Gold prices rose on the first day of trading in 2016 as a sell-off in global equities burnished the metal's safe-haven appeal. Global equity markets fell sharply after bruising losses in Chinese shares sparked by weak factory data rekindled worries over the health of the world's second-largest economy. Caixin manufacturing purchasing managers index (PMI) came in at 48.2 in December, down from 48.6 in November. Gold also drew support from rising tensions in the Middle East.

If world stock markets remain under selling pressure, the precious metal may continue to receive some extra support in the short-term. Over the past few years geopolitical tensions or volatility in stocks had little lasting impact on gold and because of that it is difficult to get too bullish on gold in the long term. The dollar is expected to strengthen as the Federal Reserve hikes interest rates gradually so it could be another tough year.

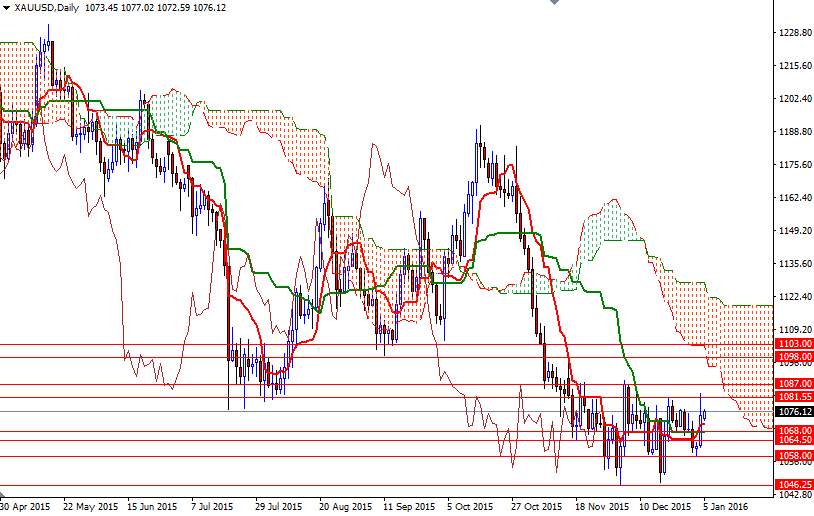

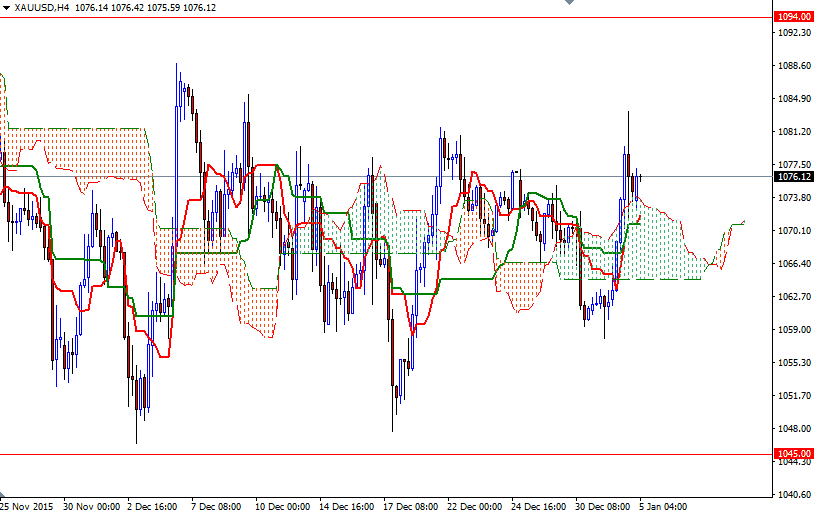

This week sees a deluge of economic reports, including the monthly non-farm payrolls report and minutes from the Federal Open Market Committee’s December 15-16 gathering. From a technical point of view, the short-term outlook appears to be slightly positive. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines on both the daily and 4-hourly charts, along with Chikou Span/Price crosses in the same direction. If the 1070/68 support remains intact, we could see a renewed push up to the 1081.55 level. The area between the 1087 and 1089 levels has been resistive in the past so clearing that resistance is essential for a bullish continuation towards 1094. However, if the market dives below the 1070/68 area, then the XAU/USD pair will probably fall to the 1064.50 level before finding some support. Closing back below 1064.50 would indicate that the market is getting ready to revisit the support at 1058.