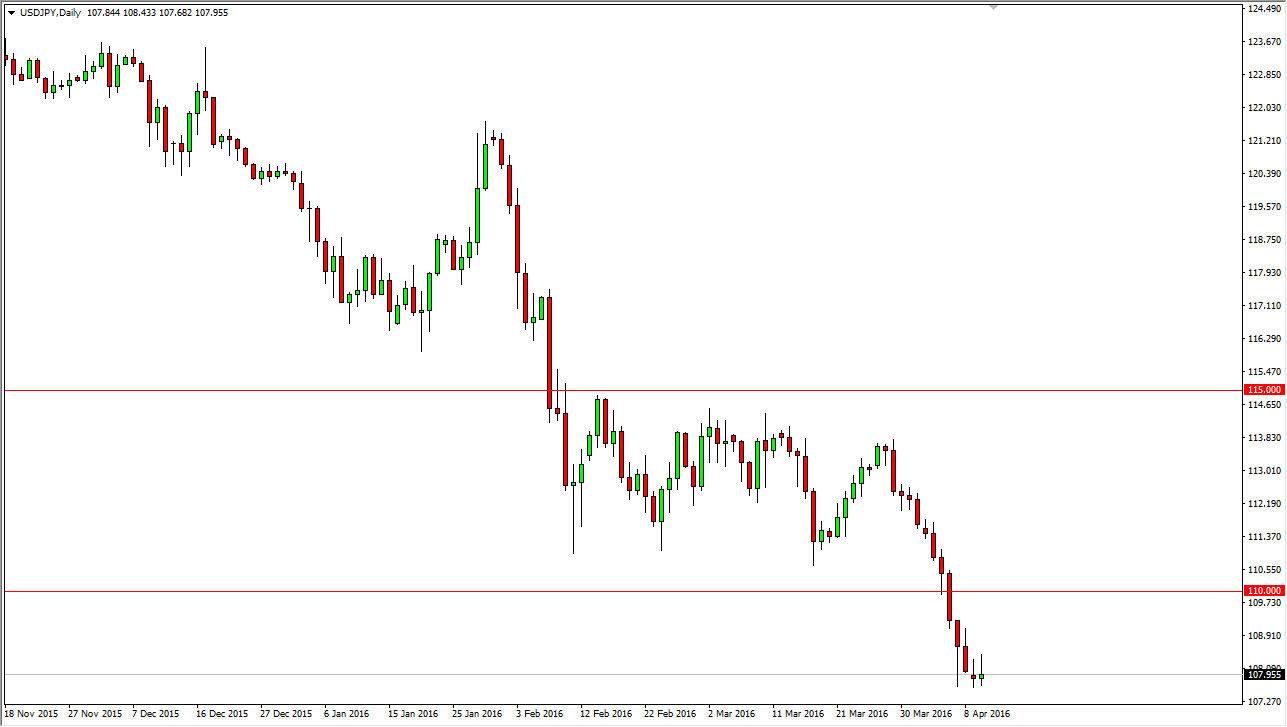

The USD/JPY pair initially tried to rally during the course of the day on Monday, but as we had seen on Friday, the market tried to rally but failed. We ended up forming a bit of a shooting star, and this is at the bottom of a downtrend. Also, you have to keep in mind that forming a couple of these candles at the same time is very negative. With this being the case, if we break down below the bottom of the range for the session on Monday, I believe that the market will then try to reach down towards the 105 level, as it is a large, round, psychologically significant number.

On the other hand, if we break above the top of the shooting star that would show a fairly significant amount of bullish pressure. Ultimately, this is a market that would have a massive amount of resistance at the 110 handle. So having said that, if we break above there it will more than likely be a short-term trade at best.

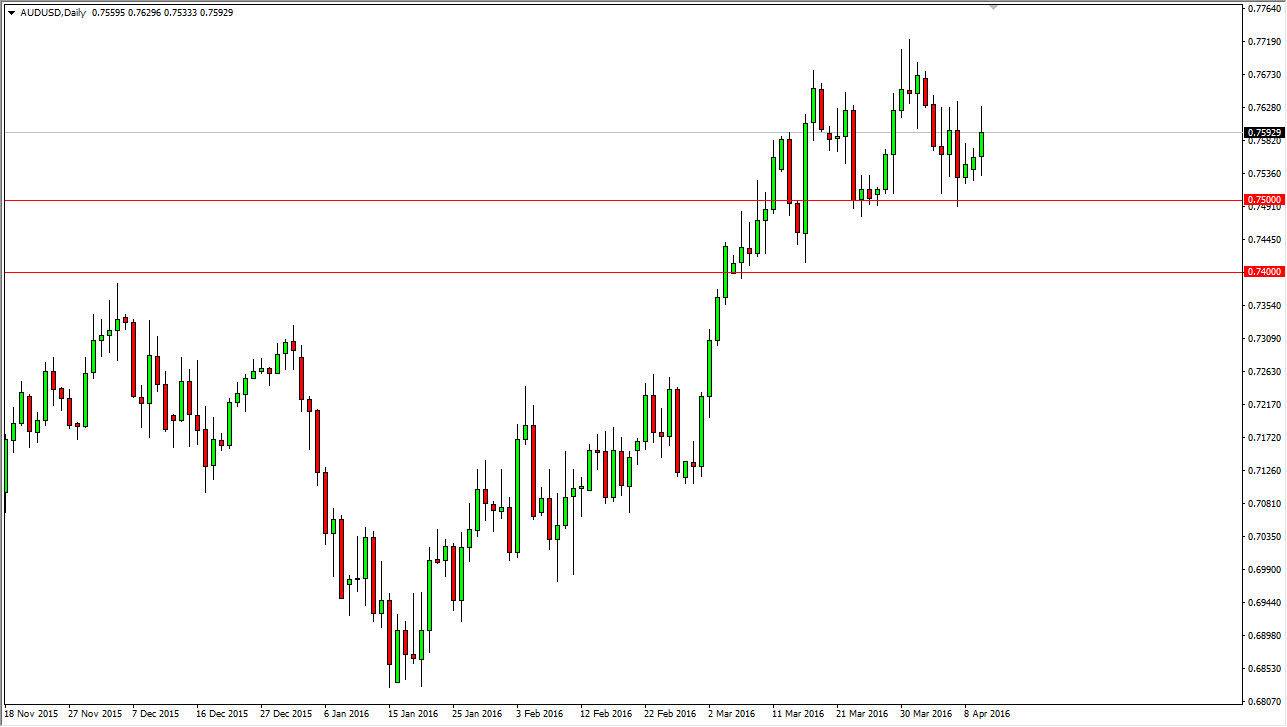

AUD/USD

The Australian dollar initially fell, but turn right back around during the course of the session on Monday to turn things back around. We didn’t keep all of the gains though, and as a result the market didn’t end up as impressive as it could have. Ultimately, I believe this shows that the market will probably simply bounce around between the 0.75 level and the 0.77 level just above for the short-term trade. I do believe that eventually we break out to the upside, but it may take a while to have that happen. If we can break above the recent high, then the market should continue to grind its way towards the 0.80 level. That is my longer-term target, and they do believe we will eventually get there with the help of the gold markets. Having said that, I recognize that there is a massive floor in this market that starts at the 0.75 level, and extends all the way down to the 0.74 level.