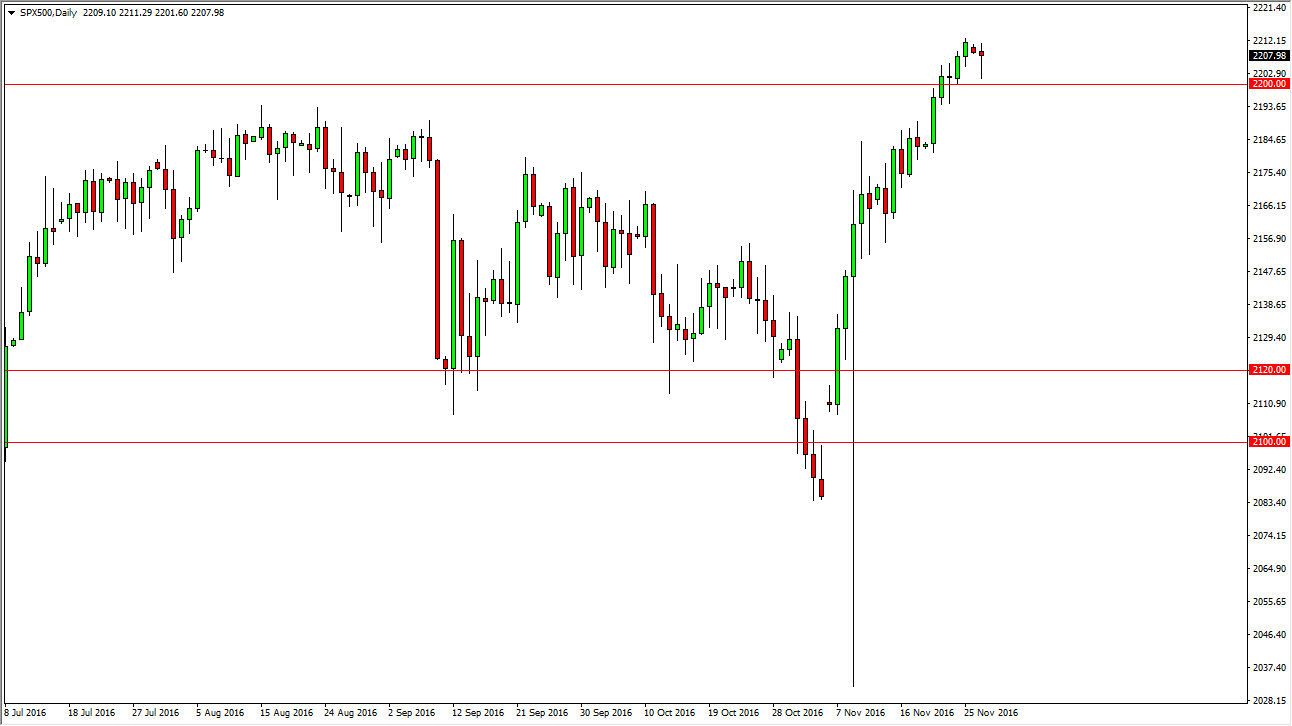

S&P 500

The S&P 500 initially fell on Monday, testing the 2200 level for support. It found it at that area, as the markets retested what was previously resistance. Having formed a hammer is a very bullish sign, and as a result I believe that we will continue to go higher. I have a target of 2250 above, as the market should continue to grind its way to the upside. This is a market that is a bit overbought, so we may have to go sideways for a while but ultimately there’s no way he can sell this market. I believe that the support level extends all the way down to the 2180 handle underneath, and that of course should continue to be a deterrent for the sellers.

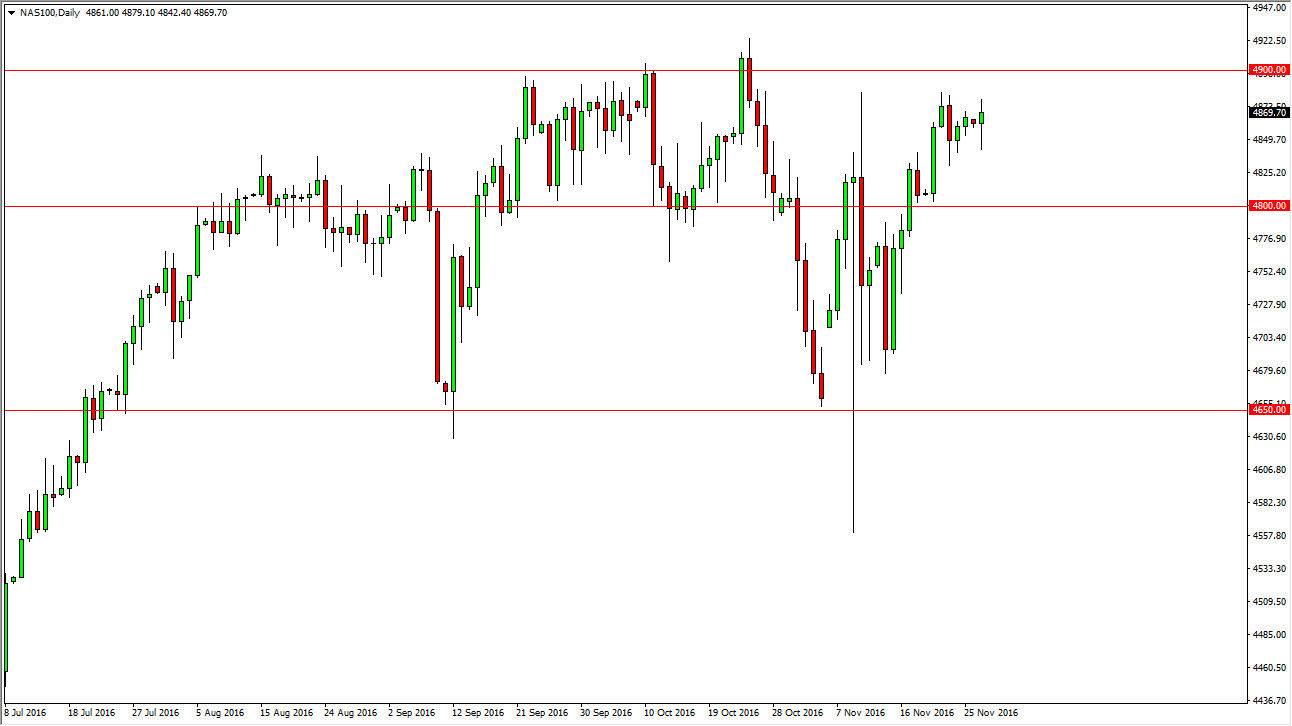

NASDAQ 100

The NASDAQ 100 went back and forth during the day on Monday, as we continue to bounce around the 4850 region. I have no interest whatsoever in selling this market, and I believe that a pullback should find plenty of support below at the 4800 level. If we can break above the 5900 level, the market should continue to reach towards the 5000 level above. That’s my longer-term target, but I recognize that the NASDAQ 100 is going to be a bit of a laggard when it comes to the overall health of the US indices in general. I think that they will all gone the same direction, but this one might be a little bit more stagnant because it is so dependent on overseas sales. The market should continue to be choppy nonetheless, so I don’t favor going long this market when you can buy the S&P 500 or even the Dow Jones 30, but do recognize that the upward pressure is what should continue to be a mover of this particular index.