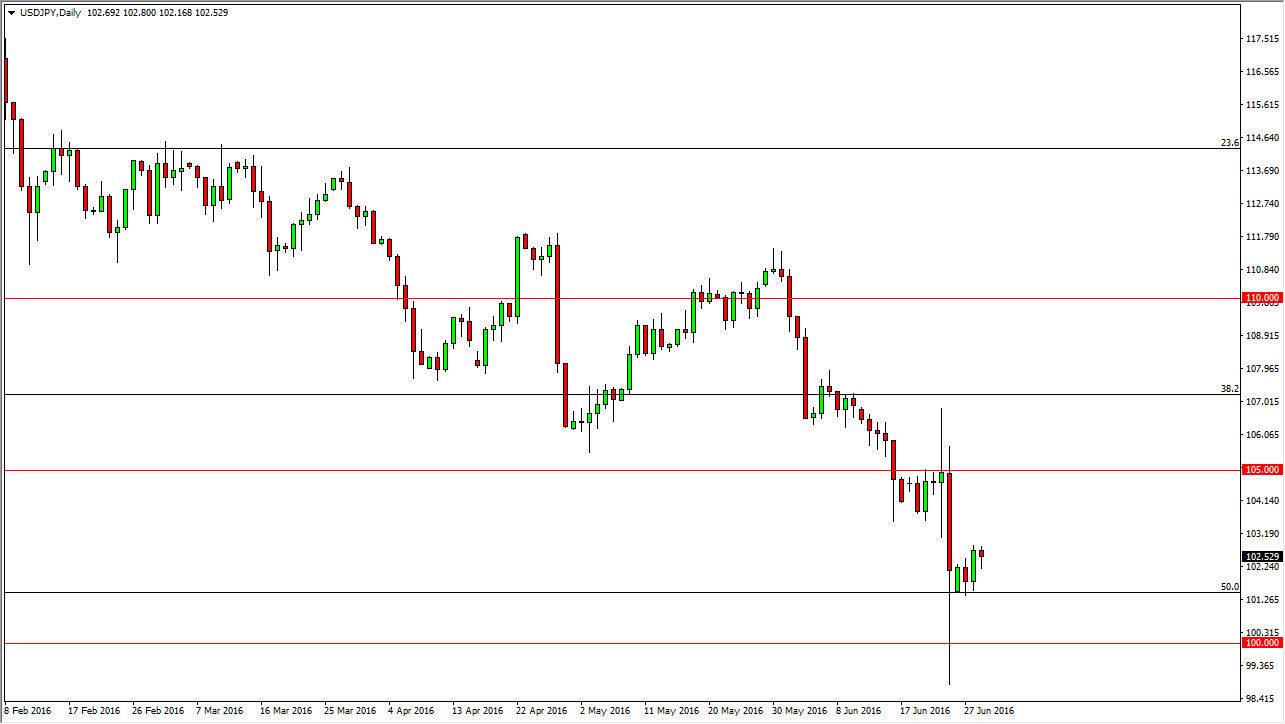

USD/JPY

The USD/JPY pair initially fell during the course of the day on Wednesday, but bounced enough to form a bit of a hammer. Quite frankly I think that this pair could go higher but I don’t really have that much interest in trading it, because I see a massive amount of resistance near the 104 level, but also have a massive amount of support at the 100 handle. Ultimately, this is a market that will bounce around and you also have to worry about the Bank of Japan. They will more than likely get involved in this market fall significantly from here, so quite frankly am not comfortable selling. At this point in time, I feel there are plenty of other currency pairs out there that should offer easier trading.

AUD/USD

The Australian dollar rose slightly during the course of the day on Wednesday, as the market tried to test the gap and of course the 0.75 level above there. That being the case, the market should continue to be volatile, and perhaps find sellers above. I have no interest in buying the Australian dollar the moment, as I am very cautious about riskier currencies. I would like to sell exhaustive candles if we see them appearing, as I expect they will.

At this point in time, I cannot imagine buying the Australian dollar until we break the top of the shooting star from last Thursday, which would be a very significant move higher. With this, it’s likely that the market will more than likely find sellers as we rise, and with that I have no interest in trying to fight what I see is a very significant barrier. If we can break down below the 0.73 level, I feel that the market should then go down to the 0.7150 level. I think that it will be difficult to get down there, but that is probably more likely than breaking above the aforementioned shooting star.