By: DailyForex.com

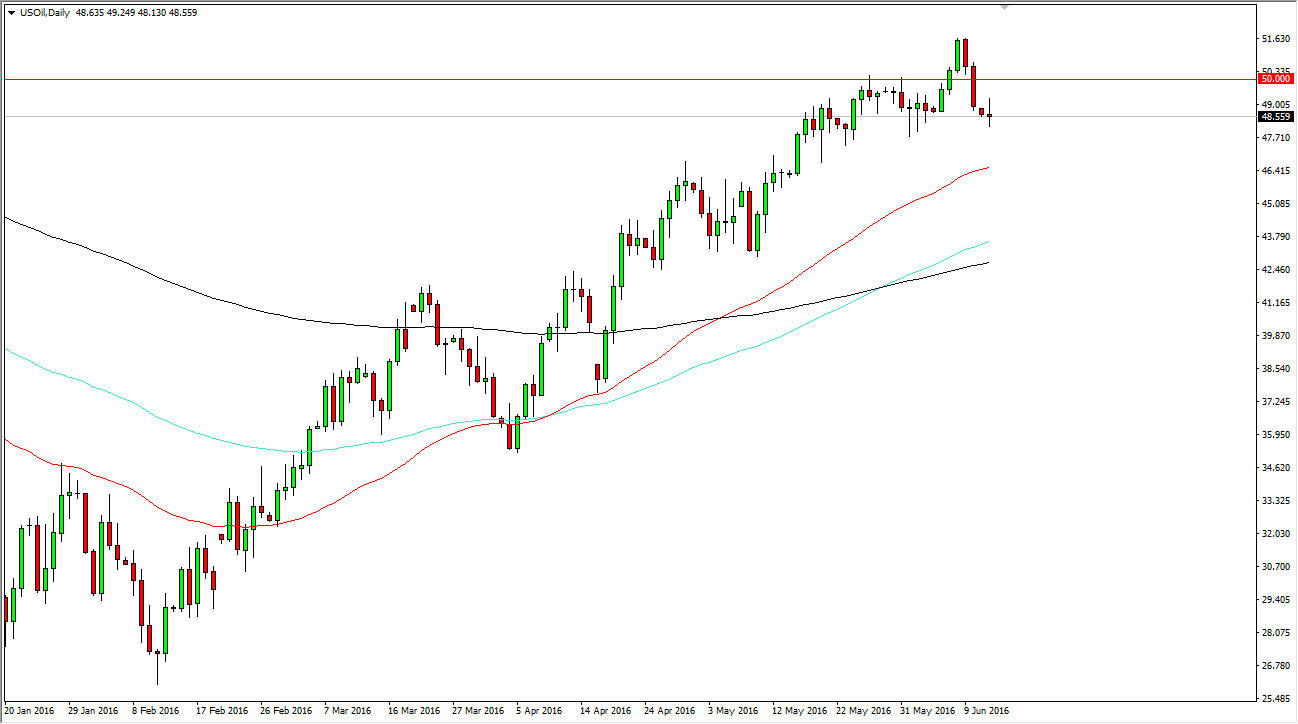

WTI Crude Oil

The WTI Crude Oil market had a very volatile session on Monday, as we continue to test the $48 level for support. By doing so, we ended up forming a neutral candle, and that of course suggests that the market doesn’t quite know what it wants to do next. However, we most certainly have a longer-term uptrend so I still feel much more comfortable buying than selling, and as a result I am looking for a supportive candle or a break above the top of the range from the Monday session in order to start going long. I have no interest in selling, as the 50 day exponential moving averages just below and should be somewhat supportive.

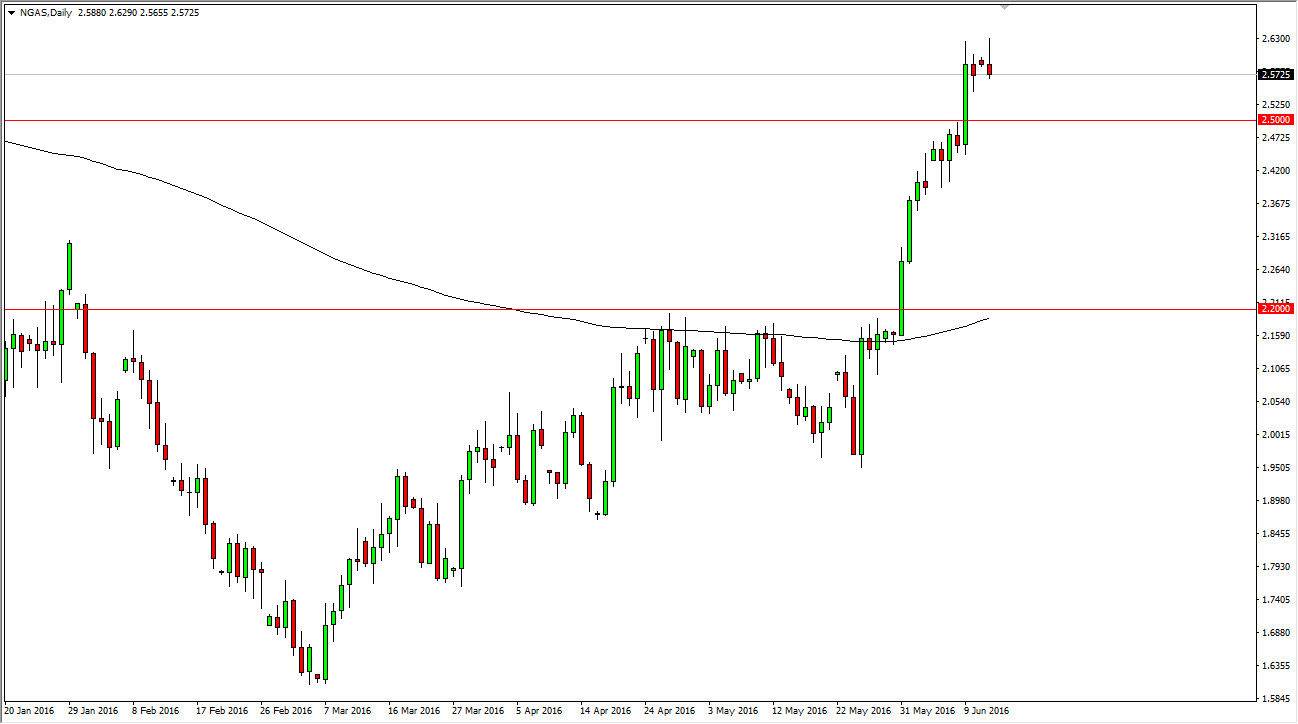

Natural Gas

The natural gas markets have broken out recently, and have been extraordinarily bullish. However, we broke above the $2.50 level and found quite a bit of resistance. With that being the case, it makes sense that we formed a shooting star and I think that a pullback is somewhat imminent. Ultimately though, I do not want to sell this market right now, as I believe there is a massive amount of support all the way down to the $2.40 level. I think a pullback will more than likely just trying to build up enough momentum to continue to go higher. After all, we are just far too overextended at this point in time to continue at this rate.

If we did break above the top of the shooting star though, I would have to start buying. I believe that we are more than likely going to target the $2.75 level over the longer term, as we have most certainly seen a change in the attitude of natural gas traders. With this, I believe that buying this market on short-term dips will probably continue to offer value.