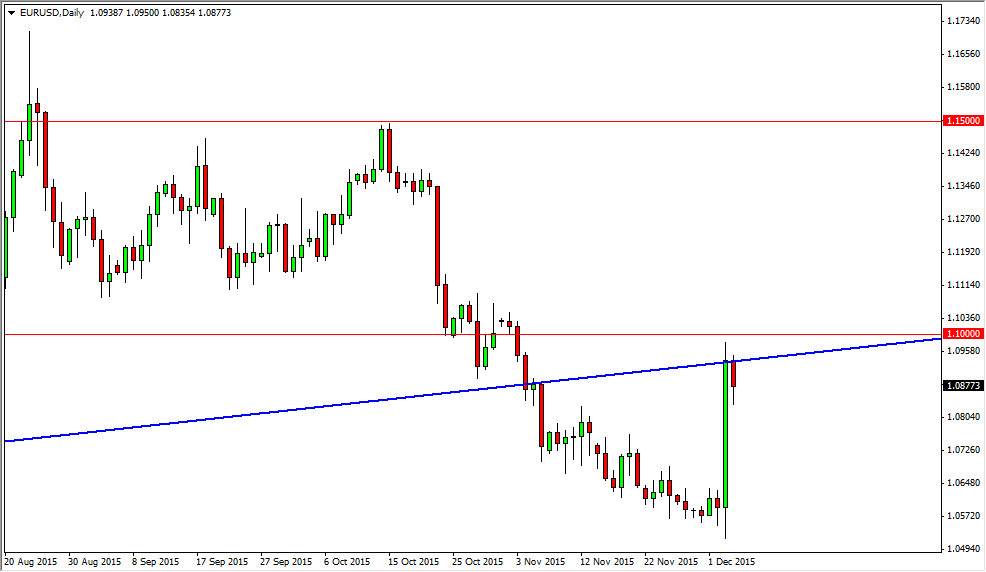

During the session on Friday, the EUR/USD pair fell slightly as the jobs number out of America ended up adding 211,000 for last month. This is a very bullish sign for the US economy, you have to keep in mind that the Federal Reserve is all but required to raise interest rates at the next meeting. However, the question then becomes whether or not they are going to continue to raise rates. In the meantime, looks like the market doesn’t necessarily believe so, so the pullback was minor to say the least. The uptrend line that had previously This market higher has offered a bit of resistance though, so with that being the case and the fact that the 1.10 level above sits just a short distance from the uptrend line, suggests to me that we will continue to have volatility. I do not think that the recent breakout is going to continue with any real sustainable momentum, but I don’t a certainly think that this market is going to selloff strongly either. I think we are probably going to eventually grind a little bit lower.

1.11

On the other hand, if we can get above the 1.11 level, I believe that the market will continue to go higher given enough time. At that point time I believe we would reach towards the 1.15 level but the truth of the matter is that the market is testing a significant resistance barrier, and of course we have quite a bit of support in the form of the massive green candle.

The European Central Bank did less stimulus than anticipated, but that doesn’t necessarily mean that the European economy is turning around suddenly. I think that the market is a bit off by just a little bit, but we had been over exuberant in are selling of the Euro. Ultimately, I think the volatility will be the way going forward but it’s not going to be a clean move either way.