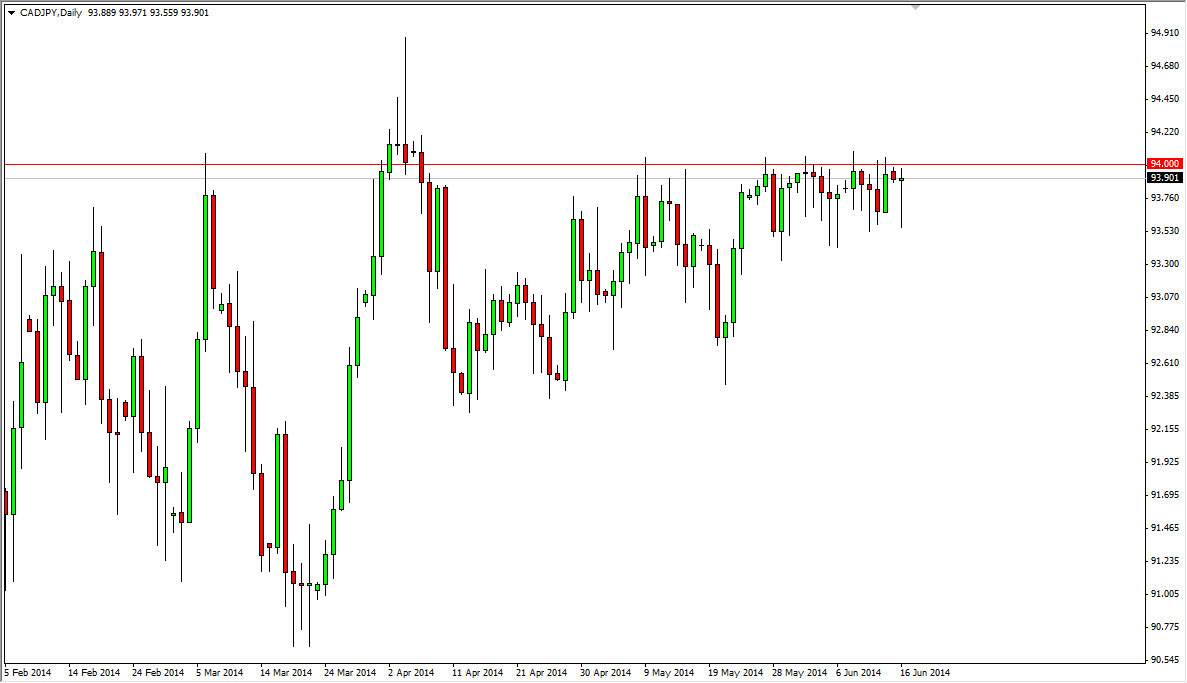

The CAD/JPY pair has been very congested recently, and the Monday session really didn’t do anything to change that. However, what has caught my attention is that every time we fall down towards the 93.50 level, the market bounce is nicely. This is especially true considering how many hammers we have seen in this marketplace lately, which has piqued my interest to say the least. With that, I believe that we are in fact trying to break above the 94 handle, going towards the 95 level. There is a shooting star from the end of March that we will have to deal with, but ultimately I believe that we will break above it.

The area above 94 will be choppy, but I have a hard time believing that the hammers signify that the market has a ton of support below, and that it will continue to push the CAD higher. Also, the 94 level has the potential to be like the proverbial “beach ball held under water”, meaning that the market should be spring-loaded once we get above.

The oil markets should help.

The oil markets are going higher in general, and have broken out. The CAD tends to follow that market, and the Japanese import 100% of their oil. The market tends to follow oil in general, and as such I figure that the market will have to play “catch up.” This happens from time to time, and can often be a great signal to get involved ahead of time.

Every time the markets fall from here, I believe it will represent value, and that the market will bounce. This means that the market is essentially “buy only” at this point. Selling doesn’t make any sense at this point, and I think it isn’t until we get below the 92 handle that this market looks vulnerable and able to be sold with any confidence – possibly going to 90.50 level. The market is essentially forming an ascending triangle at this point, and I think the writing is on the wall. I’m going to be long.