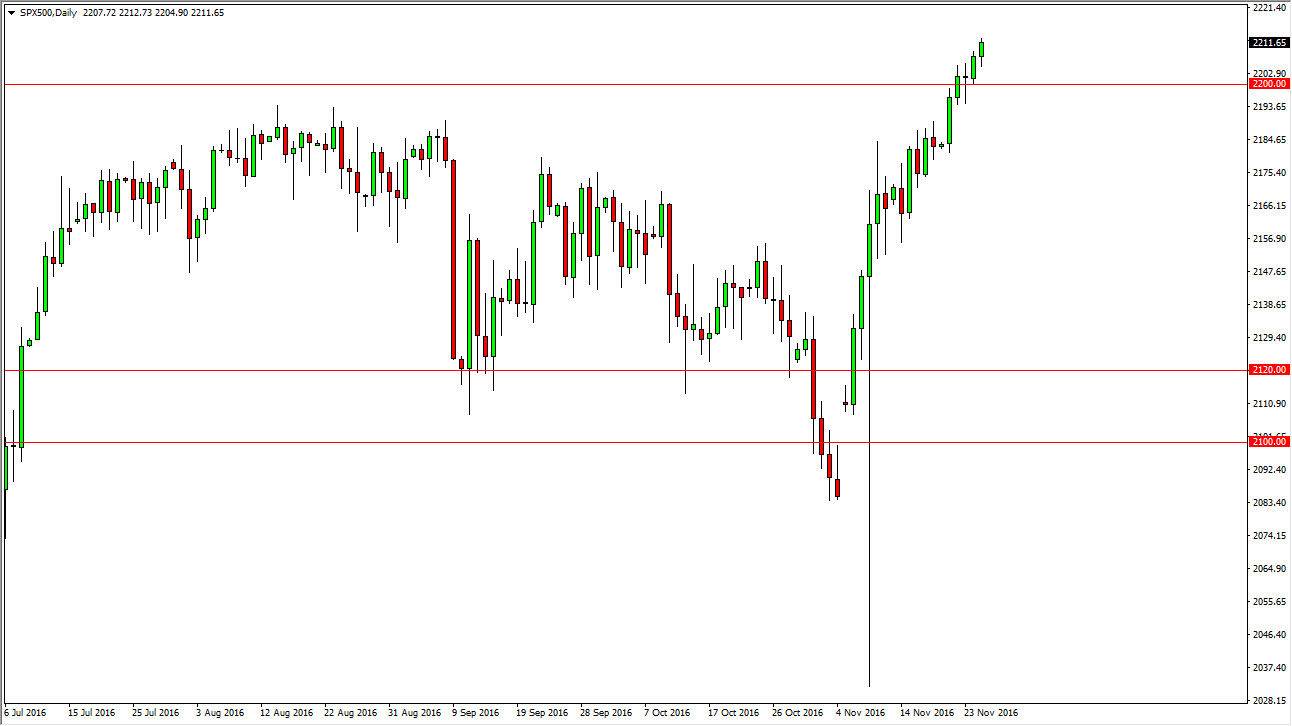

S&P 500

The S&P 500 initially fell on Friday but turned around the green candle that shortened the session. Seems all but a foregone conclusion that we will continue to go higher, and at this point in time I believe that the best way to play this market is that buying pullbacks offer value. It will probably be a bit choppy, because biometrics are certainly overbought. However, the ascension has slowed down so it’s likely that we can sustain at least a modicum of positivity. I believe that the 2200 level below is massively supportive, and believe the 2180 below there is even more so. Because of this, I can only buy the S&P 500 as US indices in general look very strong currently.

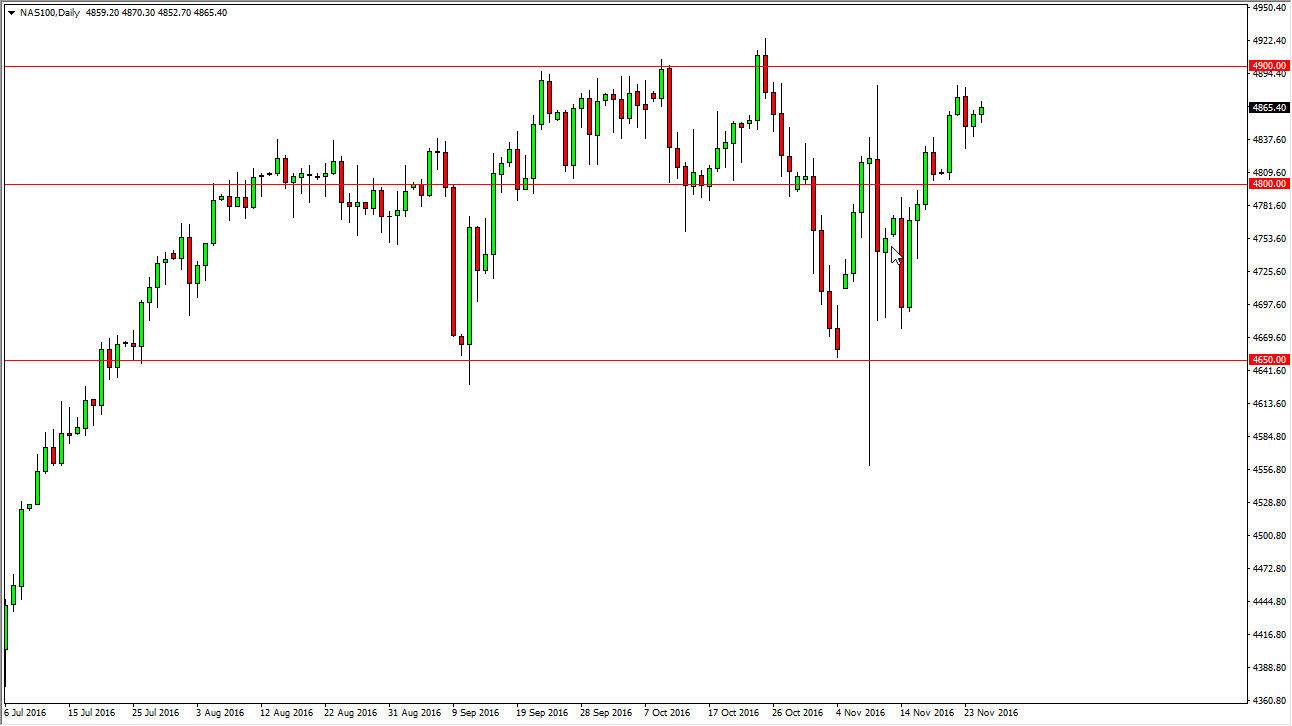

NASDAQ 100

The NASDAQ 100 has been a little bit of an outlier at this point, because US indices in general have done very well. However, the NASDAQ 100 has struggled just a little bit. Perhaps this is due to the fact that the NASDAQ 100 tends to have a lot of companies are doing business overseas. I don’t think that this is a reflection of US economic strength, but perhaps a reflection of weakness around the world. After all, if your clients don’t have any money, they aren’t buying anything.

Nonetheless, the US indices are all going higher and the old expression is “a rising tide lifts all boats”, and that should be the case here. The NASDAQ 100 will be a bit of a laggard, but most certainly it should have buyers every time we dipped. I think the 4900 level above is resistance, just as the 4800 level below is supportive. Given enough time, I think that we break above the 4900 level and reach towards the 5000 level which is been my longer-term target for quite some time.