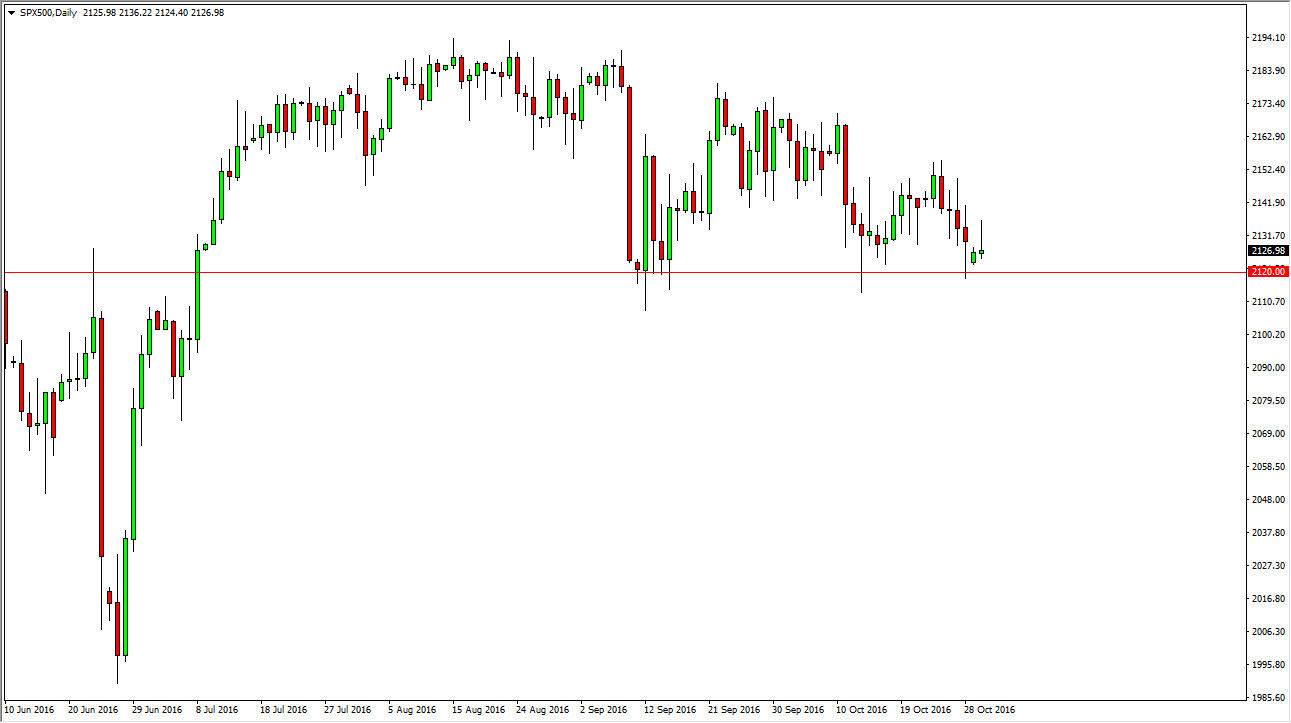

S&P 500

S&P 500 markets rallied after initially falling on Monday, as the 2120 has offered quite a bit of support. The fact that we formed such a negative looking candle has me wondering whether or not we are getting ready to break down below the support. If we do, we will have to get through the 2100 level in order to continue to drift much lower. Rallies at this point in time could be sold off but a break above the top of the shooting star could be a very positive sign and therefore I feel we would probably reach towards the 2160 handle at that point in time. This area is massively supportive obviously, so having said that it’s not a huge surprise that if we take off to the upside from here.

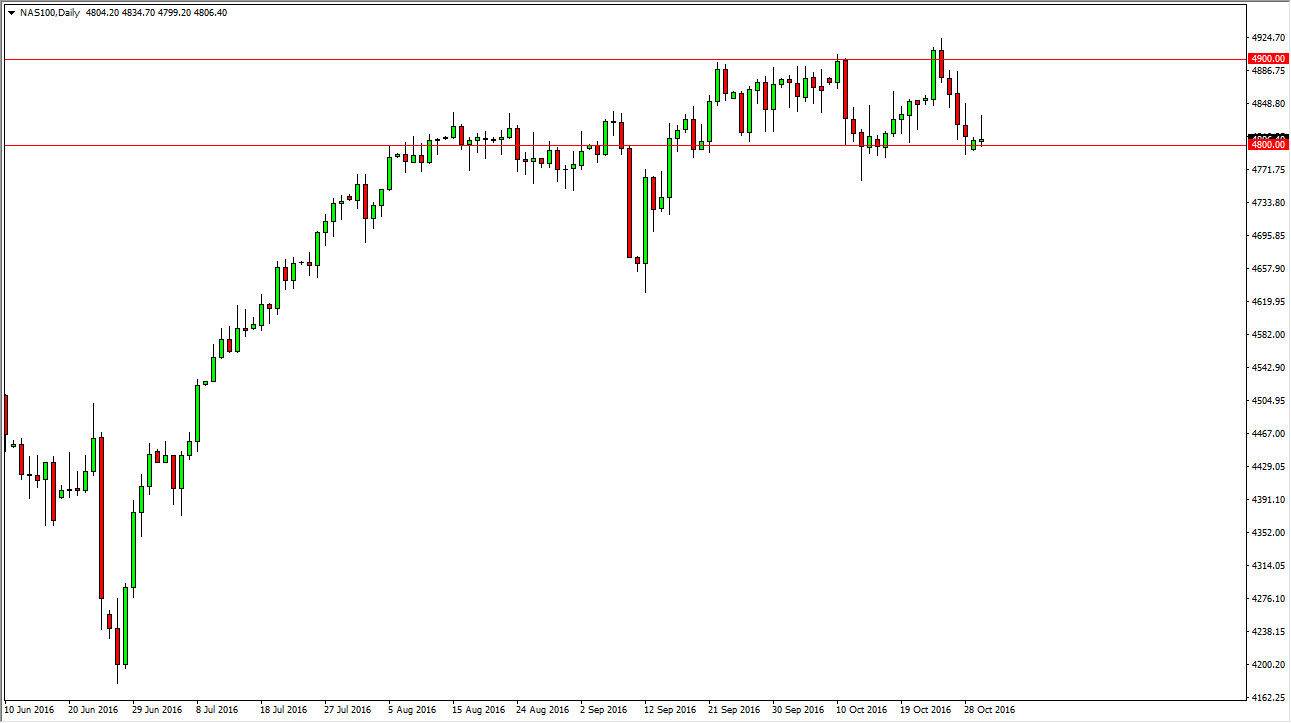

NASDAQ 100

The NASDAQ 100 did the same thing as well, bouncing off of the 4800 level for support, but as you can see ended up forming a shooting star which of course is very negative. I think that the market continues to bounce between the 4800 level on the bottom and the 4900 level on the top. I think that there is quite a bit of support all the way down to at least the 4750 handle, and with that being the case I feel that it’s only a matter of time before the buyers return and continue to take advantage of low interest rates in the United States by going long the NASDAQ 100.

If we broke down below the 4750 level, the market could find itself going down the 4650. On the other hand, I do think that it’s much more likely that we will break the top of the shooting star from the Monday session which would have the market looking for 4900. With that being the case, I continue to be bullish overall but I recognize we have a fight on our hands.