

S&P 500

The S&P 500 had a positive session on Tuesday, bouncing off of the 2200 level to show continued signs of bullishness. I believe that pullbacks at this point will continue to find buyers below, and that the 2180 level below is essentially the “floor” in this uptrend. I think that the S&P 500 will follow the rest of the US indices in general, meaning that we should see plenty of bullish pressure over the longer term. That’s not to say that it won’t be choppy, you can almost count on that, but at the end of the day this is a market that certainly has a lot of bullish pressure in it, and therefore you can’t go against that type of move.

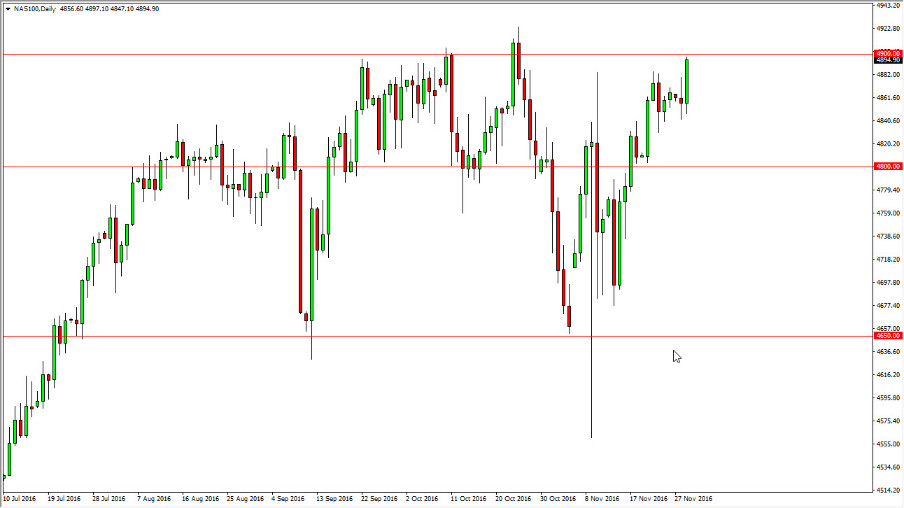

NASDAQ 100

The NASDAQ 100 broke higher during the day on Tuesday as well, testing the 4900 level. The 4900 level of course is a large, round number and has been rather resistive as of late. I believe that if we can break above there, and I think we will given enough time, it’s time to continue going towards the 5000 level which is been my longer-term target for some time. I also believe the pullbacks will be supported, especially near the 4850 handle. Any pullback to show signs of support will be a nice short-term buying opportunity, and then perhaps a momentum building opportunities so that we can break out and move much higher.

Currently, I have no interest in selling the NASDAQ 100 but I do recognize that it is probably thought to be the laggard when it comes to US indices at the moment. Nonetheless, all of them are going higher as far as I can see, and of course the NASDAQ 100 isn’t going to be any different. Perhaps it’s that the NASDAQ 100 rely so much on foreign sales that it is just a bit behind the S&P 500.