EUR/USD

The EUR/USD pair fell initially during the course of the session for Wednesday, and as a result this looks as if the market could try to test the bottom of the uptrend line that I have a shot. Ultimately, this is a market that will have a lot of uncertainty in it, basically because of the vote to leave the European Union buying the United Kingdom. With that being the case, it’s only a matter of time in my opinion that we will see bearish pressure in this market as the US dollar is probably going to be considered to be a safer asset. Ultimately, I think that the Euro will continue to go lower but we need to build up enough momentum to finally break down below the 1.10 level with any type of gusto. I will continue to short this pair on short-term rallies and show signs of exhaustion.

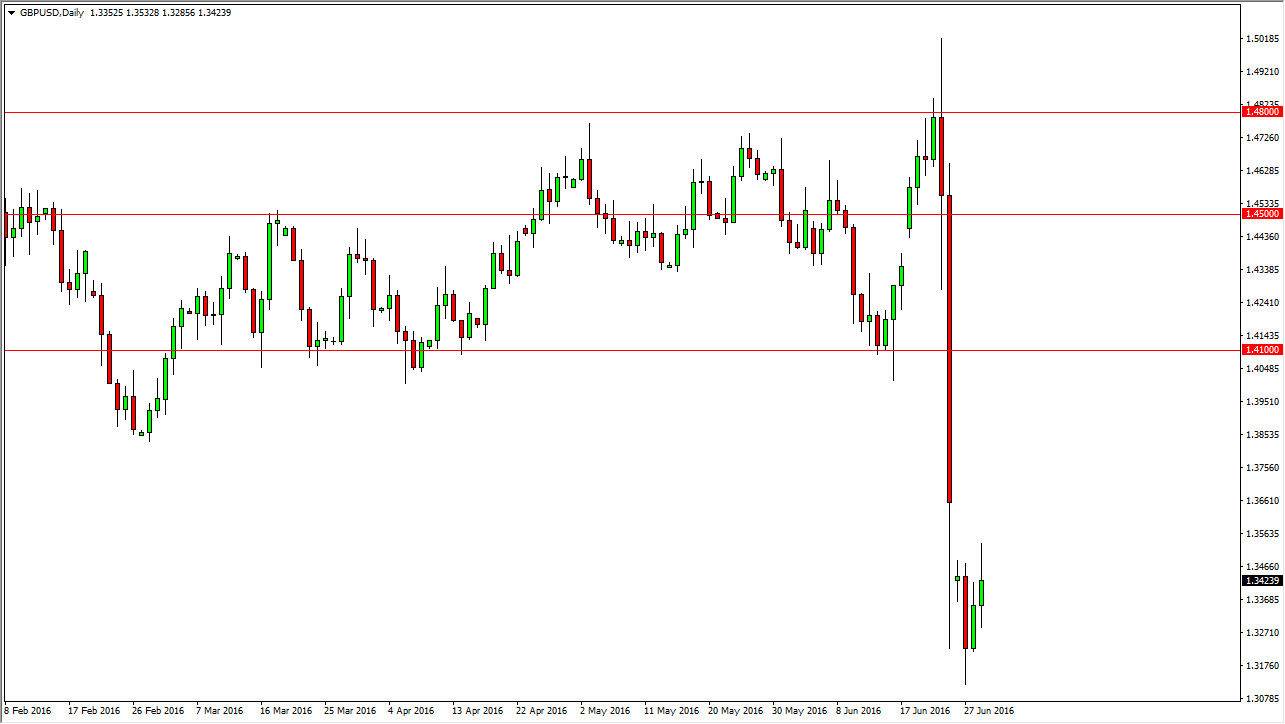

GBP/USD

The GBP/USD pair initially tried to rally during the day on Wednesday, but turned back around to form a bit of an exhaustive candle. Because of this, it makes a lot of sense that we continue to see bearish pressure. And quite frankly that’s exactly what I expect. Looking at shorter-term charts, it is possible that the sellers will come in every time we rally and it should continue to keep the pound selling off over the longer term. At this point in time, I don’t see any reason why we don’t go back to the 1.30 level, and even if we did rally from here I’d be very hesitant to start buying. In fact, I think we would have to clear the 1.41 level before I would even consider it. At this point, looks very unlikely.

The US dollar will continue to serve as a safe haven currency during the dismantling of the European Union, or at least the dismantling of the United Kingdom in the European Union, so I think we’re going to see longer-term selling in this pair.