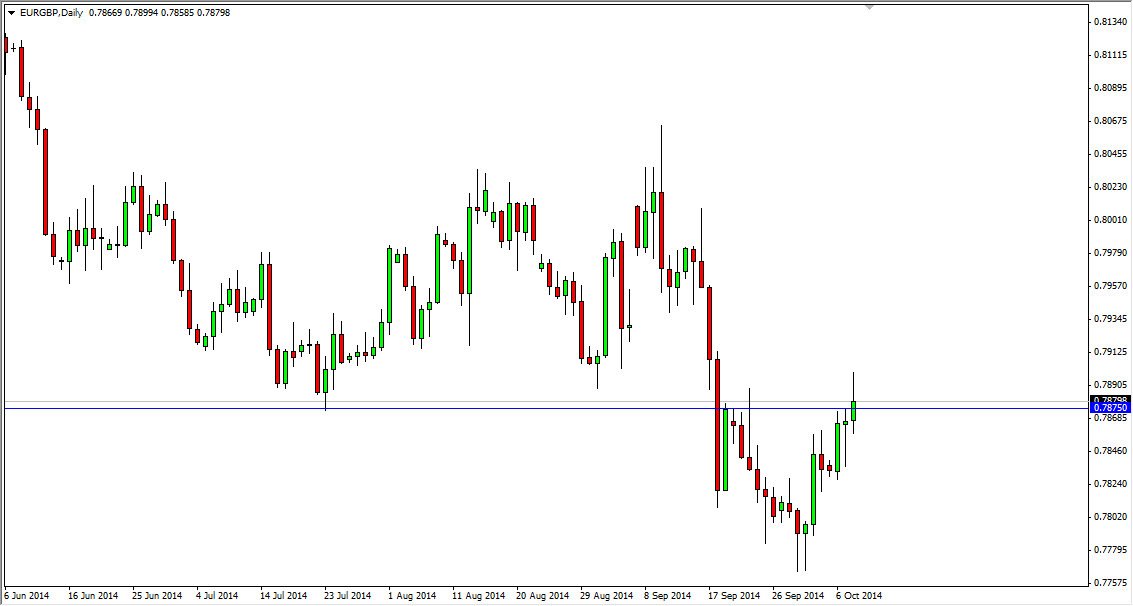

The EUR/GBP pair broke higher during the course of the day on Wednesday, slicing through the 0.7875 handle. However, we do get back quite a bit of the gains and as a result it appears that the shooting star being formed suggests that we are going to run into quite a bit of resistance above. In fact, it seems to be centered on the 0.79 level, which is the beginning of pretty significant consolidation all the way to the 0.8050 level. So what I think is that we are about to see sellers step into this marketplace, but they are quite ready to be involved yet.

If we broke down below the bottom of the shooting star from the session on Wednesday though, I think at that point time we would begin to sell off and head back into the previous consolidation area. The previous consolidation area runs all the way down to the 0.7750 region, so it would more than likely offer about a 200 pips range.

Remember, this is about relative strength.

Remember, Forex trading is about relative strength, so even though both of these currencies are relatively we get the moment, the reality is that the Euro certainly has more pressure on it, and rightfully so. After all, it’s the European Union that is facing deflation, and even though the British pound is certainly influenced by the lack of economic movement in the European Union, the reality is that the UK is doing a bit better.

With that in mind, it’s only a matter of what’s doing better, the Euro or the Pound, and nothing more. The market is in a downtrend for reason, so therefore I am much more comfortable selling this market on resistive candles than any type of buying opportunity. In fact, I need to see this market break above the 0.8050 level in order to start going long. Until then, I’m just selling this market every time we get a nice short-term rally, offering a selling opportunity in my opinion.