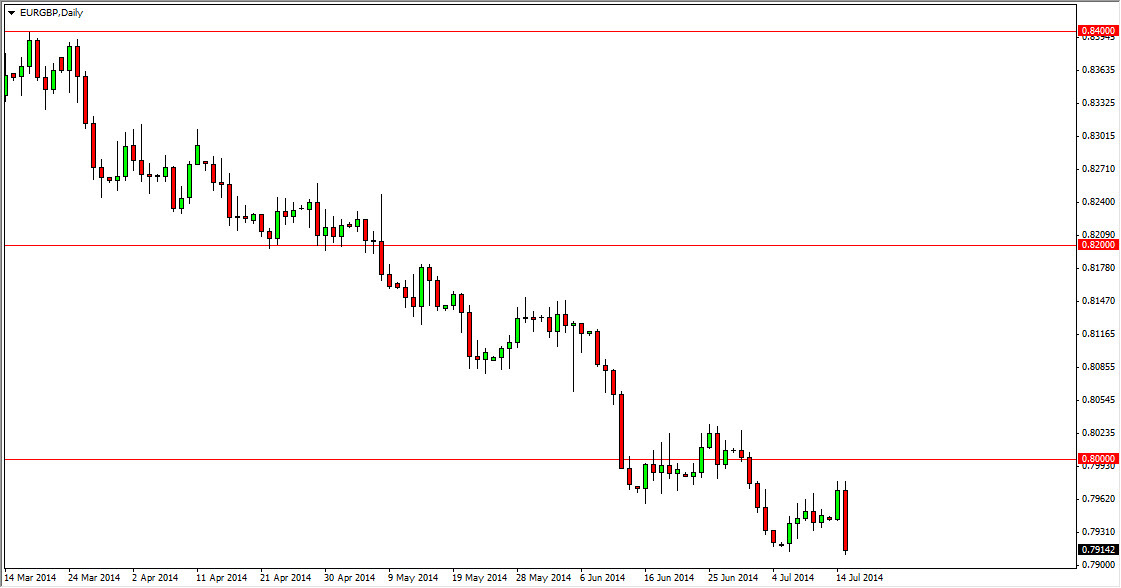

The EUR/GBP pair fell hard during the session on Tuesday, breaking to a fresh, new low. While we have not gotten below the 0.79 handle yet, I do believe that we are about to do so, and that should open the door too much lower pricing. Ultimately, and other thing that I look at is the fact that the British pound had a fairly strong showing, while the Euro struggled during the day.

The market close at the very lows of the range for the session, and that of course is a negative sign as well as it should mean continuation of the move. At this point in time, any rally would be treated suspiciously, and I would be looking to sell the first signs of resistance, especially that there the 0.80 handle. That area was one significant support, and the idea of it being resistance is the very essence of support and resistance when it comes to technical analysis.

Never fight the trend.

When you have a trend that’s this well-defined, fighting it is an exercise in futility. I believe that rallies will simply offer value as far as the British pound is concerned, and that there are plenty of people willing to head this market again and again to the downside. In fact, I have no interest in buying this market until we clear the 0.82 handle, something that I do not anticipate seen anytime soon, as the trend has been so strong and that we are so below that region at the moment.

I believe that we are heading to the 0.7750 level first, and then ultimately the 0.75 handle, which of course is a large, round, psychologically significant number and is also important on the longer-term charts, such as the monthly timeframe. With that, I am very bearish of this market, and have no interest in going long under any circumstances, save for the above dimension move to the 0.82 handle, which by at that time I suspect that we would’ve had several headlines that would have put the trend in serious doubt to begin with.