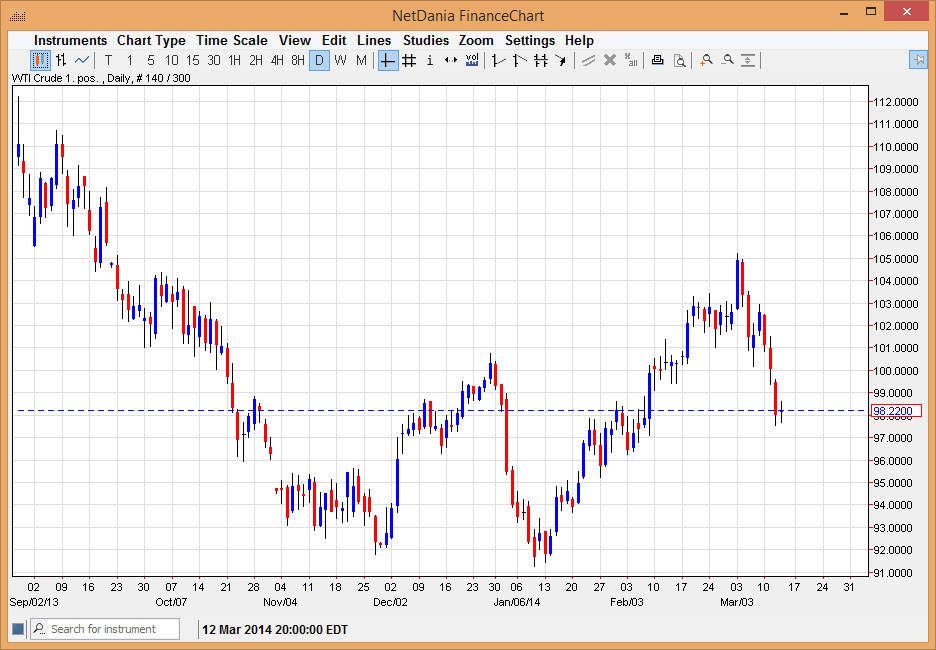

The WTI Crude Oil markets did almost nothing during the session on Thursday as we continue to meander around the $98 level. This area has in fact been resistive in the past, as recently as early February. Because of that we believe this market should find a bit of support in this general vicinity, and the fact that we finally stop falling for the session on Thursday is in fact a good sign.

Ultimately, I do believe that the oil markets bounce from here and head towards the $105 level, but there’s probably going to be a bit of a lag before we see that. I am waiting to see a supportive candle in order to go long, so I am essentially on the sidelines today as this market needs to prove itself with a daily close for me to feel comfortable not to risk trading capital.

Support area, now we just need momentum.

In this area we expect to see quite a bit of support, to simply need some type of momentum to the upside. A break above the $99 level is enough to get us to start buying this market, as we should continue to see strength going forward. Granted, we have had a pretty we could sell off, but quite frankly when you look at the move higher from the beginning of the year, we have not even really had a 50% pullback yet. When looked at the totality of the move, it’s really not that big of a deal that we sold off the way we have the last three days.

With that being said, I see quite a bit of support only down to the $95 level, and quite frankly underneath there as well. I just can’t feel comfortable selling this market even though we had significant selloff previously, the move higher certainly has made a much higher high then we had at the end of the year, so buying all accounts, if we can find some type of supportive action soon, it is the very definition of an uptrend.