By: DailyForex.com

Although XAU/USD tried to climb yesterday, the pair run out of gas and fell back to Friday’s settlement. It seems that traders simply aren’t interested in going too far out on the risk spectrum ahead of the U.S. Thanksgiving holiday on Thursday and next week's jobs and GDP data.

Persistent rally in the U.S. stock markets is also contributing further pressure on gold. Yesterday, data from the world's largest economy were mixed. Building permits numbers were stronger than expected but the Conference Board’s consumer confidence index came out weaker than forecasts. There are lots of ideas and predictions on future gold prices and I think gold prices will tend toward consolidation for the next few days. In the meantime, market players will continue to focus on U.S. data for clues on the timing of when the U.S. central bank will begin to wind down its quantitative easing program.

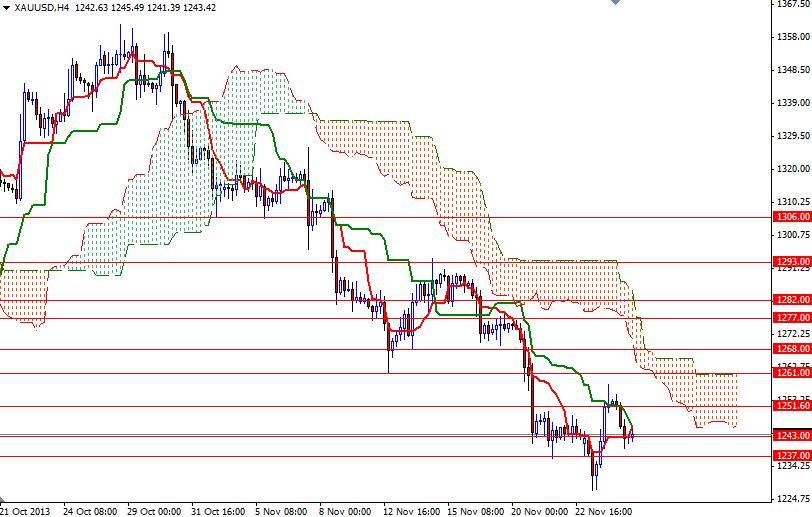

The XAU/USD pair is currently hovering around the 1243 level and it appears that the bulls intend to defend the 1237 support level. I believe the 1237 level will be the key for continuation of the recent bearish run and if get below this level on a daily close, I think we will reach 1225.50 and then 1213 eventually. However, if the XAU/USD forms a bottom and turns north, the first challenge will be waiting the bulls at the 1261 level where the Tenkan-sen line (nine-period moving average, red line) sits on the daily chart.

The bulls have to climb above the Ichimoku cloud on the 4-hour time frame in order to ease selling pressure and regain more strength. A close back above the 1268 level would suggest that the momentum is turning bullish. If that is the case, we might be heading towards the 1293 level.