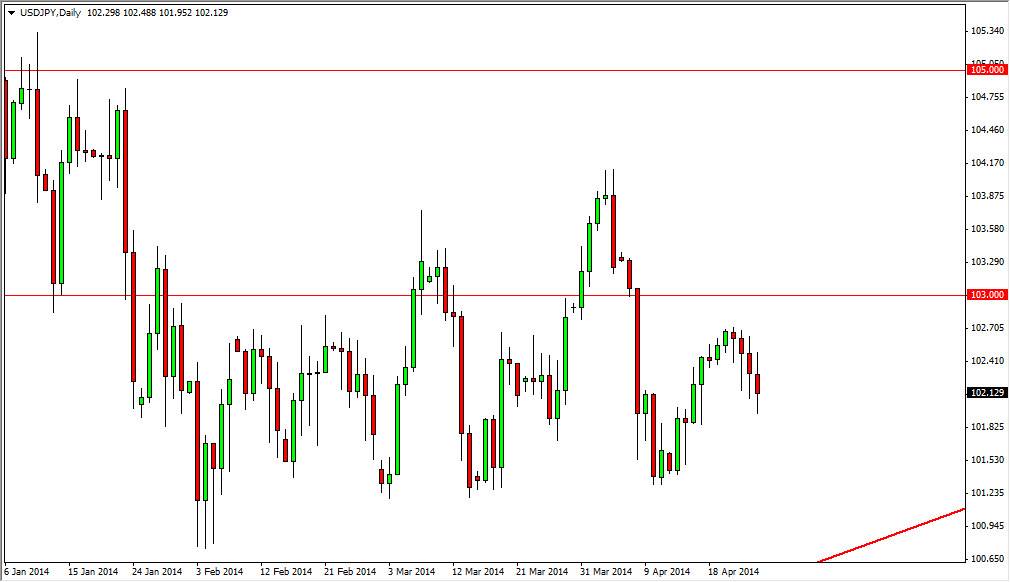

The USD/JPY pair went back and forth on Friday, but the one thing that it did show me was that the 102 level continues to be supportive. With that, I believe that the market is still well supported, especially once you get down to the 101.50 level. After all, that area has held up as support since the end of January, and I see nothing in this chart that suggests this is going to change at the moment. Because of this, I am looking for a buying opportunity, but don’t have the right candlestick formation to get involved.

Nonetheless, I do have my eyes open and I recognize that this pair should ultimately break out to the upside. You will notice that the highs keep getting higher, every time we spike. Because of this, I think that the 103 level might cause a little bit of a resistive move, but at the end of the day I believe that the 103 level will be sliced through again. With that, I’m looking for the 104 level to be head first, and then ultimately the 105 level.

Approaching trend line

In the corner of the chart, you can see that there is a red trend line that we are starting to head towards. I believe that this market will respect that ultimately, and we will start to get buying pressure. With that being the case, I see absolutely no way to sell this market, and fully recognize that this could be a bit of a resting period after the massive move higher that we had several months ago.

Ultimately, I believe that this pair goes to the 110 level later this year, but we do need some type of catalyst to get the markets moving. Quite frankly, the Forex markets in general have been relatively quiet lately, so this pair of course isn’t going to be any different. I believe that patients will panel off, and full disclaimer, I am short of the Japanese yen against other higher yielding currencies. In essence, if we can get more calm trading action like we have seen over the last couple of months, the carry trade could come back into play. However, remember that there isn’t a swamp in this pair at all currently, simply because the interest rates are so low. However, the selling of the Japanese yen in another currency pairs will have a bit of a “knock on” effect in this market.