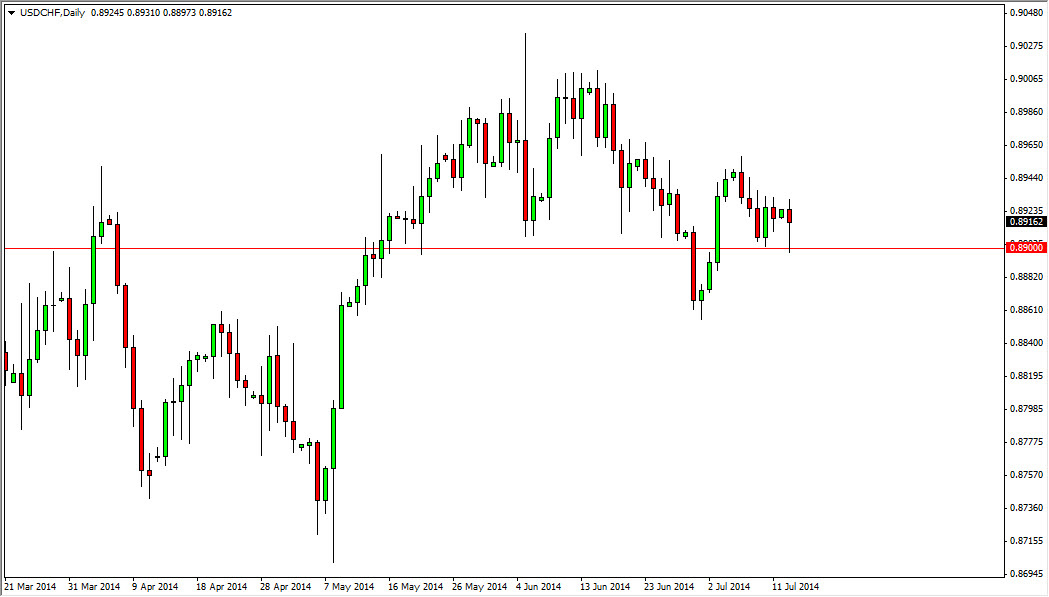

The USD/CHF pair initially fell during the session on Monday, but as you can see the 0.89 level offered enough support to turn things back around, and form a nice-looking hammer. This is one of those pairs that is essentially an argument between two safety currencies, so it is worth paying attention to even when you don’t have a decent setup. However, Monday is one that this rare sessions that interest me and actually trading the pair. I believe that the hammer that formed for the day should signal move back to the 0.90 level given enough time, assuming that we can break the top of that hammer.

On the other hand, if you break down below the 0.89 level, I think the market will find quite a bit of support at the 0.8850 level, and as a result I would buy the market on supportive candles all the way down to that level.

Quiet trading in this pair makes it a good range bound pair.

All things being equal, this pair tends to be very quiet, and as a result it’s good for range trading when we get the right setups. Remember that this is essentially the antithesis of the EUR/USD pair, and as a result when this pair rises, the EUR/USD pair typically falls.

That being said, I believe that the 0.90 level is a much more interesting level than the 0.89 level, and because of that the longer-term charts make me believe that the market should in fact try to get back up there. Whether or not we can break out above the 0.90 level is a completely different story altogether, and as a result I am only looking for short-term trades at this point in time. A break down from here would be for the likely bought out by the bullish, but at this point time I believe that a breakdown is very unlikely going forward as the impulsive move from the early part of the month of May has shown that there is underlying interest in going long.