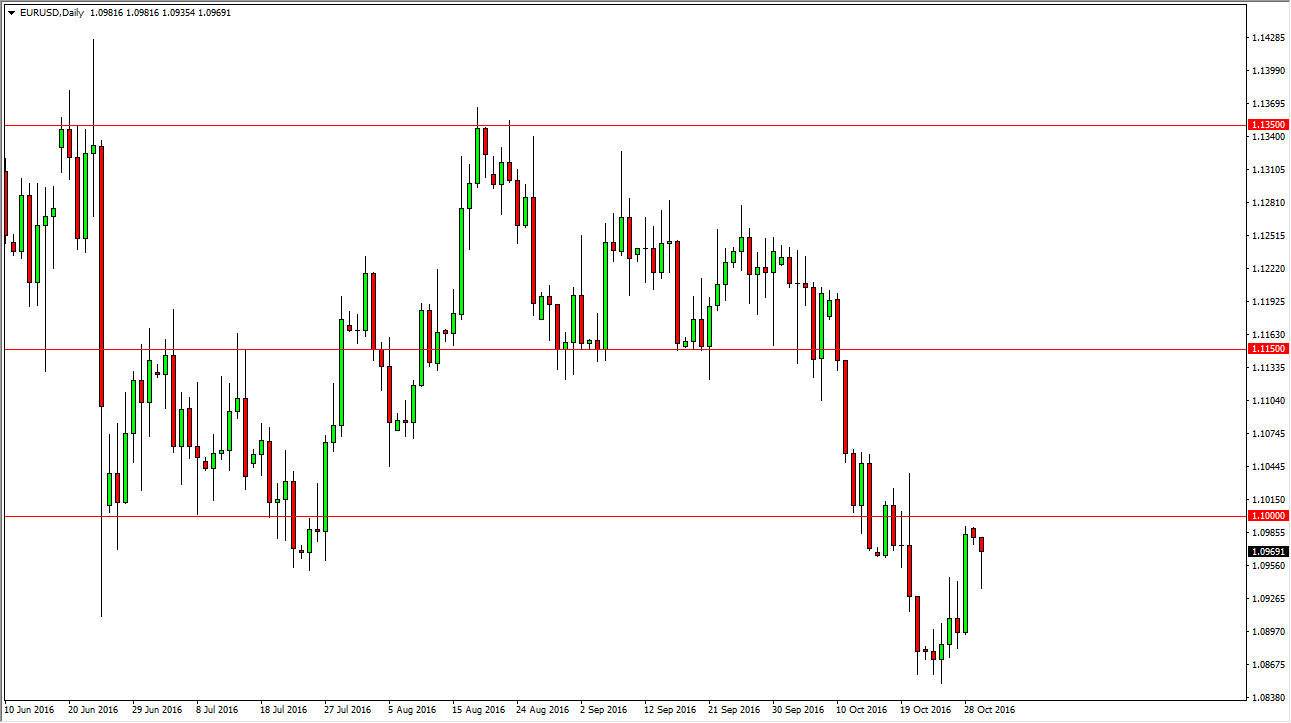

EUR/USD

The EUR/USD pair fell significantly at the beginning of the session on Monday, but did find enough support just above the 1.09 level to turn things back around. By doing so, we ended up forming a reasonably supportive candle that suggests perhaps the buyers aren’t quite done. Because of this, I think that we will try to reach above the 1.10 level, but I see a significant amount of resistance in that general vicinity that could turn this market back around. With this, I think that we will sooner or later see sellers reenter this market so that we can take advantage of what has been a very strong downtrend. A break below the bottom of the hammer would of course be a selling opportunity as well, as we should reach towards the 1.0850 level below.

GBP/USD

The GBP/USD pair fell slightly during the day but then bounced enough to form a somewhat supportive candle for Monday. Because of this, the market looks as if it is trying to reach higher and perhaps continue the consolidation area that we’ve seen again and again. I think that the market has a bit of a resistance barrier at the 1.25 handle, and then of course the 1.2850 level above there. Any exhaustive candle after a bounce is reason enough to sell as far as I can see, and therefore have no interest whatsoever in buying this pair. I think that is only a matter of time before we see sellers will return, as it will take a significant amount of momentum to break down below the “floor” at the 1.20 level. A break down below there could of course send this market much lower. Because of this, I think that sellers continue to enter this market based upon “value” when it comes to the US dollar in time we rally.