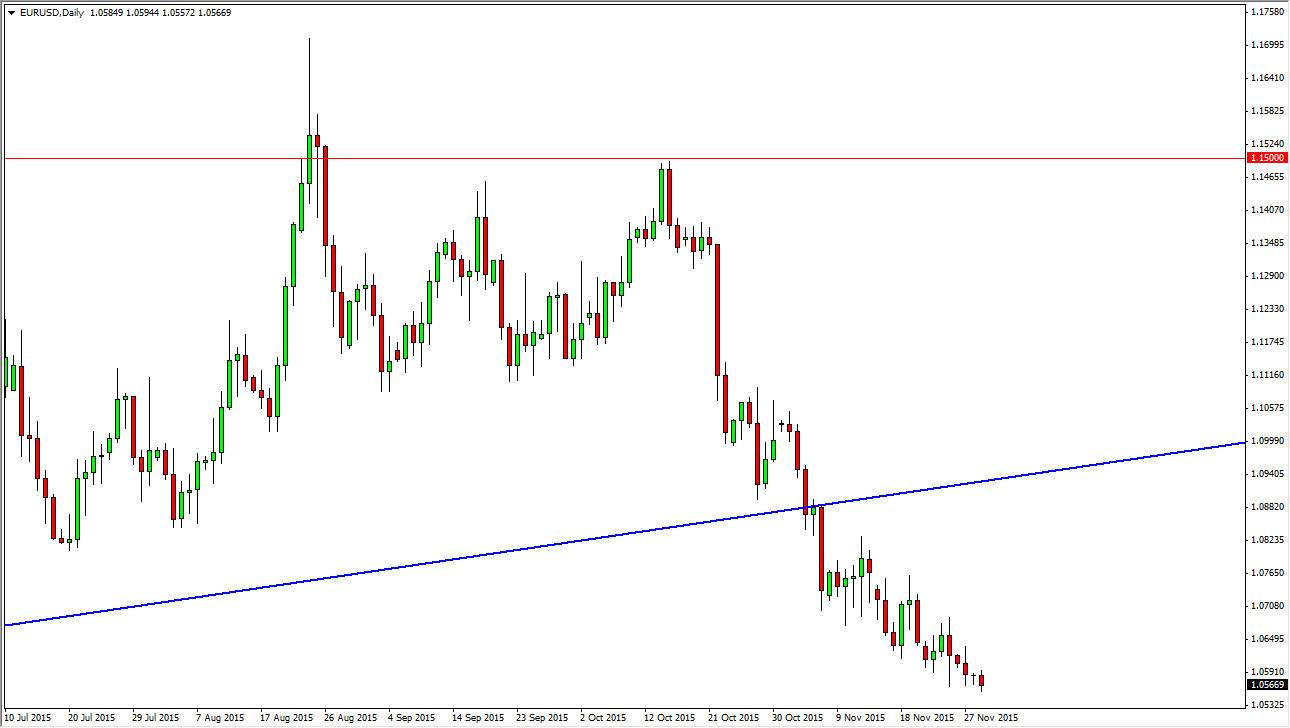

The EUR/USD pair fell again during the session on Monday, as we continue to drift lower. I have been saying for some time now that I believe this market goes down to the 1.05 level given enough time, and I think this is what we are going to see sometime this week. The real question at this point is going to be whether or not we can break down below there. Ultimately, the market should break down below there in my opinion and reach towards parity. I don’t think that’s going to happen between now and the end of the year, at least the parity part. However, we do have a couple of opportunities to break down over the course of the next couple of weeks.

Jobs Number

I believe that the Nonfarm Payroll Numbers could be the reason to break down at this point in time, and if we get a stronger than anticipated jobs number on Friday that could be the catalyst. However, it is also likely that the market could try to reach below there before the announcement, in an attempt to “front run” the potential move. Regardless, I have no interest whatsoever in buying this market, as there is more than enough noise above current levels to cause problems. I think that any rally at this point in time should be a nice selling opportunity, because I see volatility all the way to the 1.10 level at the very least.

The uptrend line on the chart is the previous uptrend line from the ascending triangle that had been so supportive in the past, as we have recently broke below it. Because of that break down, I think this signifies that we are ready to begin the “next leg” lower, and as a result it’s only a matter of time before we reach towards that parity level that seems so unrealistic considering where we started falling from. Ultimately though, I believe that the European Central Bank is going to make sure this happens.