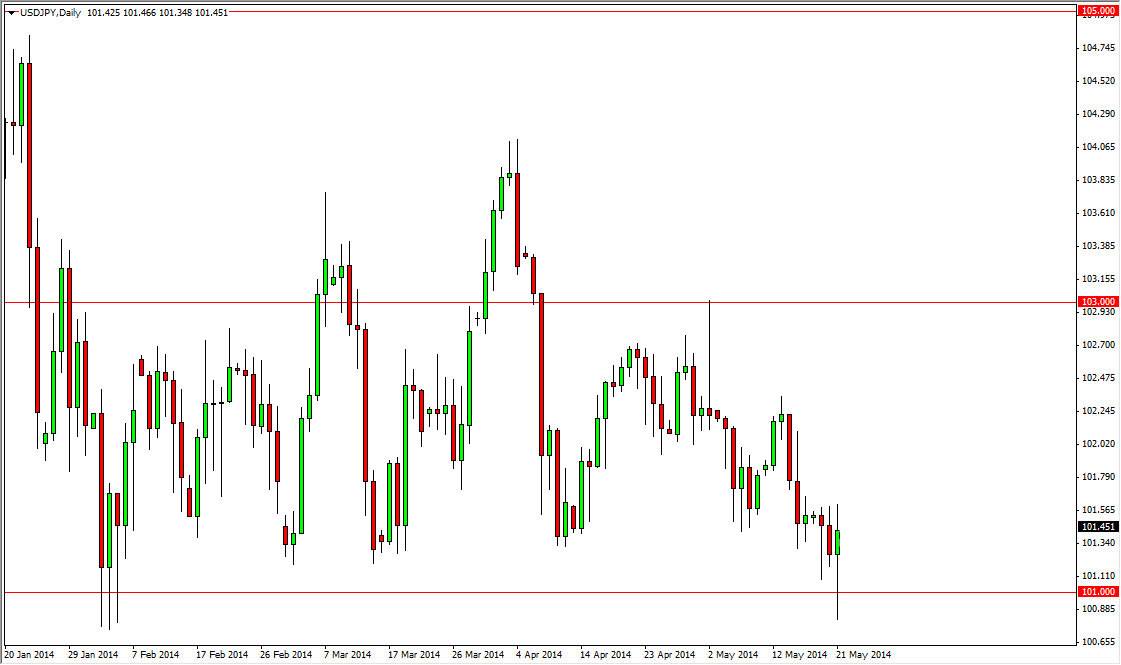

The USD/JPY pair fell during the bulk of the session on Wednesday, breaking below the 101 level at one point in time. This area of course is massively supportive, as we have seen time and time again, but at the end of the day I believe that this market will continue to hold it in this general vicinity and the fact that the support area drops all the way down to the 100 level. Because of that, I really don’t see an opportunity to sell this market. I believe that a break above the top of the hammer for the session on Wednesday would of course send the market higher, but I don’t think that is going to be the easiest move. However, the consolidation still holds, and as a result I believe that the market will continue to chop around with a somewhat upward bias.

Continued malaise.

I feel that this is going to be a market that continually feel somewhat malaise as it simply doesn’t decide easily what the market wants to do. However, I believe that there is an upward bias to it over the longer term, and that we will continue to bounce around the 101 level to the 103 level and back a few different times. Ultimately though, if we get above the 103 level, we should go to 104 relatively quick, and then on to the 105 level.

The market looks like it is one that you can simply trade for a longer-term trade, and will probably be one that is easily just “invested in” at the point, and should be fairly easy to do. This market has carved out a fairly significant consolidation rectangle, and this is something that I will be taking advantage of. In fact, I am starting to think that we are looking at the “summer range” in this pair between 101 and 103, which would be good for short-term trading, and can be very profitable if done correctly. I believe that we are going higher, but don’t expect fireworks to say the least.