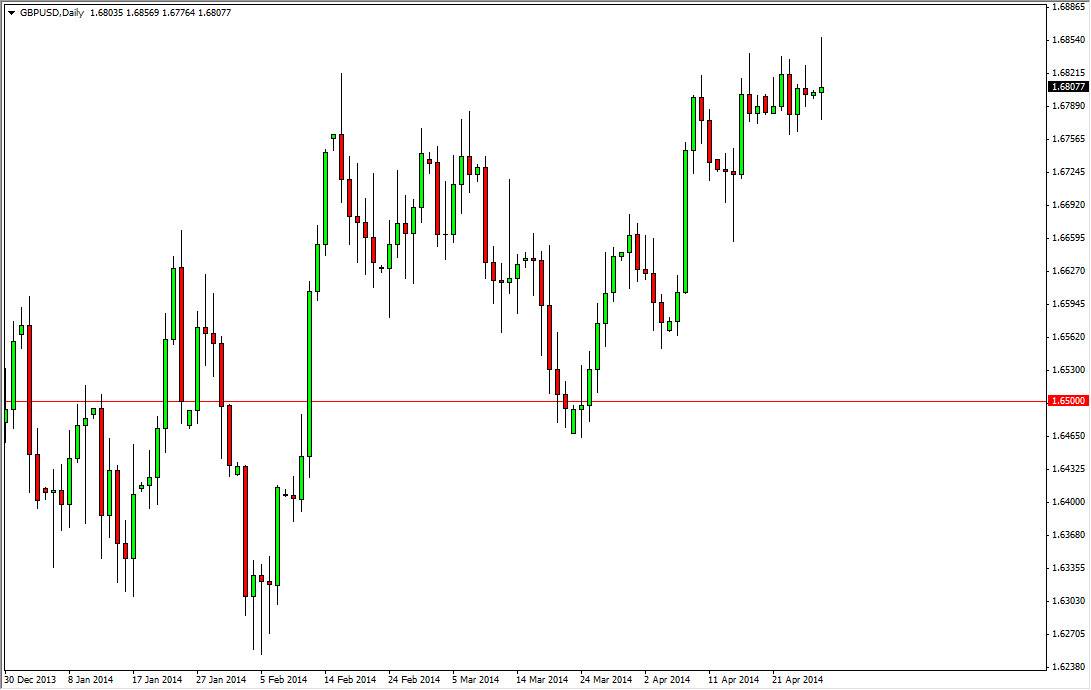

The GBP/USD pair broke higher during the session on Monday, breaking above the 1.68 handle solidly at one point during the day. However, you can see that the sellers stepped in and push the market back down to form a shooting star. The shooting star of course is typically a negative sign, but I see quite a bit of support just below, and as a result I feel that the markets will find buyers going forward. Those buyers should continue to push the market around in this general vicinity, and as a result turn the market bullish at one point or another.

If we break the top of the shooting star, that is obviously a very positive sign. That positive sign would have me buying the British pound as I had been in the past, and aiming for the longer-term spot of the 1.70 level, a target that I have been talking about for some time.

Pullbacks should be buying opportunities

Pullbacks in this marketplace should be buying opportunities, as I see far too many supportive areas below to be concerned about trying to short the market. It doesn’t really matter at this point in time, I see so many support levels between here and the 1.65 level that I cannot imagine a scenario in which I would be comfortable selling the British pound. After all, the British pound has looked strong over the longer term, and I don’t see that changing anytime soon. The US dollar of course has been stronger against the British pound than other currencies, but the British pound in general has been one of the better performers over the long term.

Of particular note is the 1.64 level, as I believe that there is a significant amount of strength at that area. The 1.64 level is probably the bottom part of the 1.65 handle and its supportive area. In other words, I see is a fictive zone which is supporting the market and creating a rather impressive “floor” at this moment in time. I do think that if we hit the 1.70 level there should be a significant snapback, as it is a large resistive number on the longer-term charts.