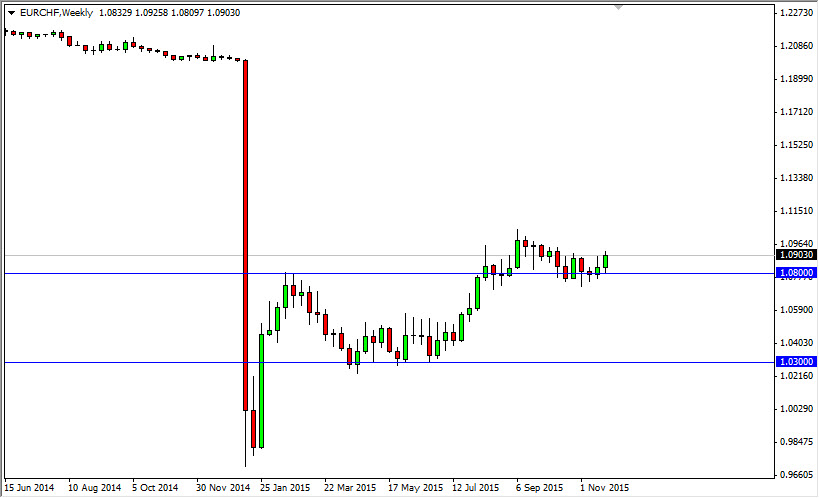

The EUR/CHF pair has been grinding sideways overall for the last couple of months, but there are a couple of reasons that I think this market could be one that you have to pay attention to. For starters, the first thing that you need to understand is that while the Euro has been selling off drastically against many other currencies in the world, this particular pair has been sitting still. That just screams that the Swiss are involved at this point. In fact, it wasn’t that long ago that the Swiss National Bank released its financial statements suggesting that it had been buying Euros recently anyway.

With this being the case, it looks as if the 1.0750 level below is significant support, and that might be the “line in the sand” that the Swiss have quietly set up again. After all, you can see that we bounced all the way to the 1.08 level back during the month of January, and now have broken above there and found support at that area. Either way, it makes quite a bit of sense from a technical analysis point of view as “what was once the ceiling should now be the floor.”

Longer-Term Buy-and-Hold

I believe that sooner or later this becomes a longer-term buy-and-hold market, as the market appears to be paying quite a bit of attention to the 1.10 level above, and if we can break above there I think it becomes a longer-term trade as we should then reach towards the 1.20 level given enough time. That was where the market had dealt with a four-year currency peg, and broke down significantly once the Swiss National Bank suggested that they were stepping on the sidelines. There should essentially be “empty air” between here and there, once we break above the resistance at the 1.10 handle. I think that’s what happens next, but it comes down to whether or not we can build up the momentum in the short-term. I don’t know about that, but during the month of December I think the only thing you can do is buy this pair on short-term pullbacks.