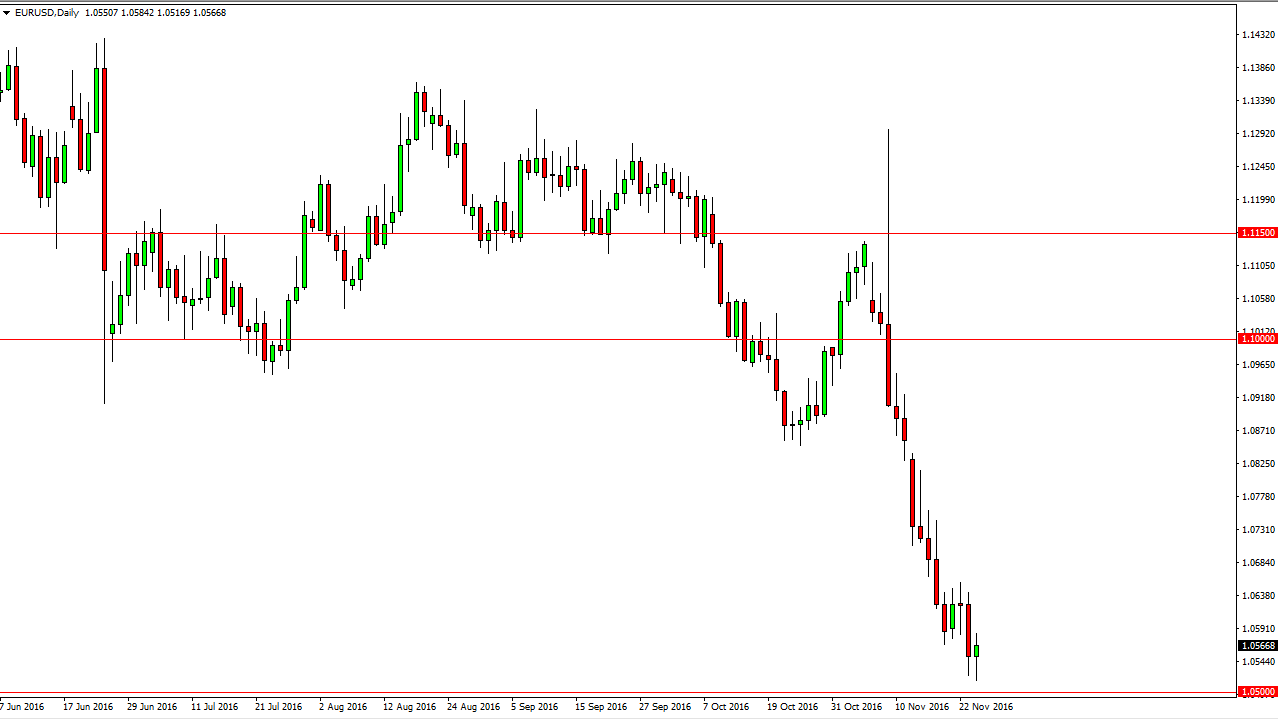

EUR/USD

The EUR/USD went back and forth during the day on Thursday, as the 1.05 level below offer quite a bit of support. This is an area that is massive when it comes to support on the longer-term charts, so having said that it is not surprising that we slowdown in this area. On top of that, it was Thanksgiving in the United States of some of the liquidity in this market was taken out. I would expect a bounce here, and I think that bounces going to offer and I selling opportunity from higher levels. I want to see some type of bounce that fails after a bit of a gain so I can take advantage of “value” in the US dollar. Alternately though, we could breakdown below the 1.05 level and then at that point I think you would have to start selling again.

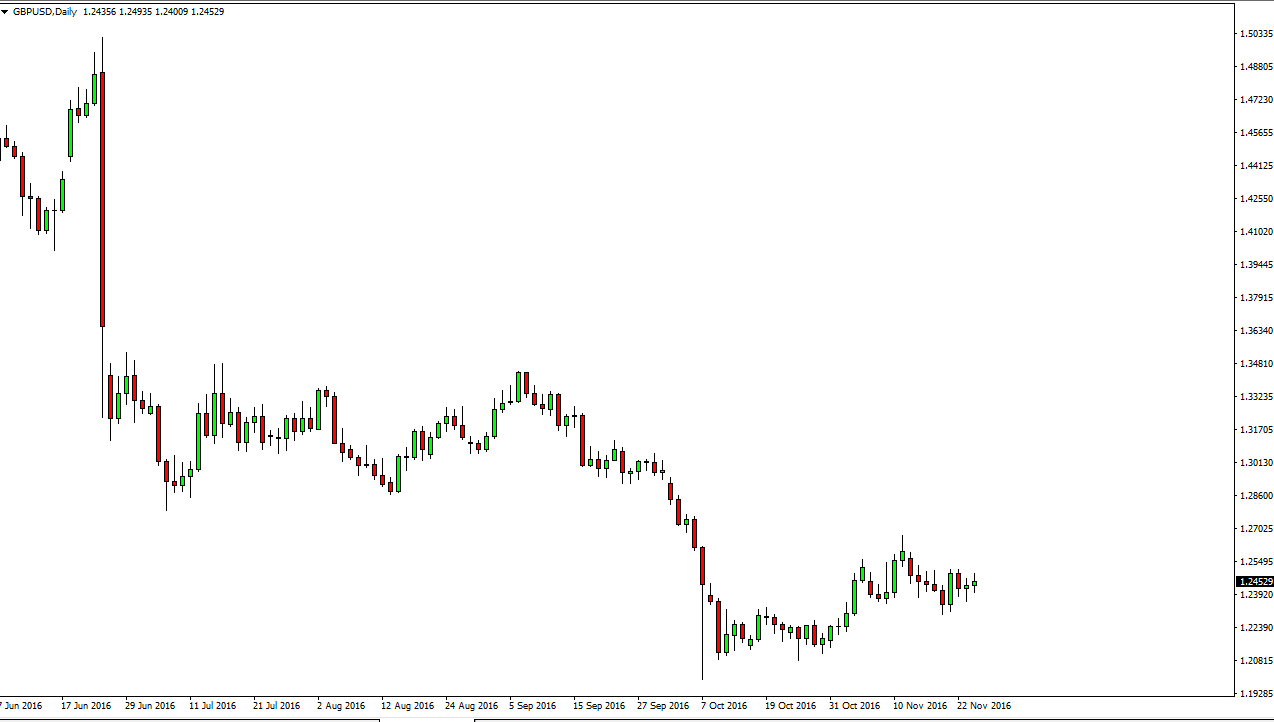

GBP/USD

The British pound went back and forth during the day on Thursday as well, ultimately forming a very minimal candle. This is a market that is can be difficult to trade now, as I believe we are essentially attracted to the 1.25 handle, and with this it’s probably going to be a difficult market to be involved in. I believe the trading the British pound against the US dollars going to be difficult, but it is much easier to trade in against the Japanese yen, the Euro, the Swiss franc, and several other currencies around the world. This is a market that essentially is “dead money” as far as I can see.

If we do breakout to the upside, I believe that the 1.2850 level is massively resistive and is can be very difficult to get above. At this point, I think the market is essentially taking a breather after the massive volatility that we have seen after the exit vote from the European Union.