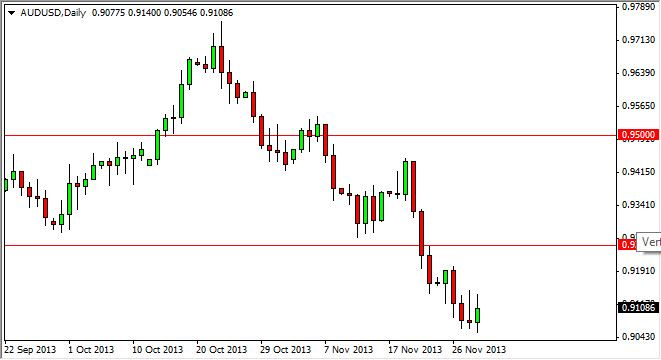

The AUD/USD pair tried to rally during the session on Friday, and as you can see did managed to keep some of the gains. However, at the end of the day the pair struggled to go higher, which of course doesn't surprise me considering that we formed a perfect shooting star on Thursday. This shows me that there are still plenty of traders out there willing to short this market, as the Australian dollar continues to suffer.

The Federal Reserve of course will be watched, as tapering off of quantitative easing continues to be the only thing the market truly focuses on at the moment. However, the Australian dollar tends the move with the gold markets as well, so of course you will have to watch that market as well, as he can either lift or drag down the Aussie. This market tends to move with the overall attitude of commodities as well, so pay attention to the overall attitude as far as risk is concerned.

Nonfarm payroll.

The nonfarm payroll numbers should continue to be the main factor driving the markets back and forth. As far as this currency pair is concerned. After all, the value of the US dollar greatly influences the value of gold, which of course greatly influences the value the Australian dollar. It's almost like a domino effect at this point in time. They can be a bit convoluted, but in the end of the day it makes sense.

I see a ton of support at the 0.90 handle, so it is going to be difficult to sell this market until we get a daily close below there, unless of course we get a nice bounce from here, and a resistive candle. This would be especially true at the 0.9250 level, which I see as the "ceiling" in this market at this time. As far as buying is concerned, I need to see this market close above the 0.93 handle in order to get excited about it, and therefore will be bothered until I see that, or possibly a longer-term signal on the weekly chart.