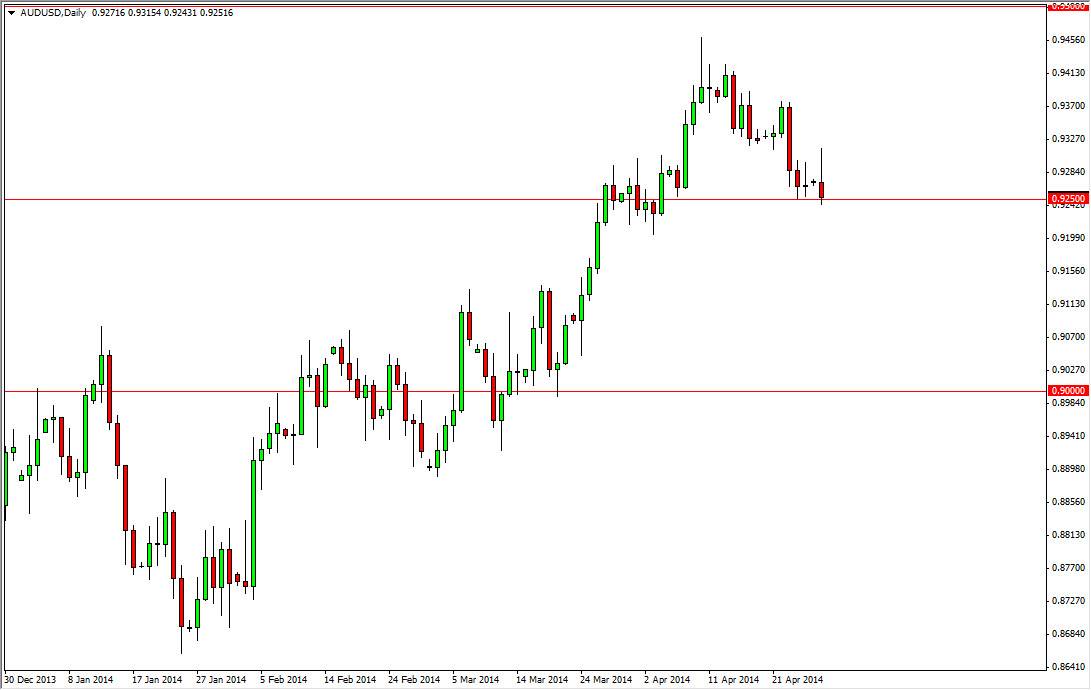

The AUD/USD pair tried to rally during the session on Monday, going as high as the 0.9325 area. However, we found enough resistance of the net general vicinity to push the market back down and form a shooting star. While the shooting star typically would have me interested in selling, I can recognize that we do have a significant amount of support just below, especially in the 0.9250 region. That area extends all the way down to the 0.92 handle, which needs to be broken to the downside in order for me to start selling at this point in time.

I believe that a break down below the 0.92 level does send this market looking for the 0.91 handle, and then ultimately the 0.90 handle. Is down there that we would find a massive amount of support, and have this market looking to go higher.

Follow the gold markets as well.

The Australian dollar and the gold markets tend to run hand-in-hand over the longer term. It is because of that that I’m not surprised that the Aussie would be struggling a little bit at this point. After all, the gold markets, although bullish looking for the longer term, are struggling at the moment. Is because of that correlation that I believe that the Australian dollar may drift a little bit lower, but it will be more of a temporary move. I believe that the Australian dollar possibly could have made a bottom a couple of months ago, and as a result I think that we will find yourselves in a nice “buy only” type of market going forward.

Quite frankly, if it pulls back, I’m even more interested in buying this market as it would show that we are finding more buyers on the balance. With that, I believe that the market will continue to offer nice buying opportunities, and eventually will be a nice longer-term buy-and-hold situation. The meantime though, traders will have to be either patient, or diligent about entries as the market could throw a few curveballs here and there.