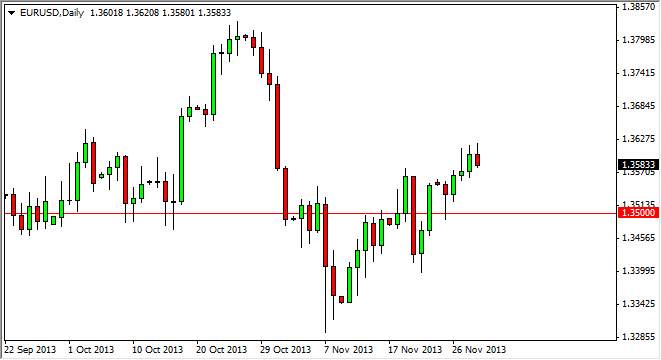

The EUR/USD pair tried to rally initially during the session on Friday, but as you can see the 1.36 level continues offer enough resistance to keep the market down. This is an area that I've been talking about for some time, and I believe it is the top of a larger consolidation area. If we can get a daily close above the 1.36 handle, I think that this market will head right directly towards the 1.38 handle, and possibly the 1.40 before it's all said and done.

However, the 1.38 handle will bring in enough noise that I anticipate a pullback from their and traders can actually reenter the market lower. But as you can see, the 1.36 level isn't quite ready to give up yet, and there is the possibility that we pullback as low as 1.35 in the short term. Nonetheless, this is going to be an interesting week for this pair, but it won't really get truly interesting until we get the announcement on Friday about jobs in America.

Nonfarm payroll will drive this market.

The nonfarm payroll numbers coming out this Friday will of course drive this market, as the world continues to fixate on whether or not the Federal Reserve can taper off of quantitative easing. If the jobs number is strong, expect this pair to fall, and we could see a move all the way down to the 1.33 level without changing the overall attitude of the market. Because of this, I do believe that this pair is inherently bullish for the time being, but if we can start to string together good economic numbers, especially employment wise, out of the United States - this pair could really fall apart.

In the meantime though, the exact opposite is certainly true, and we believe that a poor jobs number. Wilson this pair skyrocketing. It's essentially a question of whether or not you want your money parked in the European Union, or the United States at this point. Obviously, there are a lot of questions to be answered, and this Friday should be important. Between now and then, expect a lot of choppiness.