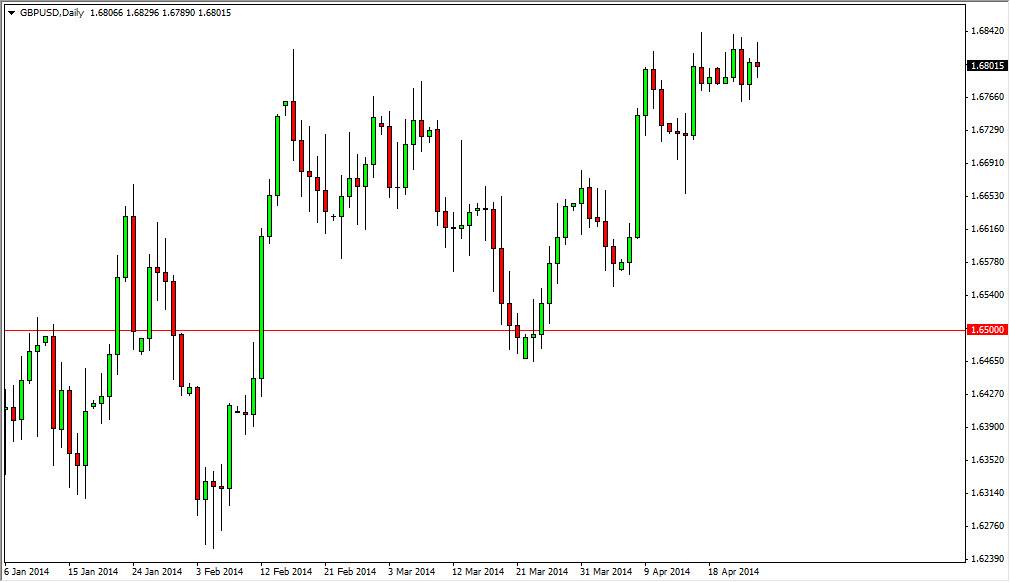

The GBP/USD pair tried to rally during the session on Friday, but you can see that the 1.6850 level offered enough resistance to turn things back around. By doing so, the market ended up forming a shooting star which normally is a very sign, but in this particular case I’m not overly concerned. After all, and we have seen significant consolidation over the last couple of days, and I think the pair is simply taking a rest at the moment. It’s obvious to me that the 1.6850 level is resistive, and as a result we may have to build up a little bit of momentum in order to overcome it.

If we have that, the market should head to the 1.70 handle which is been my longer-term target all along. I think ultimately this pair will reach that level, but we may have some work to do in the meantime. Nonetheless, all signs point to higher pricing.

Massive support below.

I see potentially massive support below current levels, as the 1.68 level has held a fairly strong, but the 1.67 level is the site of previous massive resistance and a nice-looking hammer from two weeks ago. On top of that, I see support at the 1.66 handle, as well as even more support at the 1.65 handle, as it was the last “swing low.”

I think that buying on dips will probably be the way to go using the short-term charts in this pair. Even though I think the move to the 1.70 is fairly safe, I believe that there will be continued back and forth motion in this pair, as we have seen no real confidence in any of the moves in the Forex markets at the moment.

On top of that, you have to remember that we are getting relatively close to vacation season, and as a result unless we make the move to 1.70 fairly soon, it could be more of a slow-moving affair as a lot of big players will be in the market over the course of the European and North American summers.