Gold prices fell $4.18 an ounce to $1181.56 on Thursday as a rebound in the dollar and equities prompted investors to take profits from a three-day run of gains. The XAU/USD pair dipped to a low of $1175.54 after a report from the Commerce Department showed retail sales rose 1.2% in May. Although better than expected data put some pressure on the market, gold managed to pare some losses after the IMF said its delegation had broken off negotiations in Brussels because of major differences with Athens.

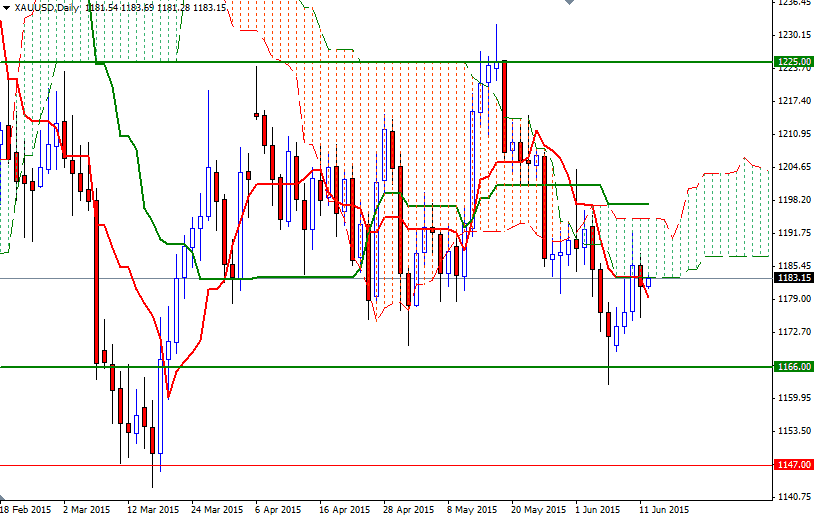

While the prospect of Greece defaulting on its debt increases the safe-haven appeal of gold, views that a U.S. rate rise could come at the Fed's September meeting limit the metal's upside potential. On the shorter-term time frames there is slightly a bullish picture but the Ichimoku clouds are right on top of us on the daily chart. Since the long term and short term charts give conflicting signals, I think the XAU/USD pair will have a hard time gaining traction in either direction at this point - i.e. the area between 1198 and 1166 will contain the market in the short term.

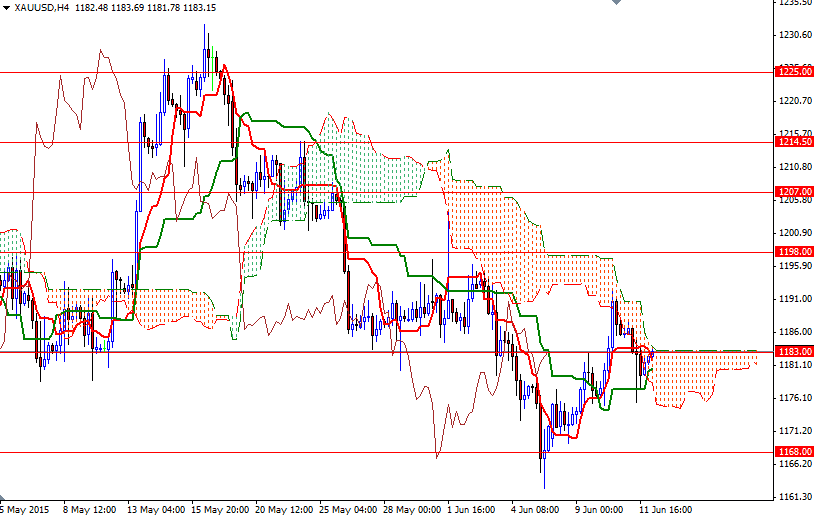

From an intra-day perspective, I think the XAU/USD pair has to push its way through 1191 in order to go higher. In that case, the bulls may have another chance to test the 1195 level. Beyond that, the bears will be waiting in the 1202/0 zone. If the bulls manage to clear this resistance, it is technically possible to see a bullish continuation targeting the 1207 level. However, if the bears take the reins and the market turns south, expect to see some support in the 1177/5 area. Breaking below 1175 would imply that the 1168/6 support will be the next stop.