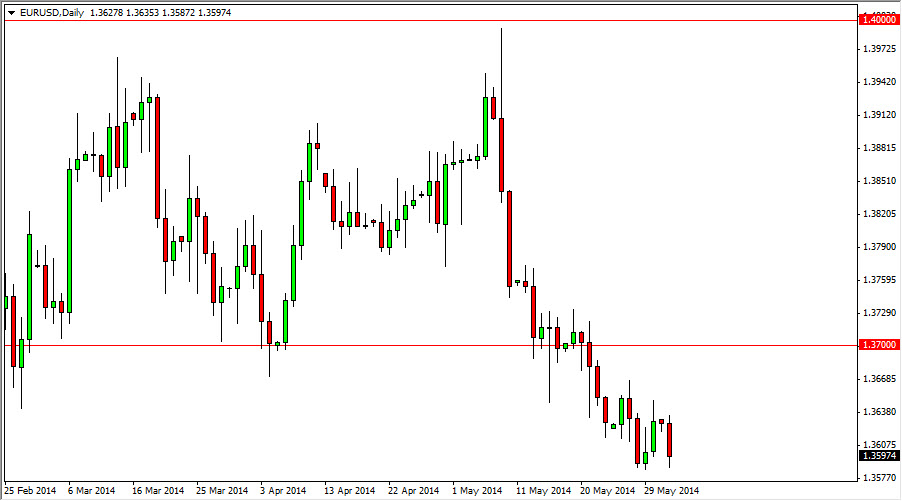

The EUR/USD pair fell during the bulk of the session on Monday, but as you can see found the 1.36 reason to be supportive enough to keep the market somewhat afloat. Ultimately, I suspect that the market could grind a bit lower from here, but I’m not anticipating any type of major move in one direction or the other. This is mainly because of the European Central Bank meeting on Thursday. Between now and then, it’s going to be difficult to imagine that a lot of traders are going to want to put a ton of money into the Euro overall. However, I would suggest that the “smart money” is probably well aware the fact that the ECB has a long-standing tradition of disappointing as far as monetary stimulus is concerned, so I believe that it’s very possible that the Euro will continue to strengthen over the longer term, simply because the ECB won’t do enough to deter people from buying it.

1.35 is probably as far as we go.

I don’t think that this market’s going to break down below the 1.35 handle, as it looks to be massively supportive. On top of that, there is the possibility that the Euro rises ahead of the meeting as smart money tries to get involved in this currency before it appreciates. If history is any guide, the ECB will more than likely go ahead and make good on its threats of negative interest rates, but ultimately I believe that the market is already priced this and. If they don’t do much more than that, it’s very likely that the Euro will gain in strength as the market fixes the potential mistake that it made of bailing out of the Euro so aggressively.

Looking for buying opportunities is how I’m going to approach this market, knowing that I am taking a bit of a risk ahead of the meeting. However, ultimately I believe that the 1.35 level is truly as far as we can fall from here, and as a result I feel like I’m fairly well protected on a long position.