Version:1.0 StartHTML:0000000167 EndHTML:0000003331 StartFragment:0000000457 EndFragment:0000003315

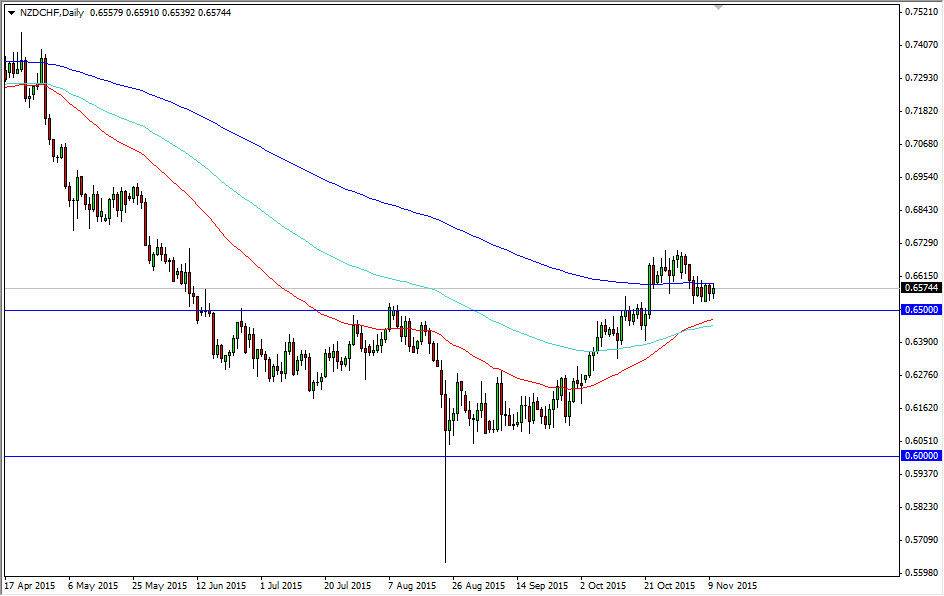

The NZD/CHF pair did very little during the course of the session on Tuesday, as we continue to hover above the 0.65 handle. This is an area that has caused resistance and support recently, so having said that it makes sense that the market will simply sit here. The 0.65 level is of course a large, round, psychologically significant number. Ultimately, I believe that this market will bounce from here and continue to go higher but we are starting to see some massive technical convergences.

When you look at this chart, you can see that the red line, the 50 day exponential moving average, has started to turn higher. In fact, it crossed above the light green line, which is the 100 day exponential moving average. That in of itself is typically reason enough for several traders out there that I know to start buying. Adding to that is the fact that the blue 200 day exponential moving average is essentially right where we are at, and at this point in time I would say that most traders would assume the market has changed its trend completely once we are either above that level, or the other 2 moving averages across that level.

Longer-term “buy-and-hold.”

I believe that this is a longer-term buy-and-hold type situation, and you will have to be patient to collector profits. However, the Swiss franc is going to continue to be a bit soft, mainly because of this was National Bank, and the fact that the Swiss are so highly dependent on the European Union economy. After all, the Swiss send 85% of their exports into the EU, while New Zealand tends to rely more on exporting to Asia, which is doing better than Europe at the moment.

I think pullbacks offer buying opportunities, and it is likely that the 50 day exponential moving average could be potential dynamic support going forward. At the moment, I believe that the market is probably going to reach towards the 0.70 level over the longer term, and further making this an enticing trade is the fact that the swap is positive.