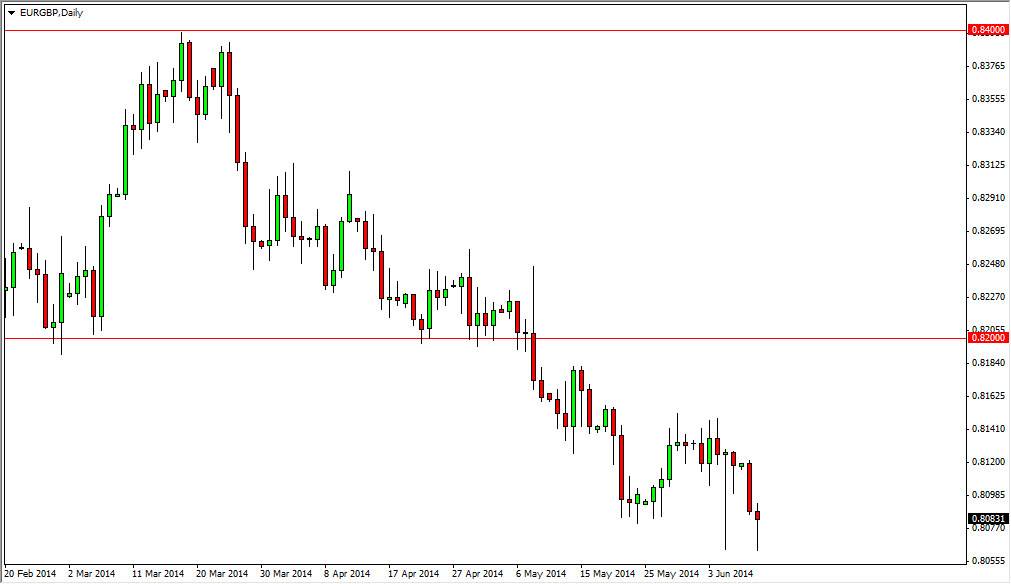

The EUR/GBP pair continues to grind lower as the Tuesday session was of course bearish as well. However, we did bounce significantly off of the 0.8050 level in order to form a hammer. With that, this is a significant and supportive candle, so I do think that we could get a bit of a bounce here. This bounce should be a short-term buying opportunity for those that are extremely nimble, but I think it only shows just how important the 0.80 level will be ultimately, as we are starting to see buyers come in 50 pips above it. With that, I think that the market will more than likely rally from here, but I think the smart traders will be looking for reasons to sell into that rally as it should show considerable weakness.

The initial bounce could go all the way to the 0.8150 level, as that would simply be continuation of the consolidation that we’ve seen. Above there, we have the 0.82 level, and that should be massively resistive as well. We need to get above the 0.8250 level in order for me to feel comfortable buying this pair, which is something that I don’t anticipate seeing anytime soon.

Trend is down, I’m not willing to fight it.

With the trend being as strong as it has been, I have no interest in fighting it. I believe that the market will continue to fall, and it will search out the 0.80 handle. It may take a while to get down there next large, round, psychologically significant number as well as a massive support level on the longer-term charts. Because of this, it’s very likely that the market will be drawn to it, and eventually we will see that area tested. However, I also believe that that area will be massively supportive and they would turnaround by this market down there on a supportive candle. This would be especially true it was on a longer-term chart. Until then, I will be selling this market over and over for short-term trades.