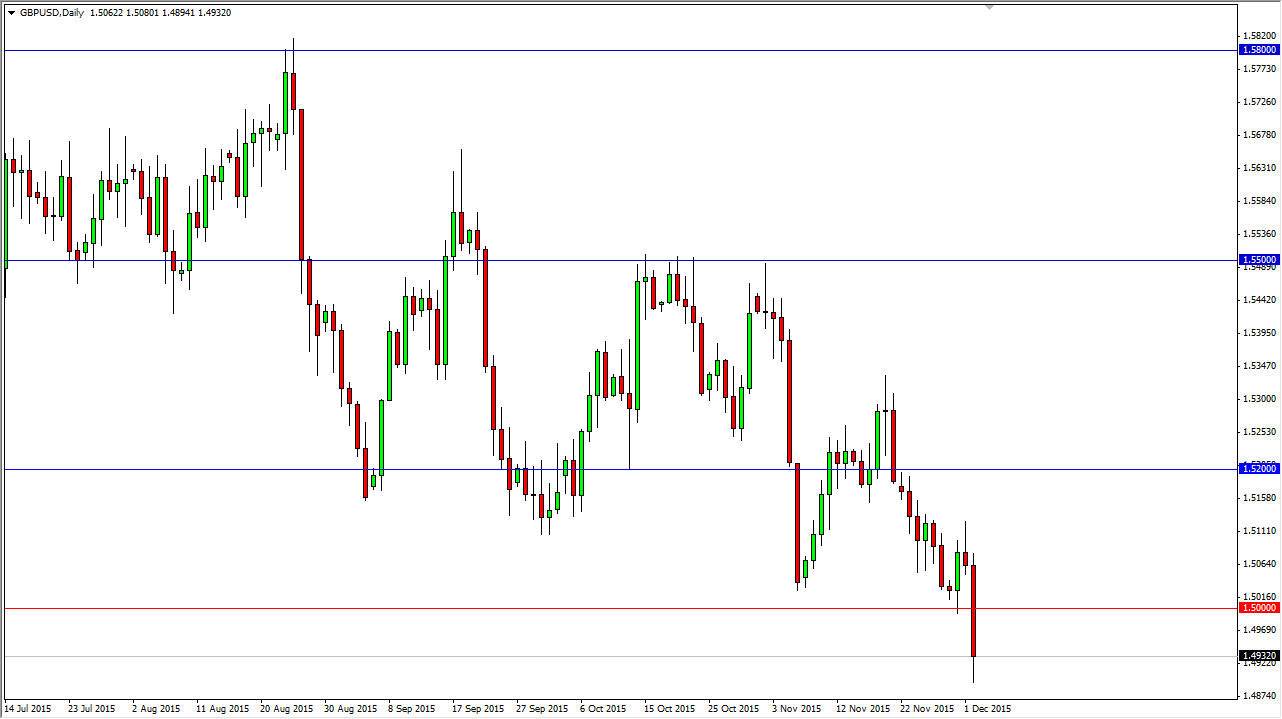

The GBP/USD pair broke down during the session on Wednesday, as the market looks very soft. The shooting star that formed on Tuesday of course suggests that we were going to try to break down below the bottom of support, which I see as the 1.50 level as it is a large, round, psychologically significant number and an area that we have seen quite a bit of interest in over the longer term.

Any rally at this point in time should continue to struggle, as the 1.50 level should now offer resistance as the previous support turns over. After all, the old technical analysis tenet of “what was once the floor now becomes the ceiling” is one that proves itself to be true over and over, so I think that short-term traders will be very interested in shorting the British pound closer to that level.

No Interest in Going Long

Looking at this chart, I have no interest in going long but I do recognize that there could be a lot of volatility even though we have broken down. After all, the area between here and the 1.48 level has quite a bit of noise in it, so given enough time I feel that we will get bounces here and there. Nonetheless though, I feel it’s only a matter time before we do break down to the 1.45 level which is a longer-term support level based upon longer-term charts.

Rallies continue to be selling opportunities as the breakdown was not only psychologically significant, but also visually significant as the candle was very long. I don’t see any interest in buying this market at all, because quite frankly there is a massive amount of resistance all the way to the 1.52 level, which was previously supportive. Given enough time, I think that the sellers will prevail again and again. It really comes up to the trader involved, as I believe that there will be a multitude a short-term opportunities which could end up being more profitable than the longer-term “sell and hold” type of approach.