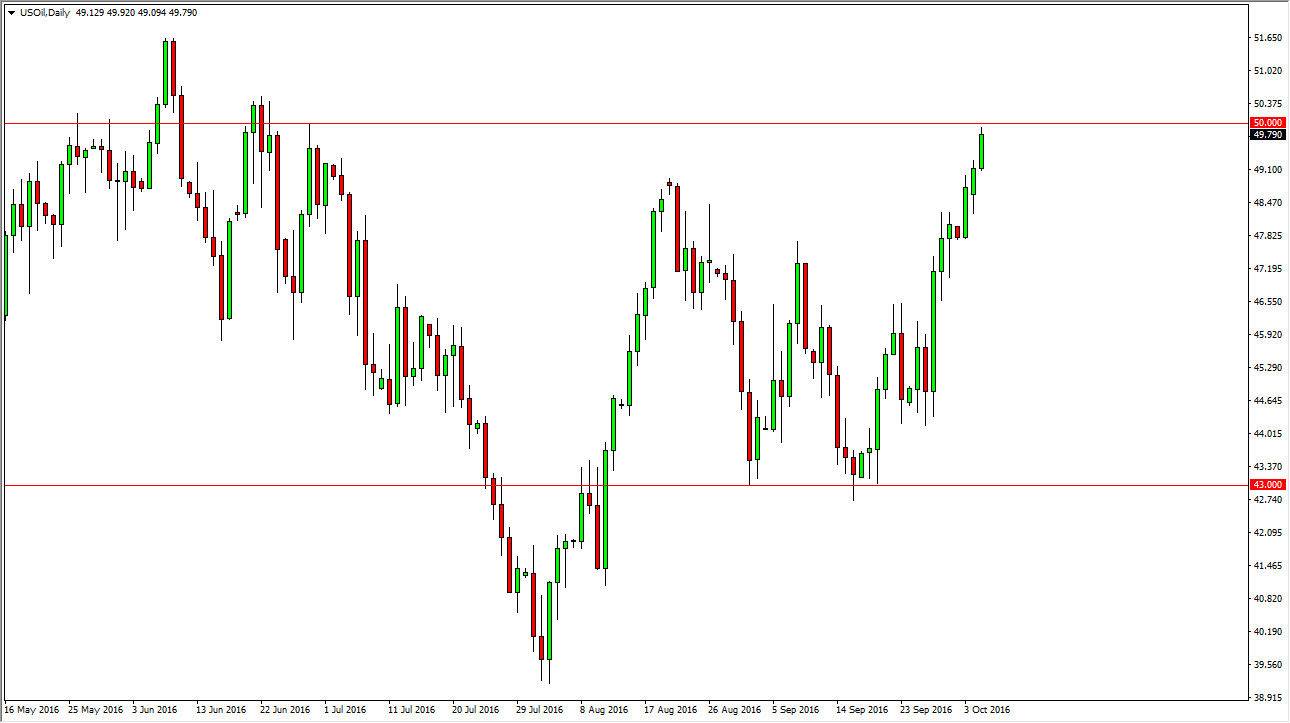

WTI Crude Oil

The WTI Crude Oil market rose slightly during the course of the day on Wednesday, slamming into the $50 level. With this being the case, it looks as if we are trying to break out but I would also be the first person to admit that the market is a bit overextended. I think that pullbacks should continue to be opportunities for buyers to get involved as we need to build up enough momentum to clear the psychologically significant $50 level. If we do get above there, the market will more than likely reach towards the $51.50 level. On the other hand, if we fell from here I do not have any interest in selling this market until we get below the $48 level, which of course would be very negative.

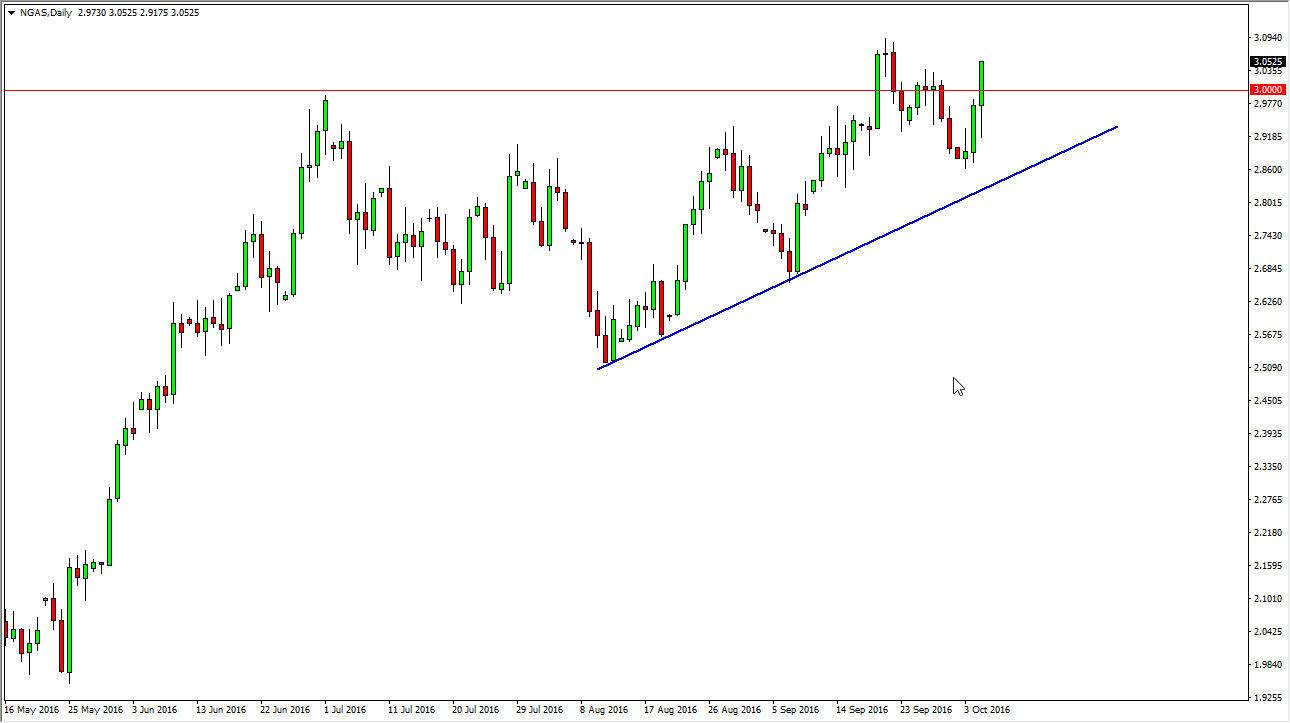

Natural Gas

The natural gas markets initially fell during the course of the day on Wednesday, but turned right back around to break above the $3 handle. This is a very bullish sign, and as a result I think that the natural gas markets will continue to grind away to the upside. It appears that we will continue to see buyers every time we dipped, and as a result it’s likely that the market will continue to reach towards the $3.00 level above, and perhaps even higher than that. I believe that the natural gas markets are still suffering a little bit of a shortage of supply, but this is a temporary situation. Given enough time, the market should eventually search selling off again but that’s not going to be anytime soon. With this, you have to buy every time the market dips based upon the most recent history. In fact, it’s not until we break down below the uptrend line that I have drawn on the chart that selling is even remotely going to be a thought on my part.