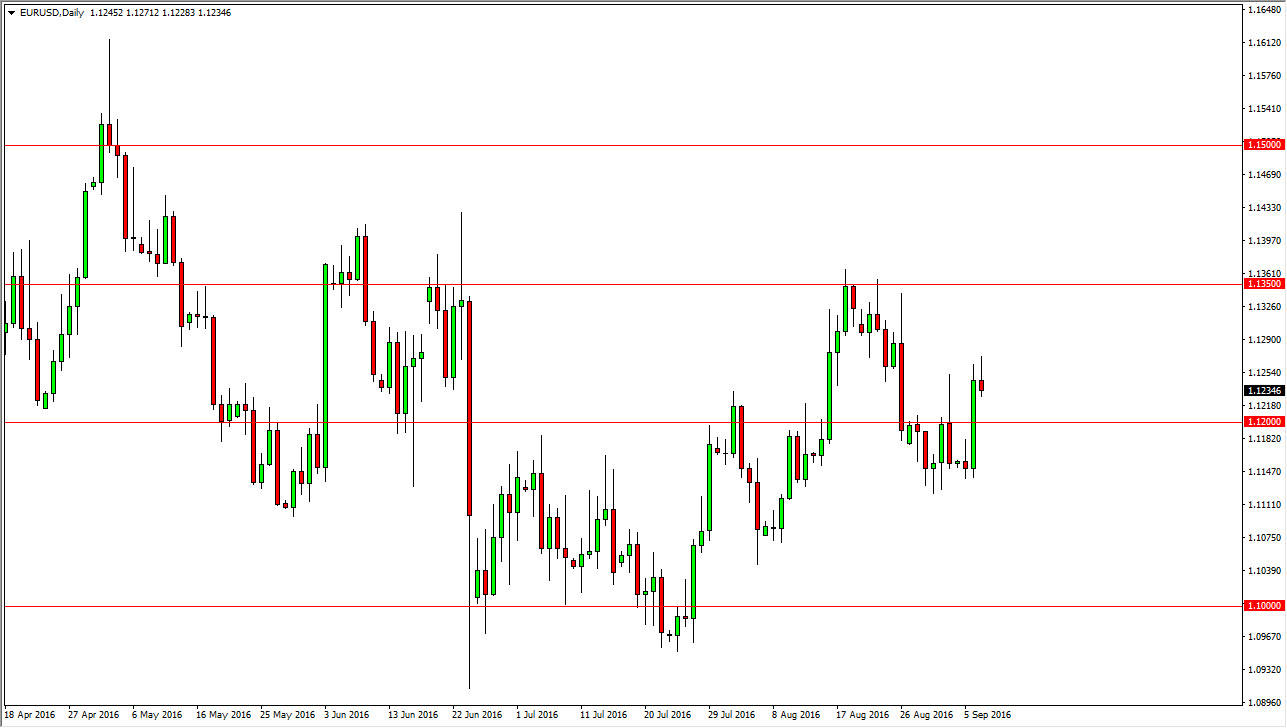

EUR/USD

The EUR/USD pair initially tried to rally during the course of the session on Wednesday, but turn right back around to form a shooting star. The shooting star of course is a negative sign, and a break down below the bottom of it will send this market lower. You should also be aware the fact that the ECB has an interest rate announcement coming out today, and that of course could be reason enough to move the market around drastically as well. We can break above the top of the shooting star and start buying, but that would be very bullish sign. Ultimately, at the end of the day we should have a little bit more clarity when it comes to the idea of the next longer-term move.

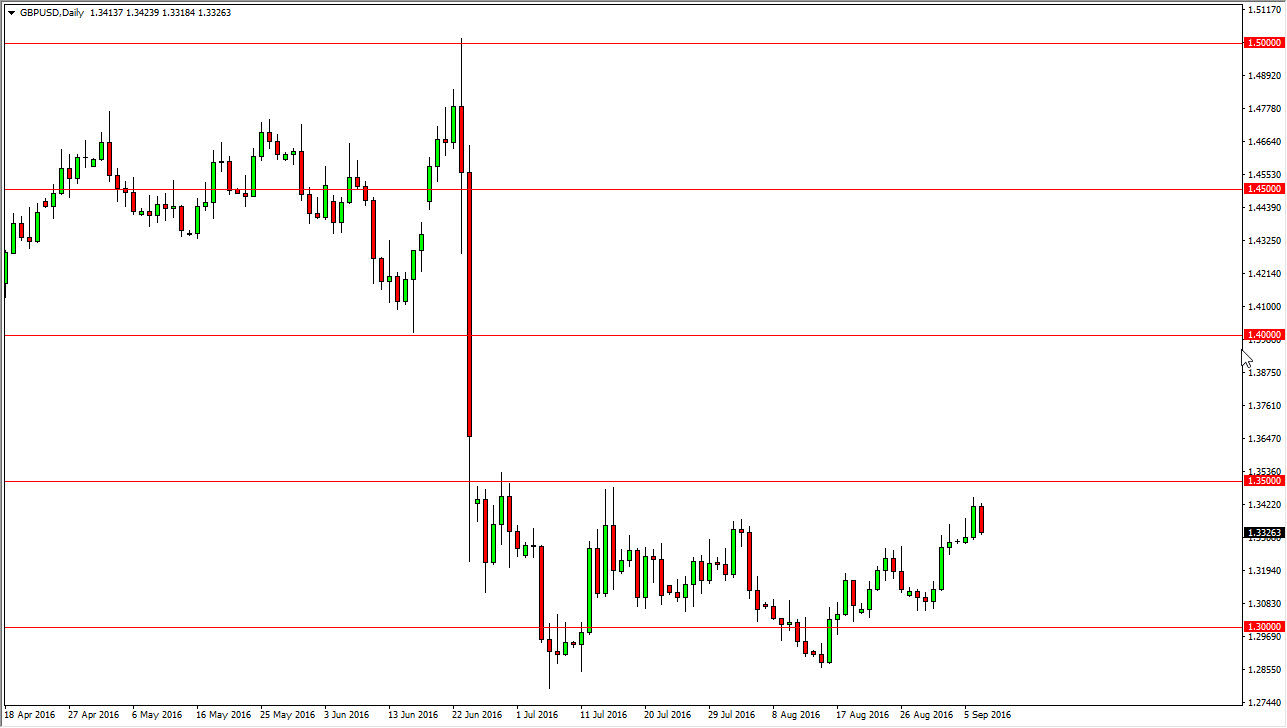

GBP/USD

The British pound fell significantly during the course of the session on Wednesday, forming a rather negative candle. We are still well within the consolidation area that we’ve been in for some time, so we can break down below the bottom of the range for the Tuesday session, I believe the market drops down to the 1.30 level. Given enough time, we could even break down to the 1.12850 level below, which has been supportive as well.

The 1.35 level above will continue to be massively resistive, and I believe that the resistance extends all the way to the 1.3650 level above as it was the top of the gap lower back during the month of June. Because of this, it makes a lot of sense that the market would turned back around and of course we have a longer-term downtrend. As volume picks up, it makes sense that the downward pressure would continue as we have seen such a change in the attitude when it comes to being British pound. With this, any signs of exhaustion could be a nice selling opportunity.