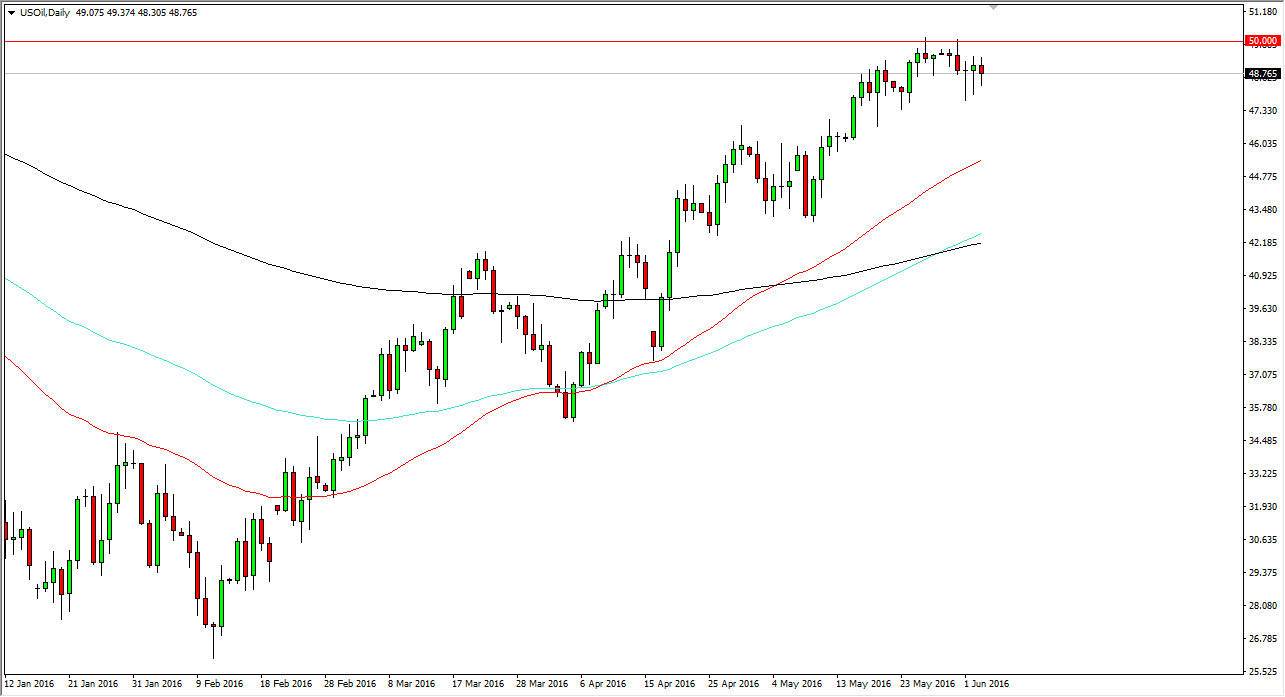

WTI Crude Oil

The WTI Crude Oil markets initially fell on Friday in reaction to the poor jobs number, but also got a little bit of a boost by a shrinking US dollar. Ultimately, the crude oil markets look very much like the stock markets in America, pressing up against a significant resistance barrier. The buyers are refusing to go away, and as a result I believe it’s only a matter of time before the breakout above the $50 level and enter into the next leg higher. On the chart I have the 50 day exponential moving average and the 100 day exponential moving average now above the 200 day exponential moving average, which is a sign of a trend change. At this point in time, I don’t have any interest in selling.

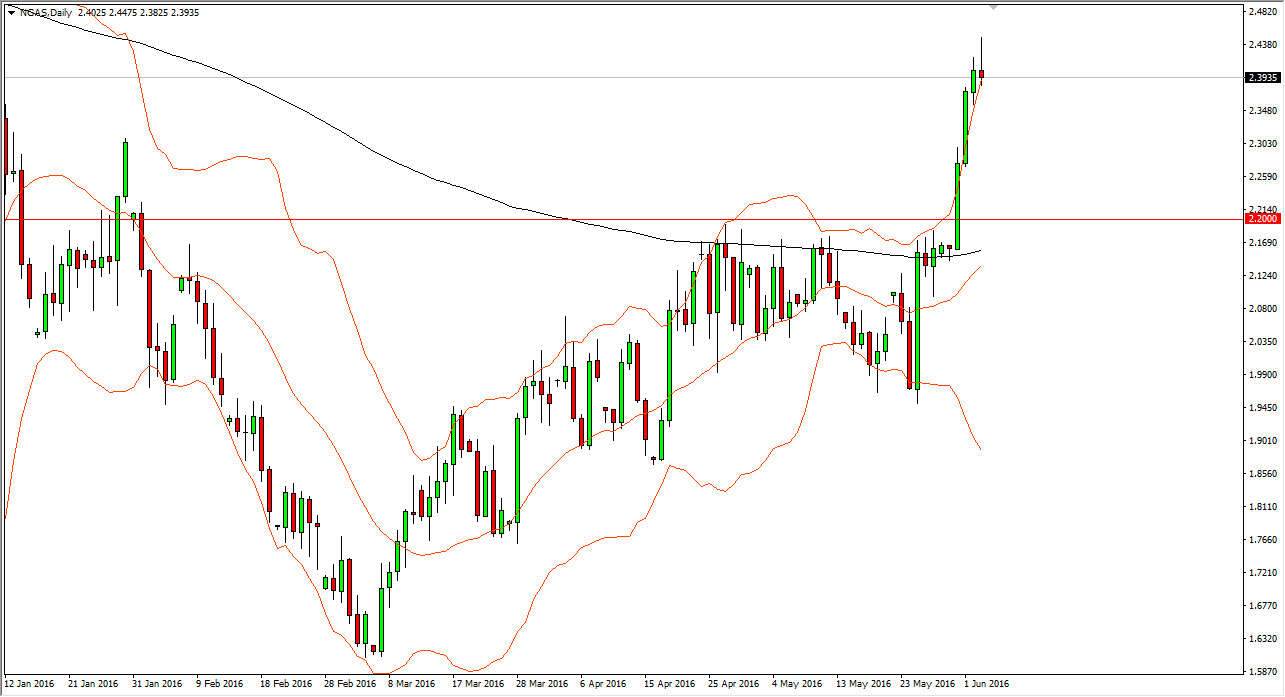

Natural Gas

The natural gas markets have shot straight up over the last several sessions, but have gotten a bit overextended at this point. Friday we ended up forming a shooting star which is one of my favorite sell signals, and therefore I think that a pullback is probably imminent. You can see that we are clearly above the 200 day exponential moving average at this moment, but I also have the Bollinger Bands on the chart as well, and you can see that we are well overextended and that incongruence of a shooting star, I believe that the market should probably trying to reach raise some of the bullish pressure lately.

I also believe that the buyers are below and waiting, so I think this is essentially a “two speed market.” With that being the case, I think that the next day or so could be negative, followed by the bullish traders coming back into the marketplace, most certainly by the time we get down to the $2.20 level. This is a market that is still negative over the very long-term, but it looks as if we are going to probably try to continue going higher.