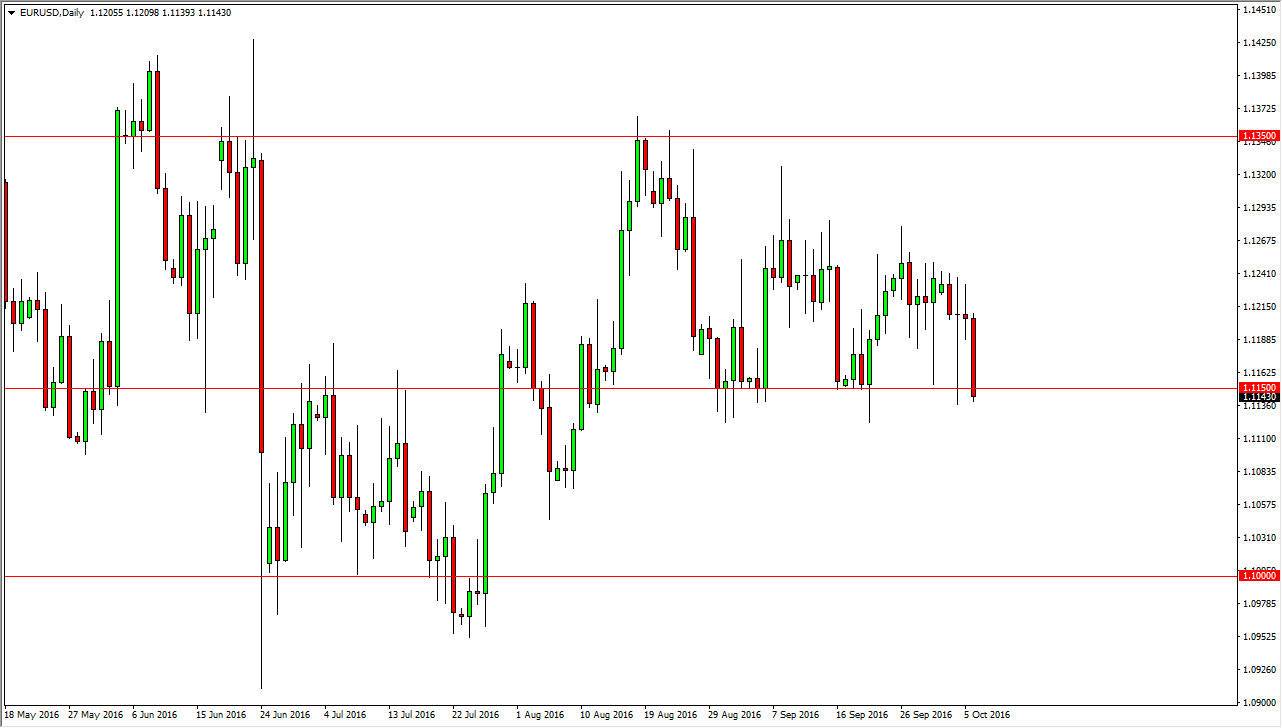

EUR/USD

The Euro fell rather hard during the course of the day on Thursday, crashing into the 1.1150 level, an area that I believe is the bottom of the potential descending triangle in this pair. I think that if we can break down below the 1.11 level, the market will continue to drop down to the 1.10 level. Ultimately, I think that a bounce from here will more than likely find quite a bit of resistance as well, so I think that this is essentially going to be a “sell only” type of market, and a knee-jerk reaction to the upside could be exactly what this pair does when we get the Nonfarm Payroll Numbers today. Any rally at this point in time I began looking for selling opportunities based upon exhaustion.

GBP/USD

The GBP/USD pair broke down during the day on Thursday, testing the 1.26 level. I feel at this point in time it’s only a matter of time before the sellers get involved. We either break down below the 1.26 level, and drop down to the 1.25 handle, or we get some type of rally that we can start selling based upon exhaustion. I believe that the 1.2850 level above is essentially the “ceiling” in this market, and with that being the case there’s no reason whatsoever for me to consider buying this pair.

I feel that the market still punishing the British pound for the exit vote, but at this point in time it more than likely will start to lose some of the downward pressure. I think given enough time this pair will turn back around, but at this point in time the Federal Reserve is the only central bank in the world that I’m aware of that is talk about raising interest rates. If that’s the case, then it makes sense that the US dollar continues to strengthen against most other currencies, especially the British pound.