By: DailyForex.com

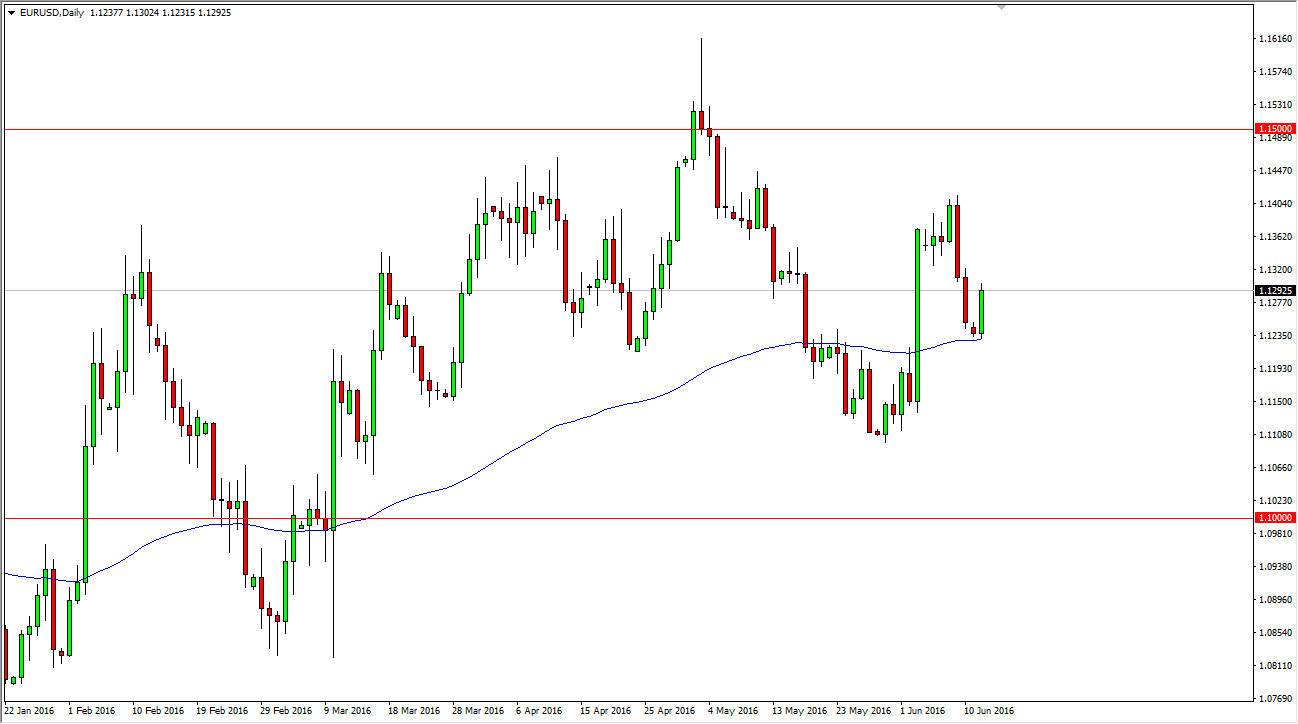

EUR/USD

The EUR/USD pair rose during the course of the day on Monday as we bounced off of the 100 day exponential moving average. In that area, we have the 1.12 level, which had been resistive in the past. Because of this, I am not surprised at all to see this market bounce and I do believe that a lot of traders are still going to be concerned about what the Federal Reserve can do as far as interest-rate hikes. It looks as if they won’t be able to raise interest rates as quickly as once thought, so it could work in favor of the Euro overall. Nonetheless, I see a lot of noise above, and I think that the market will struggle at the 1.14 level, and most certainly at the 1.15 level.

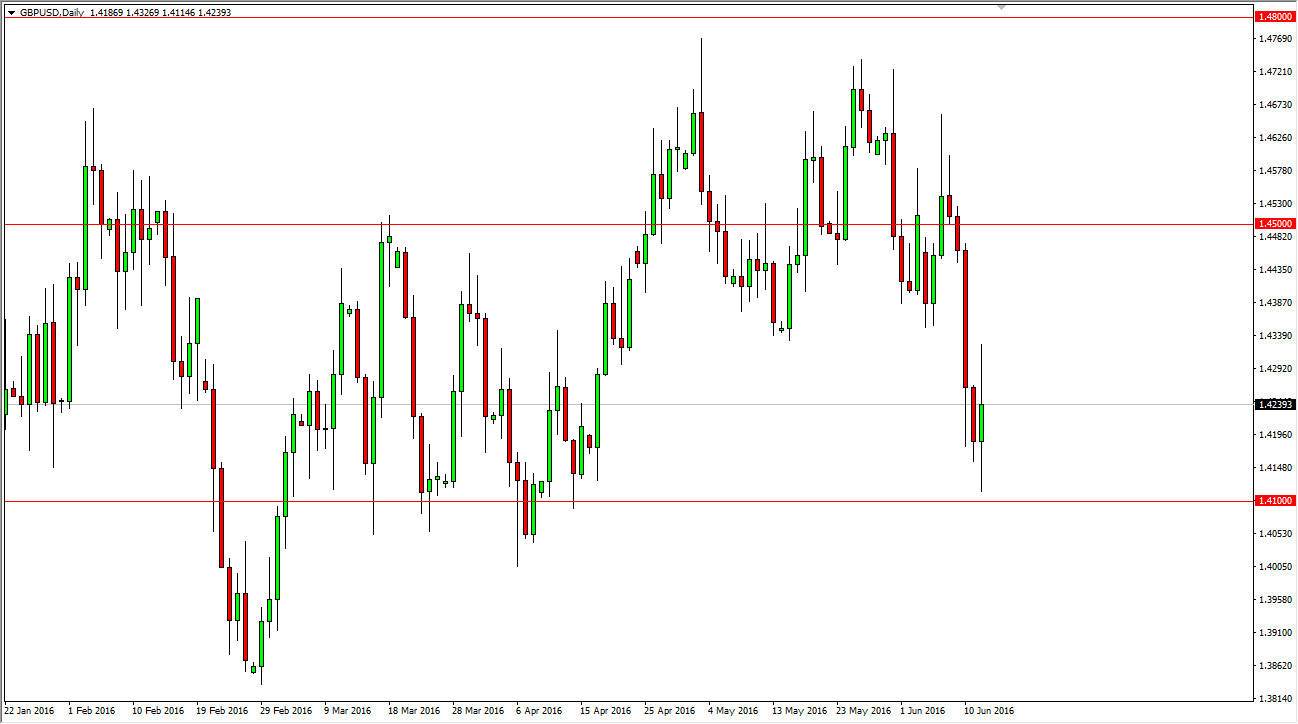

GBP/USD

The GBP/USD pair had a very volatile session on Monday as per usual, mainly because the market is being pushed around by the referendum vote on the European Union in Great Britain. With this, the market will continue to be very difficult to be involved in, see you will have to be very careful if you are trading it.

I think that the pullbacks will be offered as value, but it’s only a matter of time before rallies will be the exact opposite. Because of this, the market will continue to be extraordinarily volatile, so if you are interested in this market, it’s likely that the short-term charts will be what you have to pay attention to. After all, at any moment you can have the headlines that something across along the lines of a shift in the voter sentiment, and then the next thing you know the United Kingdom is being sold off drastically. I think that until we get the referendum vote, this market will more than likely be very difficult and as a result if I was to play the British pound, it would be for small moves only.